The Permian Basin transaction highlights Maverick Natural Resources’ portfolio focus in Texas and Oklahoma, which follows recent divestitures of assets in California and Michigan, Maverick CEO Chris Heinson told Hart Energy. (Source: Hart Energy)

Maverick Natural Resources has entered into a definitive agreement to acquire certain producing properties in the Permian Basin from ConocoPhillips for $440 million, the company announced on Jan. 28.

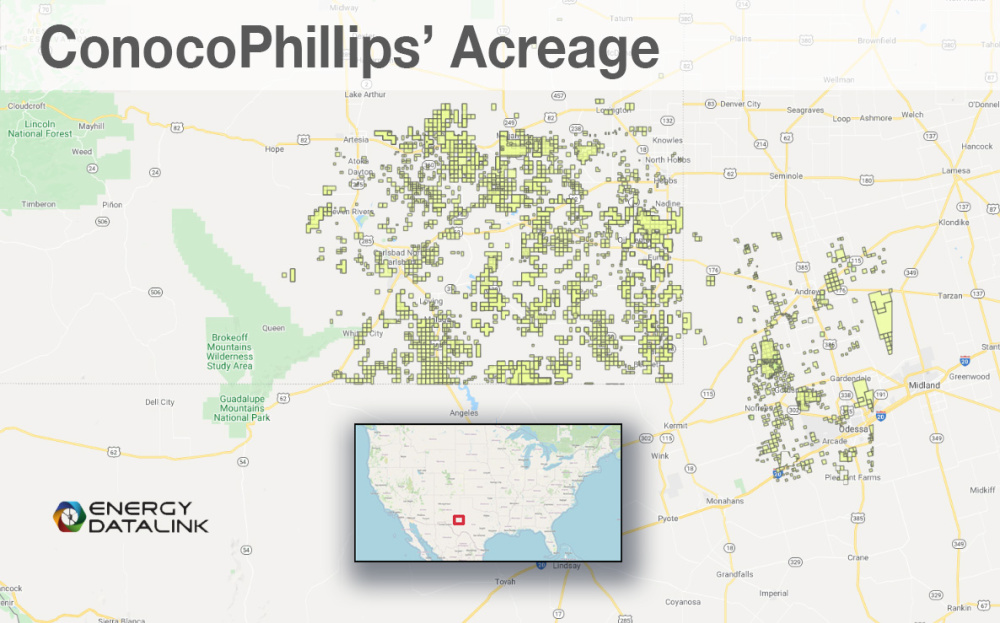

ConocoPhillips’ assets averaged more than 11,000 boe/d (50% oil) from the Central Basin Platform and Northwest Shelf of the Permian Basin during September 2021. The position spans about 144,500 net acres across Andrews and Ector counties, Texas, and New Mexico’s Eddy and Lea counties. The acreage is largely operated and HBP.

The purchase price is subject to customary adjustments and will have an effective date of Sept. 1, according to Houston-based Maverick.

Chris Heinson, Maverick’s CEO, told Hart Energy that the company is a best-in-class operator that, with the deal, will “apply our operational strengths at scale in the Permian Basin by aggressively controlling costs and by exploiting opportunities to generate additional production.”

“These producing assets are supplemented by high-quality drilling inventory, which together are a winning model for generating meaningful investor returns,” he said.

The company relies on intense cost-savings periods, which it calls “sprints,” to rapidly wring costs out of its bottom line. During the 2020 pandemic downturn, the company used such sprints to slash more than $50 million in savings over a five-day period.

Maverick’s Permian acquisition expands the scale of Maverick’s operations and provides high-quality, oil-weighted drilling inventory, the company said in a news release.

“The transaction highlights our portfolio focus in Texas and Oklahoma, which follows our recent divestitures of assets in California and Michigan,” Heinson said. “Pro forma for the acquisition, Maverick’s production exceeded 78,000 boe/d in September 2021.”

The company is conservatively financed with pro forma leverage of just 0.5x at closing and expected pro forma 2022 EBITDA of approximately $450 million, Heinson said.

“We expect to utilize our enhanced scale, operational track record and conservative balance sheet to access capital markets for funding future acquisitions,” he said.

The acquisition was approved by Maverick’s board of directors and majority equity owner, EIG, and will be funded by a fully committed $500 million reserve-based loan provided by JPMorgan Chase Bank NA, Royal Bank of Canada, Citizens Bank NA, KeyBank National Association and KeyBanc Capital Markets Inc. Subject to the satisfaction of customary closing conditions and funding, the parties expect the transaction to close in second-quarter 2022.

Maverick was formed from the ashes of the bankruptcy of Breitburn Energy Partners LP, a former MLP that shed nearly all of its $3 billion in debt on exit in 2018. It specializes in the management of mature upstream assets through the application of automation and data science technology.

Maverick’s last announced acquisition, in December 2020, was the all-equity purchase of FourPoint Energy LLC, the largest producer in the western Anadarko Basin. The company was renamed Unbridled Resources LLC and included MidPoint Midstream LLC and Wheeler Midstream LLC, which provide midstream services in the western Anadarko Basin.

Recommended Reading

The Need for Speed in Oil, Gas Operations

2024-03-22 - NobleAI uses “science-based AI” to improve operator decision making and speed up oil and gas developments.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.