Demand for products downstream may help the midstream remain stable. (Source: Marathon Petroleum)

[Editor's note: This story appears in the June 2020 edition of Midstream Business. Subscribe to the magazine here. It was originally published May 26, 2020.]

Industry observers have maintained for some time that the sector needs fewer firms. They cite multiple reasons, among them the shale boom’s maturity, harder to find capital and the fact that— as in all industries—bigger players enjoy a natural advantage over time.

That advantage proves crucial in downturns such as the double whammy that hit the energy business in the first quarter of 2020. (See the accompanying story for insights on what may lie ahead for midstream players.)

Consolidation’s not a new trend, but it accelerated last year. The tune behind the midstream’s corporate musical chairs just got louder and faster.

So, what is the most significant year-over-year change in the new Midstream Business Midstream 50? No surprise: Some 10% of the companies on last year’s list disappeared. Those names remain on the 2020 Midstream 50 list to provide something of an apples-to-apples comparison with the prior year.

Read: Coronavirus Will Create Opportunities for the Midstream Sector

What it is

The Midstream 50 ranks the largest publicly held midstream sector players, whether MLPs or conventional corporations, by EBITDA, as compiled by Barclays. Interpretation of and reporting on the rankings is done by Midstream Business editors. The 2020 list’s rankings are based on 2019 full-year data, either fiscal or calendar, depending on which a company reports and which Barclays deemed to be most appropriate in comparison.

Changes shown in the accompanying tables are against the 2019 Midstream 50 rankings, which were based on comparable 2018 financials. All financials are in U.S. dollars.

“Consolidation and acquisition by the infrastructure firms—large private equity versus being bought by other publics or going public—is definitely the story for 2019,” Josh Sherman, partner with Opportune LLP, told Midstream Business. Last year “was a little more stable, I guess” than the painful 2014 to 2015 industry retrenchment, he added. Never mind what happened in early 2020.

Check out last year’s Midstream 50 here.

Sherman had an up-close and personal view of that period when he served as chair of the board of directors’ audit committee with midstream player JP Energy Partners LP. In 2016, JP Energy merged with American Midstream Partners LP, which in turn was taken private by their collective sponsor, ArcLight Energy Partners LP, in July 2019.

Chicken versus egg

Consolidation nudged along last year but not necessarily because of a commodity freefall, Sherman said. In general, the long-running midstream buildout to support the big shale plays had been completed or was nearing completion in the major plays. That created a “chicken or the egg game” for midstream firms, he said. In other words, should companies build ahead of production increases, or wait for the production and then build? Either way, getting bigger helps in decision-making.

The sector ended 2019 on a fairly positive note, which included continuing expansion. In a January research report, RBN Energy wrote that midstream capex soared to a record $37 billion in 2019 and is “forecast to steeply decline over the next few years as the lion’s share of the infrastructure needed to gather, transport, process and store current and expected hydrocarbon volumes has already been built or is nearing completion.”

Alerian benchmarked 2019 in an early 2020 study that saw a “positive outlook,” based on stable or increasing distribution yields.

“Overall, the vast majority of midstream MLPs either maintained or grew their distributions on a sequential basis,” Alerian said. However, it noted four distribution cuts in the year’s final quarter, led by EnLink Midstream LLC’s 33.7% sequential reduction, which “came as little surprise given its lofty yield of over 18% at the end of December, even after a 29.1% increase in price performance for the month.”

EnLink ranks No. 18 on the 2020 Midstream 50, the same spot it held on last year’s list.

Executives of smaller, privately financed startups that once dreamed of ringing a stock market’s opening bell as they did an IPO found the going tough once again in 2019.

“In the midstream sector, private companies that were traditionally either targets for publicly traded MLPs or IPO candidates themselves now needed to find a new exit strategy less reliant on public energy equity markets,” Simmons Energy said in its 2019 review, published in January.

