The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Reserve Oil & Gas Inc. et al retained EnergyNet for the sale of a 188-well package in West Virginia through a sealed-bid offering closing Oct. 6.

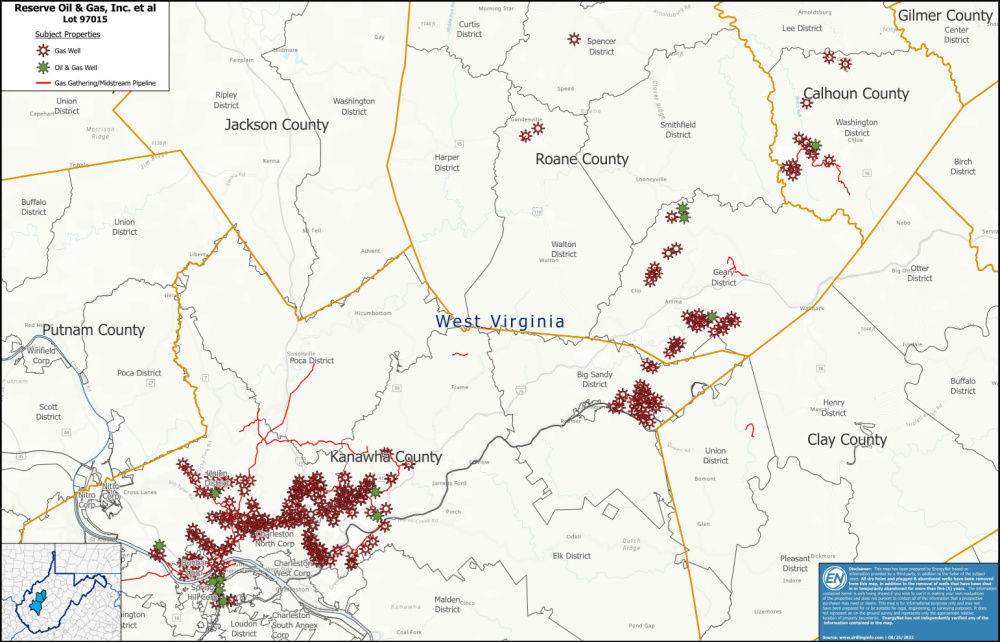

The property, Lot# 97015, includes operations, overriding royalty interest (ORRI) and royalty interest plus HBP leasehold acreage and midstream pipelines in Calhoun, Kanawha and Roane counties in West Virginia.

Highlights:

- Operated Working Interest in 188 Wells:

- Average Working Interest ~60.38% / Average Net Revenue Interest ~49.87%

- An Additional ORRI in 153 Wells

- An Additional Royalty Interest in 41 Wells

- Six-month Average Net Cash Flow: $279,003/Month

- Six-month Average 8/8ths Production: 2,405 Mcf/d

- Six-month Average Net Production: 1,270 Mcf/d

- 13,499.97 Net HBP Leasehold Acres:

- 34 Undeveloped Locations | 1,360.00 Undeveloped Acres on HBP Leases

- ~40 Miles of Gas Gathering/Midstream Pipelines in Kanawha County, W.Va.:

- Operated by United Gas Pipeline (UGP), Ajax Pipeline and Liberty Pipeline

- Operator Bond Required

Bids are due at 4 p.m. CDT on Oct. 6. For complete due diligence information visit energynet.com or email Cody Felton, managing director, at Cody.Felton@energynet.com, or Denna Arias, executive director of acquisitions and divestments, at Denna.Arias@energynet.com.

Recommended Reading

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.

US Could Release More SPR Oil to Keep Gas Prices Low, Senior White House Adviser Says

2024-04-16 - White House senior adviser John Podesta stopped short of saying there would be a release from the Strategic Petroleum Reserve any time soon at an industry conference on April 16.

Core Scientific to Expand its Texas Bitcoin Mining Center

2024-04-16 - Core Scientific said its Denton, Texas, data center currently operates 125 megawatts of bitcoin mining with total contracted power of approximately 300 MW.

Trans Mountain Pipeline Announces Delay for Technical Issues

2024-01-29 - The Canadian company says it is still working for a last listed in-service date by the end of 2Q 2024.