The following information is provided by Energy Advisors Group (EAG). All inquiries on the following listings should be directed to EAG. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

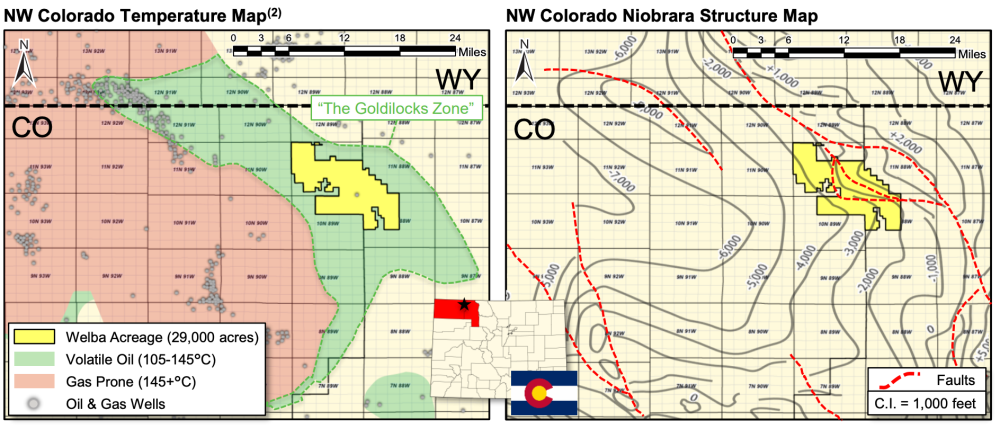

Energy Advisors Group (EAG) retained by Welba Peak to market its unique, expansive and de-risked Niobrara development opportunity chasing 200 million boe in a horizontal volatile oil play across three benches in Colorado’s Moffatt and Routt counties. Welba estimates it will take $188 million in original capital to develop an immediate 18 wells and applicable infrastructure. The project anticipates individual wells to come on (30-day IP, after cleanup) just under 1,000 boe/d and recover 535,000 barrels of oil and 3.6 Bcf of gas (1.135 million boe/well, 47% oil) per 10,000-ft lateral.

Overview:

- Significant Northwest Colorado Sand Wash Basin Project

- 220-well Development Opportunity. 18-Initial Wells. 29,000-Net Acres

- Prolific Niobrara Resource Play

- Liquids-Rich Tow Creek, Wolf Mountain and Rangely Formations (10,200 – 10,900 ft)

- Overpressure and Thermally Fractured Rock Offer Great Potential

- Project De-risked By Pilot, Reservoir Modeling, Geological Studies and 2D Seismic

- Pilot Horizontal Seven-Month Production: 93,000 barrels of oil and 300 MMcf of gas – on choke

- Pilot Well Peak Rate of 820 bbl/d of oil and 2.9 MMcf/d of gas from 8,000-ft effective lateral

- Single Well Drill and Complete Costs: $9.8 million for 10,000-ft lateral

- Project Offers An Estimated IRR >100% at $60/bbl & $3.30/Mcf

- Seeking Partners and Capital To Initiate 2+ Rig Program To Develop Project.

Key Investment Highlights:

- $11 million in upfront infrastructure costs (gas pipeline and saltwater disposal well) to kick off the project

- $59 million D&C first tranche of wells (six wells on two pads)

- $118 million D&C on next tranche of wells (12) to fill up capacity on planned gas pipeline

- Ability to loop gas pipeline as needed when moving to full development

Bids are due in early April and the virtual data room is available at EnergyAdvisors.com/deals. For more information email Steve Henrich, EAG director of business development and execution, at shenrich@energyadvisors.com, or Alan Yoelin, EAG director and petroleum engineer, at ayoelin@energyadvisors.com.

Recommended Reading

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.