THE MIDSTREAM 50 FOR 2020,

|

|||||

|---|---|---|---|---|---|

| Rank | Ticker | Company Name | 2018 EBITDA |

2019 EBITDA |

% Change |

| 1. | ET | Energy Transfer LP | $9,510 | $11,214 | 18% |

| 2. | ENB | Enbridge Inc. | $9,918 | $10,001 | 1% |

| 3. | EPD | Enterprise Products Partners LP | $7,223 | $8,117 | 12% |

| 4. | KMI | Kinder Morgan Inc. | $7,568 | $7,618 | 1% |

| 5. | TRP | TC Energy Corp. | $6,609 | $7,058 | 7% |

| 6. | WMB | Williams Cos. Inc. | $4,638 | $5,015 | 8% |

| 7. | MPLX | MPLX LP | $3,475 | $4,334 | 25% |

| 8. | PAA | Plains All American LP | $2,684 | $3,237 | 21% |

| 9. | LNG | Cheniere Energy Inc. | $2,641 | $2,946 | 12% |

| 10. | OKE | ONEOK Inc. | $2,448 | $2,580 | 5% |

| 11. | WES | Western Midstream Partners LP | $1,206 | $1,179 | 43% |

| 12. | MMP | Magellan Midstream Partners LP | $1,396 | $1,581 | 13% |

| 13. | TRGP | Targa Resources Corp. | $1,366 | $1,436 | 5% |

| 14. | EQM | EQM Midstream Partners LP | $998 | $1,338 | 34% |

| 15. | PSXP | Phillips 66 Partners LP | $1,137 | $1,436 | 5% |

| 16. | DCP | DCP Midstream LP | $1,092 | $1,200 | 10% |

| 17. | ENBL | Enable Midstream Partners LP | $1,074 | $1,147 | 7% |

| 18. | ENLC | EnLink Midstream LLC | $1,042 | $1,080 | 4% |

| 19. | TGE | Tallgrass Energy LP | $654 | $996 | 52% |

| 20. | AM | Antero Midstream Corp. | $709 | $830 | 17% |

| 21. | SHLX | Shell Midstream Partners LP | $616 | $730 | 19% |

| 22. | NS | NuStar Energy LP | $666 | $704 | 6% |

| 23. | GEL | Genesis Energy LP | $716 | $669 | (7%) |

| 24. | SXL | Sunoco Logistics LP | $732 | $665 | (9%) |

| 25. | NGL | NGL Energy Partners LP | $464 | $564 | 21% |

| 26. | HESM | Hess Midstream Partners LP | $505 | $551 | 9% |

| 27. | CEQP | Crestwood Equity Partners LP | $420 | $527 | 25% |

| 28. | USAC | USA Compression Partners LP | $320 | $420 | 31% |

| 29. | AROC | Archrock Inc. | $352 | $417 | 18% |

| 30. | HEP | Holly Energy Partners LP | $347 | $359 | 4% |

| 31. | SMLP | Summit Midstream Partners LP | $294 | $287 | (2%) |

| 32. | OMP | Oasis Midstream Partners LP | $178 | $270 | 52% |

| 33. | SPH | Suburban Propane Partners LP | $283 | $267 | (6%) |

| 34. | NBLX | Noble Midstream Partners LP | $223 | $255 | 14% |

| 35. | CNXM | CNX Midstream Partners LP | $189 | $239 | 26% |

| 36. | GLP | Global Partners LP | $311 | $234 | (25%) |

| 37. | BPMP | BP Midstream Partners LP | $196 | $219 | 12% |

| 38. | PBFX | PBF Logistics LP | $152 | $185 | 21% |

| 39. | DKL | Delek Logistics Partners LP | $164 | $179 | 9% |

| 40. | TLP | TransMontaigne Partners LP | $133 | $147 | 10% |

| 41. | CCLP | CSI Compressco LP | $99 | $128 | 29% |

| 42. | MMLP | Martin Midstream Partners LP | $107 | $108 | 1% |

| 43. | SRLP | Sprague Resources LP | $102 | $106 | 3% |

| 44. | BKEP | Blueknight Energy Partners LP | $60 | $64 | 6% |

| 45. | GPP | Green Plains Partners LP | $66 | $54 | (18%) |

| 46. | USDP | USD Partners LP | $57 | $50 | (11%) |

| 47. | ANDX | Andeavor Logistics LP | $1,201 | N/A | N/A |

| 48. | BPL | Buckeye Partners LP | $1,005 | N/A | N/A |

| 49. | APU | AmeriGas Partners LP | $622 | N/A | N/A |

| 50. | SEMG | SemGroup Corp. | $394 | N/A | N/A |

[Editor's note: A full version of this chart appears in the June 2020 edition of Midstream Business. Subscribe to the magazine here.]

