Permian Basin E&P Matador Resources exceeded oil and gas production forecasts in first-quarter 2023, and the company expects to see more production later this year after closing a $1.6 billion acquisition.

And while the markets remain skittish due to a developing banking crisis and commodity price volatility, Matador is pressing forward with production growth, including the development of new “horseshoe” wells.

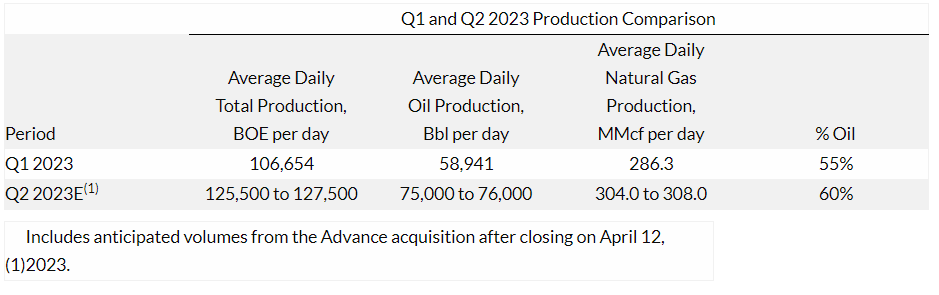

First-quarter oil and natural gas production came in at 106,654 barrels of oil equivalent per day (boe/d), Matador announced in earnings after markets closed on April 25.

That’s about 6% more than Matador’s earlier production forecast, which called for production to average 101,000 boe/d at the midpoint during the first quarter.

Joseph Wm. Foran, founder, chairman and CEO at Matador, said the outperformance was driven by better-than-expected production in the company’s Stateline asset area in the Delaware Basin and fewer days of shut-in production than expected.

Matador’s crude oil production in the first quarter averaged 58,941 bbl/d – 6% above the company’s guidance range of between 55,000 bbl/d and 56,000 bbl/d for the quarter.

The company also raised its outlook for oil production in the second quarter to between 75,000 bbl/d and 76,000 bbl/d, an 8% increase from Matador’s previous forecast of 69,200 bbl/d to 70,200 bbl/d.

Looking ahead, Matador aims to grow crude oil production to 87,500 bbl/d in 2024 – a 40% increase over oil production of 62,316 bbl/d in the fourth-quarter of 2022.

Natural gas production also exceeded expectations in the first quarter: Matador’s gas production averaged 286.3 million cubic feet per day (MMcf/d), above the guidance range of between 270.7 MMcf/d and 274.7 MMcf/d.

The fruits of M&A

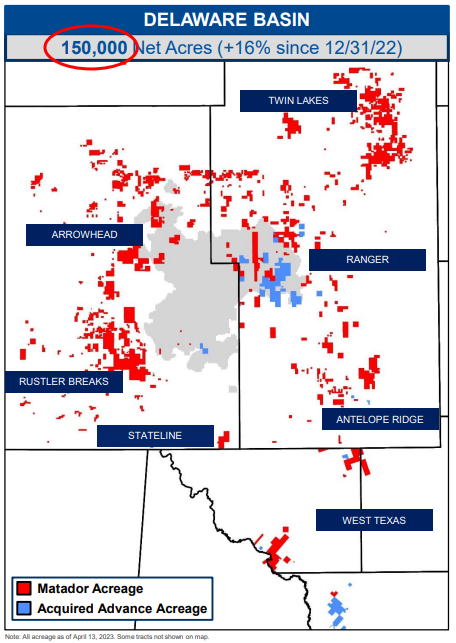

Matador expects to receive a boost in production volumes this quarter from its bolt-on acquisition of EnCap Investments LP-backed Advance Energy Partners Holdings LLC. Matador closed the $1.6 billion deal earlier this month.

The deal included producing properties and undeveloped acreage in the Delaware Basin’s Lea County, New Mexico, and Ward County, Texas.

Advance’s position added 18,500 net acres and more than 100 MMboe of reserves to Matador’s portfolio. The Advance assets averaged an estimated 25,450 boe/d during the quarter.

Following the Advance acquisition, Matador made debt reduction a strategic priority. The company plans to use a portion of free cash flow for the rest of 2023 to primarily repay debt under its credit agreement.

Matador expects to pay back borrowings from its revolving credit agreement by the second half of 2024.

Free cash flow will also be directed towards measured drilling growth, paying fixed dividends and supporting more opportunistic bolt-on acquisitions in upstream and midstream, Foran said.

Last week, the Matador board of directors declared a quarterly cash dividend of $0.15 per share, in line with the company’s previous quarterly dividend.

