The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

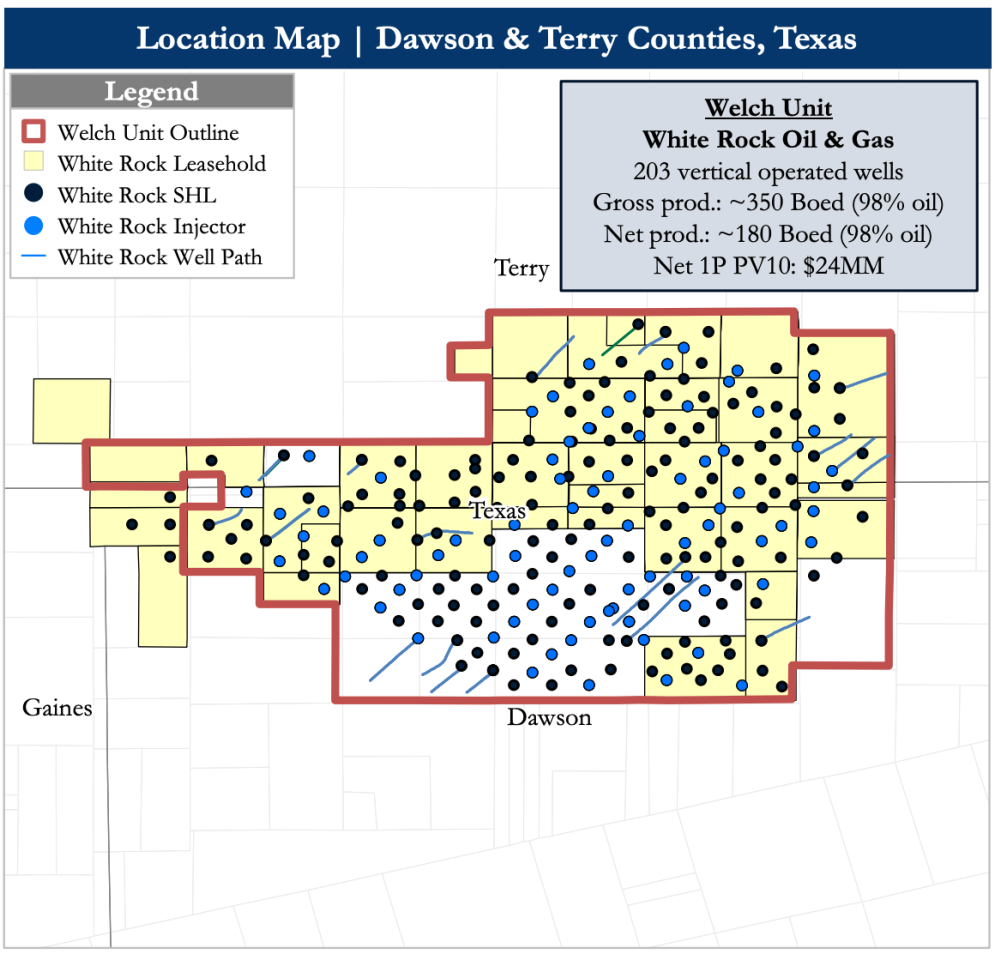

White Rock Oil & Gas retained PetroDivest Advisors to market for sale its Welch Unit waterflood properties in Dawson and Terry counties, Texas.

The assets offer an attractive opportunity, PetroDivest said, to acquire strong, low-decline, and oil-weighted net production and cash flow, about 4,700 operated net acres with interest in 161 producers and injectors, and multiple identified opportunities for field redevelopment and waterflood optimization to unlock additional production, reserves and cash flow.

Asset Highlights:

- Consolidated ~4,700 Net Acre Position

- Large, operated, HBP and contiguous position provides control for buyer improvements of waterflood and ongoing operations

- 80 producing wells, 81 water injection wells, 42 PDNP wells

- Concentrated position enables efficient operations and low lifting costs of <$20/Bbl

- Large, operated, HBP and contiguous position provides control for buyer improvements of waterflood and ongoing operations

- Low-Decline, Oil-Weighted Net Production (~180 bbl/d of oil on 6% Decline)

- A legacy oil-producing asset with 60 years of productivity and consistently low annual decline serves as a resilient cash flow engine

- ~$5 million next 12-month operating cash flow (PDP)

- PDP NPV-10: $22 million

- PDP Net Reserves: 1.0 MMboe

- Asset well-maintained throughout prior and current operatorship (Devon and White Rock, respectively)

- Infrastructure in place to support operations and improvements

- A legacy oil-producing asset with 60 years of productivity and consistently low annual decline serves as a resilient cash flow engine

- Primed for Optimization & Redevelopment

- Significant workover potential with 17 wells identified to return low-risk, meaningful production online

- +43 boe/d initial additional net production

- +$2 million NPV10%

- Waterflood pattern realignment potential with producer-to-injector and injector-to-producer conversion resulting in better reservoir sweep and a further arrested decline

- Injection realignment identified by White Rock based on analog Chevron McElroy Field

- Significant workover potential with 17 wells identified to return low-risk, meaningful production online

Process Summary:

- Evaluation materials available via the Virtual Data Room on May 11

- Bids are due on June 9

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

What's Affecting Oil Prices This Week? (March 4, 2024)

2024-03-04 - For the upcoming week, Stratas Advisors expect the price of Brent will move sideways and will struggle to break through $85.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

Oil Prices Edge Up on Big US Crude Withdrawal, China Stimulus

2024-01-24 - U.S. crude storage withdrawal, Chinese economic stimulus and geopolitical tensions countered concerns over tepid demand.

What's Affecting Oil Prices This Week? (Jan. 29, 2024)

2024-01-29 - For the upcoming week, Stratas Advisors forecast that increase in oil prices will be moderated likely due to the U.S. being cautious in response to the recent attack on U.S. troops.

Oil Dips as Demand Outlook Remains Uncertain

2024-02-20 - Oil prices fell on Feb. 20 with an uncertain outlook for global demand knocking value off crude futures contracts.