“Large, infrastructure-oriented private-equity funds filled this void, attracted by long-term contracted cash flow and fueled by access to low cost debt capital,” Simmons added. “Additionally, we have worked with several upstream operators seeking to monetize their midstream infrastructure assets as a source of capital.”

Top 10

The 2020 list sports a new name at the top: Energy Transfer LP. It jumped Enbridge Inc. to assume the No. 1 position. Energy Transfer’s EBITDA rose 18% year over and year, largely due to one of the bigger consolidations in 2019— its acquisition of Tulsa, Okla.-based SemGroup Corp. SemGroup ranked No. 31 on last year’s Midstream 50.

THE MIDSTREAM 50

|

|||||

|---|---|---|---|---|---|

| EBITDA | Revenue | Assets | Distribution Yield |

Stock Price |

|

| Average | 12% | 3% | 11% | 4% | 4% |

| Mean | 10% | 0% | 8% | 10% | 6% |

Dallas-based Energy Transfer’s EBITDA climbed by more than $1 billion in 2019 to $11.2 billion, while Enbridge saw a 1% increase in the key financial metric to $10 billion. Otherwise, the list’s top 10 showed minimal change as Enterprise Products Partners LP and Kinder Morgan Inc. swapped the Nos. 3 and 4 slots.

The other large players returned in the same order as 2019—TC Energy Corp. (formerly TransCanada), Williams Cos. Inc., MPLX LP, Plains All American LP, Cheniere Energy Inc. and ONEOK Inc. Stability at the top seems to be a trend. The last big switch in the top 10 list came in 2018 as Cheniere rocketed up an astounding 30 points on that year’s Midstream 50 as its long-promised Sabine Pass LNG operation in Cameron Parish, La., started up.

Combined EBITDA for the Midstream 50 members rose to $83 billion, a 6% increase from the $78.4 billion reported in the previous year.

Revenue rankings

Revenues for the list leaders were flat or declined overall. Energy Transfer maintained its top rank in revenues with 0.2% increase to $54.2 billion. Enbridge showed a 5% increase to $37.7 billion. MPLX scored the biggest jump, 43%, to $8.6 billion, following—what else?—its consolidation with Andeavor Logistics LP, the biggest midstream deal in 2019.

Oasis Midstream Partners LP reported the largest gain in revenue, a 51% increase to $410 million from $272 million. Half the list members reported flat or lower earnings.

Combined revenues for the list members declined 4% in 2019 to $312 billion from $326 billion.