RELATED: Matador Closes $1.6 Billion Delaware Basin Bolt-on

’Horseshoe’ well test

Supporting its production growth outlook, Matador plans to turn 21 wells to sales on the Advance properties during the second half of 2023.

Matador also plans to turn to sales eight wells in the company’s Stateline asset area, 18 wells in the Stebbins area and nine wells in the Wolf asset area throughout this year.

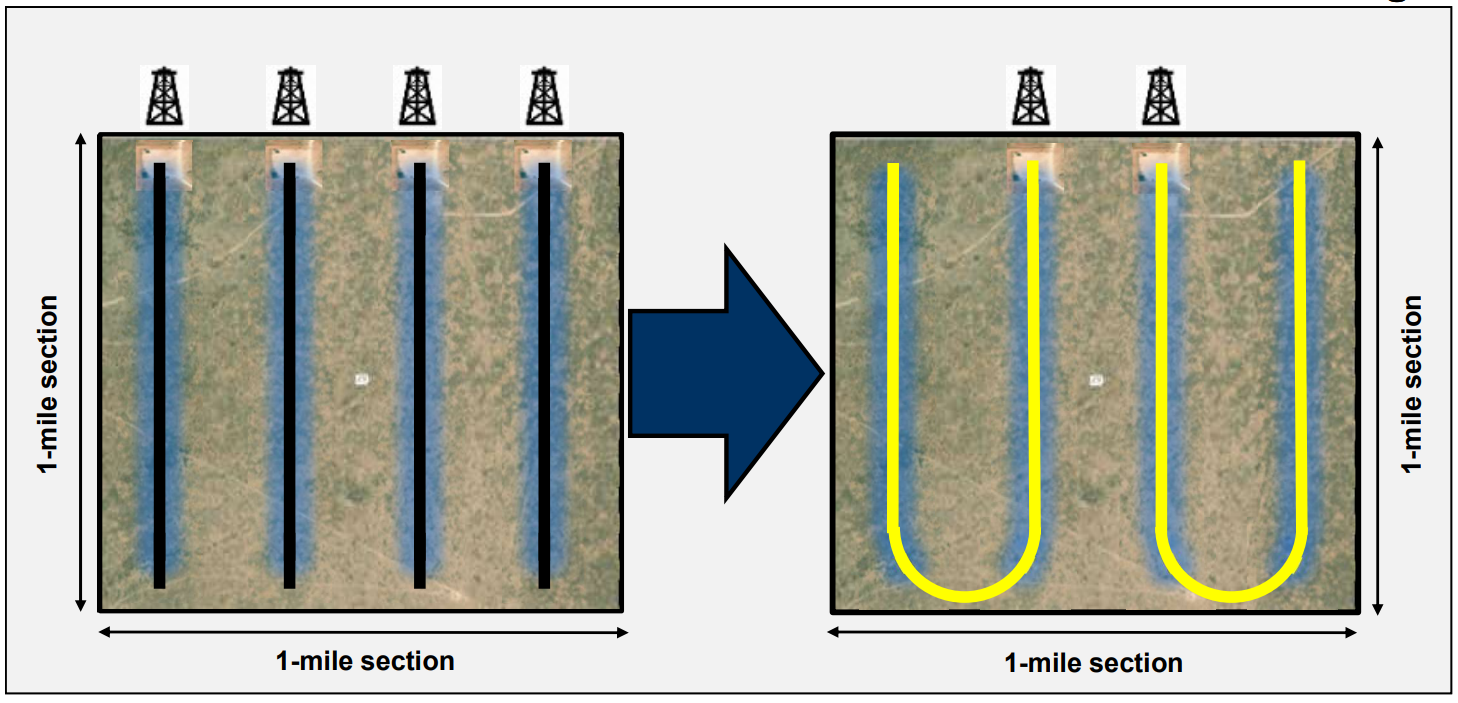

The company also announced testing its first batch of “horseshoe” wells in the Wolf asset area in West Texas.

Instead of drilling four 1-mile wells, Matador drilled two-mile U-shaped laterals with its horseshoe well test.

Chris Calvert, executive vice president and co-COO at Matador, said drilling two horseshoe wells versus drilling four 1-mile lateral wells resulted in about a 50% reduction in overall drilling and completion times.

Matador also expects to realize about $10 million in cost savings by drilling two horseshoe wells over drilling four 1-mile horizontal wells. The company was able to save around 10 miles of extra steel casing by reducing two vertical portions of the wells, Calvert said.

The company expects to turn its first horseshoe wells online in the latter half of the year.

RELATED: Wells in Top U.S. Oil Basins Getting Gassier

Recommended Reading

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

Subsea7 Awarded Sizable Contract in GoM

2024-04-12 - Subsea7 will install a flowline for Talos’ Sunspear development in the Gulf of Mexico.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.