The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

White Rock Oil & Gas retained PetroDivest Advisors to market for sale its oil and gas properties, leasehold and related assets in Dawson County, Texas.

The assets comprise of a fully operated, 100% HBP position with low-decline, 100% oil production including highly economic Middle Spraberry (MSS) locations demonstrated by analogous results and supported by nearby offset activity, according to PetroDivest. Additionally, the offering includes potential in the Lower Spraberry (LSS) and Dean formations providing additional near-term development targets.

Highlights:

- Contiguous ~1,417 net acres (100% operated and 100% HBP)

- Blocky, HBP, operated position provides extended lateral development with optionality on development timing

- ~1,417 gross and net acres (100% working interest and 80% royalty interest)

- Access to proven and highly economic Spraberry targets

- Stable, legacy vertical production (~20 boe/d and $380,000 next 12-month PDP cash flow)

- Low-decline production provides reliable cash flow while retaining HBP status

- Three PDP, three PDNP and one saltwater disposal vertical well

- PDP PV-10: ~$2 million

- Two near-term recompletions provide low-cost conventional opportunities

- PDNP PV-10: ~$3 million

- Includes production facility capable of handling a scalable 2,000+ bbl/d of water

- Low-decline production provides reliable cash flow while retaining HBP status

- Spraberry development alongside active operators

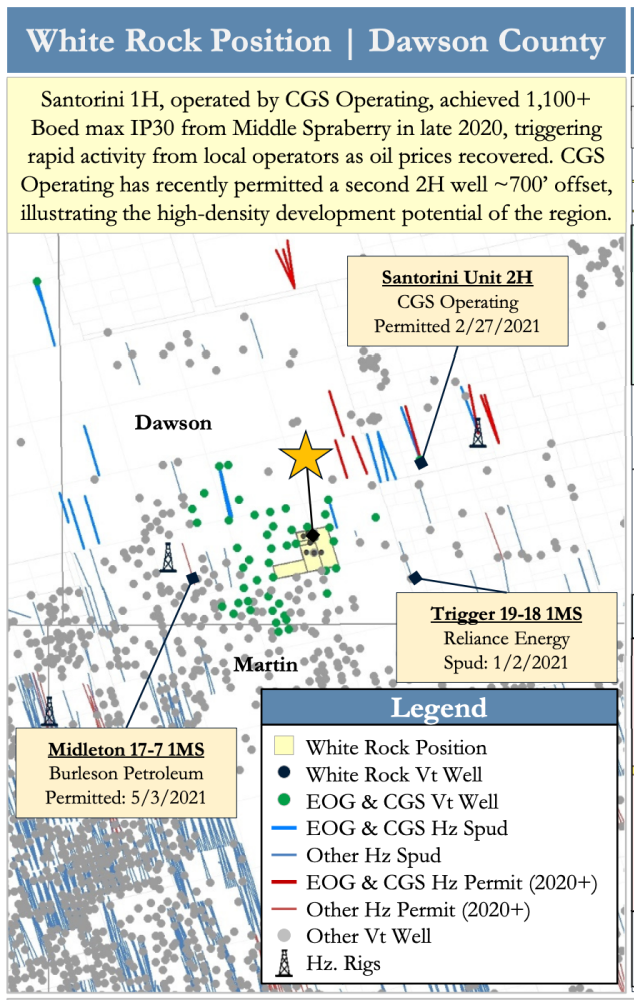

- Regionally focused operators, including EOG Resources Inc., CGS Operating LLC and others, surround White Rock’s position

- 11 nearby wells permitted over the last 12 months

- Santorini 1H, operated by CGS Operating, achieved 1,100+ boe/d max IP30 from Middle Spraberry in late 2020, triggering rapid activity from local operators as oil prices recovered

- CGS Operating has recently permitted a second 2H well ~700-ft offset, illustrating the high-density development potential of the region

- Encouraging Spraberry results in Dawson County with additional Dean potential

- 100%+ single well IRRs

- Lower D&C costs of ~$650/ft

- Surrounding Middle Spraberry wells achieved average IPs of ~700 boe/d (90%+ oil) with IRRs of 100%+, due to lower D&C costs, providing rapid returns on investment

- 16 Spraberry locations identified (eight MSS and eight LSS)

- 3P PV-10: ~$53 million

- NE-SW trending MSS (Gin Sand) proven to be highly productive and on-trend with recent development

- Log characteristics are similar to logs offset the highly productive Santorini well

- Regionally focused operators, including EOG Resources Inc., CGS Operating LLC and others, surround White Rock’s position

Process Summary:

- Evaluation materials available via the Virtual Data Room on June 30

- Proposals due on July 28

PetroDivest anticipates purchase and sale agreement execution by mid-August and closing by September. For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.