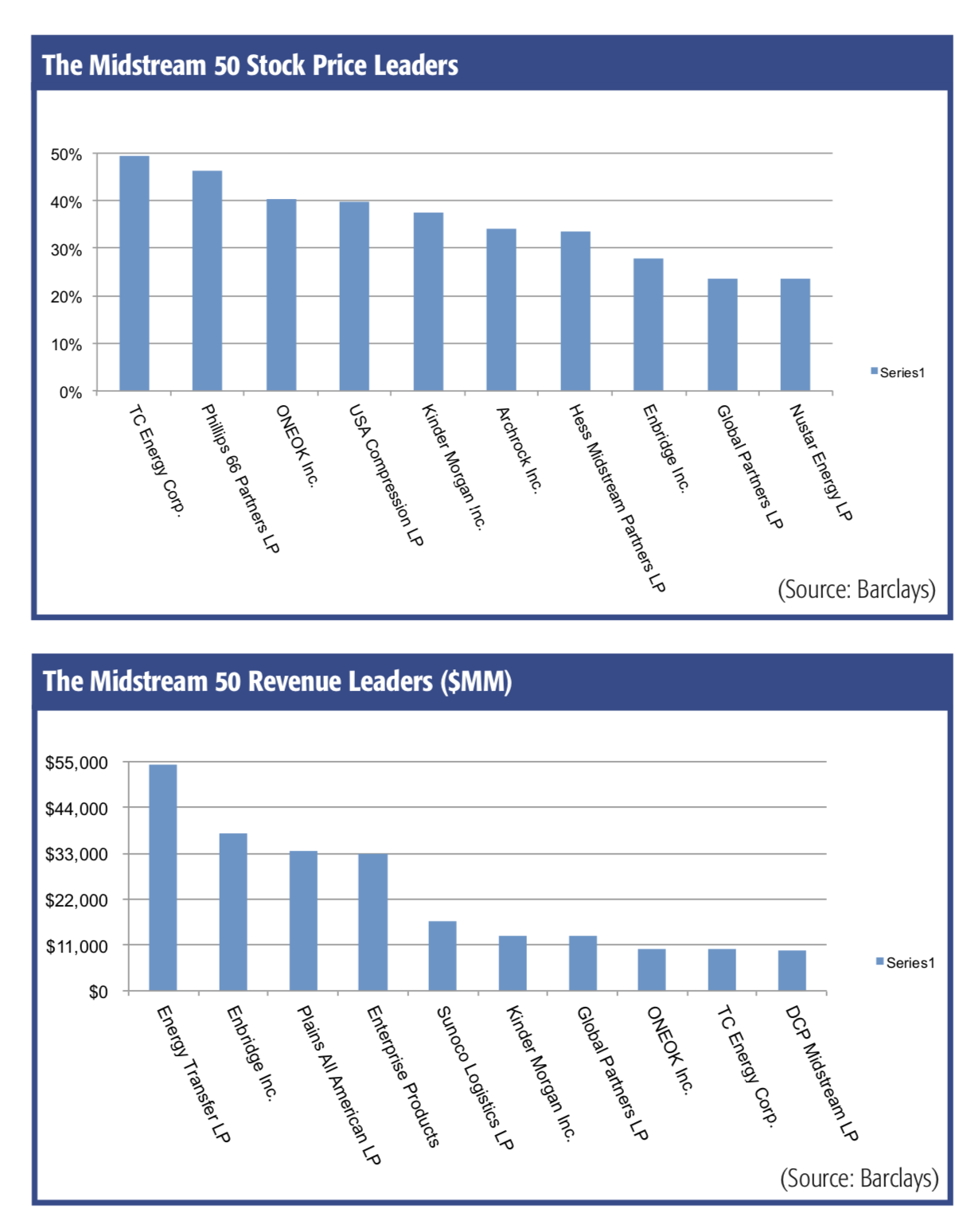

Wall Street’s disaffection with all things energy showed in midstream share and unit prices. Two firms, TC Energy and Phillips 66 Partners LP, scored healthy increases of 49% and 46%, respectively. Yet 16 firms reported flat or lower share/unit prices from year-end to year-end.

Given indifferent pricing, it’s no surprise that distribution yields were very good, overall, for 2019. Antero Midstream Corp. sported a 16.21% yield for the year to top the list, with Sprague Resources LP close behind at 15.78%. Half the list members marked double-digit distributions for the year.

Au revoir, Andeavor

Andeavor Logistics, ranked No. 14 a year ago, was the largest midstream name to vaporize in 2019’s M&A wave. That came as part of the overall merger between two downstream heavyweights, Marathon Petroleum Corp. and Andeavor Corp., formerly San Antonio-based Tesoro Corp. Andeavor Logistics, the acquired firm’s midstream operation, became a part of Marathon’s MPLX midstream subsidiary.

Under the terms of the merger agreement, Andeavor Logistics unitholders received 1.135 times MPLX units for each Andeavor unit, a 7.3% premium. Marathon Petroleum received 1.0328 times MPLX common units for each Andeavor Corp. unit held. The blended exchange ratio of 1.07 times represents a 1% premium to market, MPLX said in announcing the agreement.

Energy Transfer acquired SemGroup in another round of musical chairs. The $5 billion deal, announced in September 2019, valued SemGroup at $17/unit.

The increase in energy exports provided an important inducement for Energy Transfer, given SemGroup’s interest in the sprawling Houston Fuel Oil Terminal, which has some 18.2 MMbbl of storage and dockage on the Houston Ship Channel. To enhance that asset, Energy Transfer announced plans for the Ted Collins Pipeline to connect the SemGroup operation with its existing Nederland, Texas, terminal.

Meanwhile, Pennsylvania gas and electric utility UGI Corp. acquired AmeriGas, the nation’s largest LP gas distributor, which held significant midstream assets to support its sprawling retail operations. AmeriGas announced a strategic operational review in late 2018, which culminated in the UGI merger in April 2019.

AmeriGas units were delisted in August 2019 following closure. Units were converted into $7.63/ unit of cash and UGI shares at an exchange ratio of 0.5 share of UGI per AmeriGas unit.

