The sale of Mid-Con Energy’s Texas properties, which at $60 million was the larger of the two transactions, was to an affiliate of Scout Energy Partners and included properties within the Permian Basin’s Eastern Shelf, an SEC filing said. (Source: Hart Energy/Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Mid-Con Energy Partners LP (NASDAQ: MCEP) launched plans to exit Texas on Feb. 19 as it concentrates on building its Oklahoma waterflood inventory in a series of A&D transactions the Tulsa, Okla.-based company called “liquidity enhancing.”

Mid-Con Energy said it entered agreements to sell substantially all of its Texas properties and acquire producing Oklahoma properties in Caddo, Grady and Osage counties. The combined value of the transactions, which the company expects will significantly lower its total outstanding debt and leverage ratio, is about $87.5 million.

“We are excited to announce this latest in a series of transactions which strengthen our financial position while enhancing the partnership’s asset base with low-decline properties and an inventory of waterflood growth projects,” said Mid-Con Energy CEO Jeff Olmstead in a statement on Feb. 19.

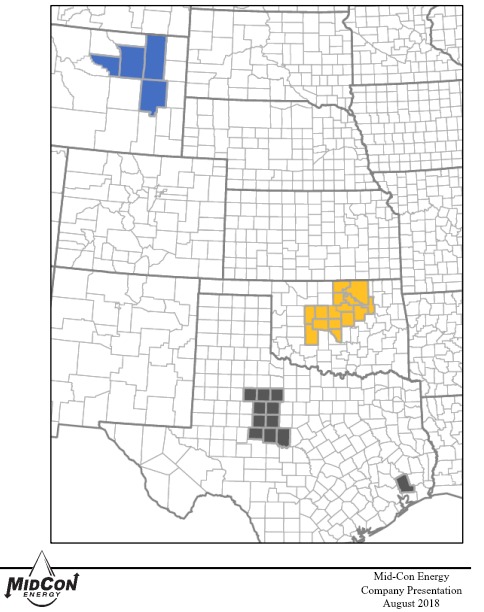

Formed in 2011, Mid-Con Energy focuses on EOR in core areas located in Oklahoma, Texas and Wyoming with the Sooner State being the base of the company’s operations.

The sale of Mid-Con Energy’s Texas properties, which at $60 million was the larger of the two transactions, was to an affiliate of Scout Energy Partners and included properties within the Permian Basin’s Eastern Shelf across Coke, Coleman, Fisher, Haskell, Jones, Nolan, Runnels, Stonewall and Taylor counties, a filing with the U.S. Securities and Exchange Commission (SEC) said.

The sale of Mid-Con Energy’s Texas properties, which at $60 million was the larger of the two transactions, was to an affiliate of Scout Energy Partners and included properties within the Permian Basin’s Eastern Shelf across Coke, Coleman, Fisher, Haskell, Jones, Nolan, Runnels, Stonewall and Taylor counties, a filing with the U.S. Securities and Exchange Commission (SEC) said.

According to a company presentation from August, Mid-Con Energy’s position in Texas comprised conventional oil assets held in 10 counties within the Eastern Shelf of the Permian Basin with four new waterflood developments in the last two years.

Scout, a private, Dallas-based investment firm focused on acquiring and operating mid-sized upstream conventional oil and gas properties on behalf of institutional investors, was also revealed in the SEC filing as the seller of the Oklahoma assets in a $27.5 million transaction with Mid-Con Energy.

The Oklahoma assets include 10 mature waterflood units with net proved developed producing (PDP) reserves of 6.2 million barrels of oil equivalent (96% oil), as of Jan. 1, and a PDP decline rate of less than 5%. Production from the assets was 1,313 barrels of oil equivalent per day during the third quarter of 2018.

“Like many of the other assets we have acquired in the past few years, we see significant opportunity in optimizing margins and the value of the new properties in a short time frame through a combination of operational efficiency improvements, reactivation of wells, and production enhancements,” Olmstead said.

Pro-forma for the transactions, Olmstead said the underlying PDP decline rate for Mid-Con Energy will be less than 10%, with a portfolio of development projects for future growth.

“Lowering our overall base decline rate allows us to allocate more of our free cash flow to acquisitions and new growth projects,” he said.

Mid-Con Energy plans to continue to look for acquisitions of long-lived, low-decline assets with opportunities to enhance margins and cash flow or waterflood potential, according to the company press release.

The company said it expects to close both transactions in late March. The effective date of each transaction will be the same date as the closing date.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.

E&P Highlights: April 8, 2024

2024-04-08 - Here’s a roundup of the latest E&P headlines, including new contract awards and a product launch.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.