Buckeye deal

One of the sector’s biggest petroleum product operators, Buckeye Partners LP, announced in May 2019 a $10.3 billion, all-cash acquisition deal with IFM Global Infrastructure Fund that took Buckeye private. The deal valued Buckeye units at $41.50/unit, a 27.5% premium.

Buckeye’s assets included 6,000 miles of pipeline with more than 100 delivery locations and 115 liquid petroleum product terminals with a combined storage capacity of 118 MMbbl. It also had a network of marine terminals, primarily along the East and Gulf coasts and in the Caribbean.

Terminals have growing value in the sector, and one of the first 2019 deals involved TransMontaigne Partners LP, which operated a major terminal network east of the Mississippi. It disappeared as a public company in early 2019 following the $536 million, year-end 2018 announcement of a cash deal with ArcLight Energy Partners Fund VI LP for the TransMontaigne units it did not already hold. ArcLight paid $41/unit, a 12.6% premium to what TransMontaigne units traded at when the parties announced the deal.

The wheeling and dealing represents a growing trend in the midstream: private ownership. Privately held Koch Industries Inc. and its Flint Hills Resources LLC unit, for example, hold significant pipeline and terminal operations. The Wichita, Kan.-based Koch conglomerate is believed to be the largest privately held firm in the U.S. behind agribusiness-focused Cargill Inc.

“Consolidation and acquisition by the infrastructure firms—large private equity versus being bought by other publics or going public—is definitely the story for 2019.”

—Josh Sherman, Opportune LLP

But wait, there’s more to the private-ownership trend. As 2019 ended, Tallgrass Energy LP, No. 19 on the Midstream 50, announced that it had accepted a sweetened buyout offer from a group led by private-equity heavyweight Blackstone Group Inc., which valued the company at about $6.3 billion. An earlier, take-private offer triggered a dispute with investors over a provision that gave Tallgrass executives a 30% premium for their shares. That dispute led former CEO David Dehaemers to criticize institutional shareholders for driving down the value of the company.

Blackstone and its affiliates held some 44% of Tallgrass units at the time of the agreement. The deal was approved at a special shareholder meeting in April.

In the same month, a unit of Axel Johnson Inc. announced plans to purchase the units that it did not already own of terminal operator Sprague Resources, No. 43 on the list. Axel Johnson’s Sprague Resources Holdings LLC subsidiary offered to acquire all of the outstanding Sprague common units that it did not hold for $13/unit, a 14% premium. Axel Johnson held 53.3% of the outstanding Sprague units at the time of the offer.

Sprague had a terminal network in New York State, New England and Quebec.

More to come

Given this year’s business disruptions, industry observers say the consolidation trend will continue and likely will accelerate.

A frequently mentioned name that may end up short a place to sit the next time the music plays is No. 11, Western Midstream Partners LP, the affiliate of former big upstream player Anadarko Petroleum Corp. Anadarko merged into Occidental Petroleum Corp. in a giant, $38 billion deal last year.

What is the most significant year-over-year change in the new Midstream Business Midstream 50?

No surprise: Some 10% of the companies on last year’s list disappeared.

It seemed like a good idea at the time. However, the timing proved way off as crude prices went into freefall in the first quarter. That gave now debt-heavy Occidental a financial stomachache following the merger. It has since announced multiple deals to spin off noncore E&P assets.

To date, it appears Occidental is content to keep Western as a standalone organization, but rumors persist. The firm holds approximately 55% of Western’s outstanding units.

Water ways

There were other notable trends in 2019, Opportune’s Sherman said. In particular, he mentioned water. “That was the bright spot for midstream,” he said. “Water logistics was a midstream growth area. That’s the part of the infrastructure that has not been built out. We saw a lot of small [water-focused] companies that were growing.”

Could a significant, and publicly held, water midstream emerge? It’s possible, Sherman said. But overall, he expects the consolidation trend to continue.

“I think there are still some unique opportunities out there,” Sherman said. “It’s going to take companies like [private-equity providers] Tailwater and EnCap Flatrock, that really know the space and have a ton of data, and experts in the midstream to capitalize on it.”

“I know that there are always opportunities,” he said. “They may be fewer and further in between for other players, but they are there.”

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.