The following information is provided by BOK Financial Securities. All inquiries on the following listings should be directed to BOK Financial Securities. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

VirTex Operating Company, Inc., with related entities Faraday Midstream Co., and Catalyst Drilling Company, Inc., (collectively "VirTex" or the "Company") are offering for sale certain operated and non-operated upstream properties, associated midstream infrastructure, and well service assets concentrated in the Eagle Ford Shale. The Company has retained BOK Financial Securities, Inc., ("BOKFS") as their exclusive advisor in connection with the transaction.

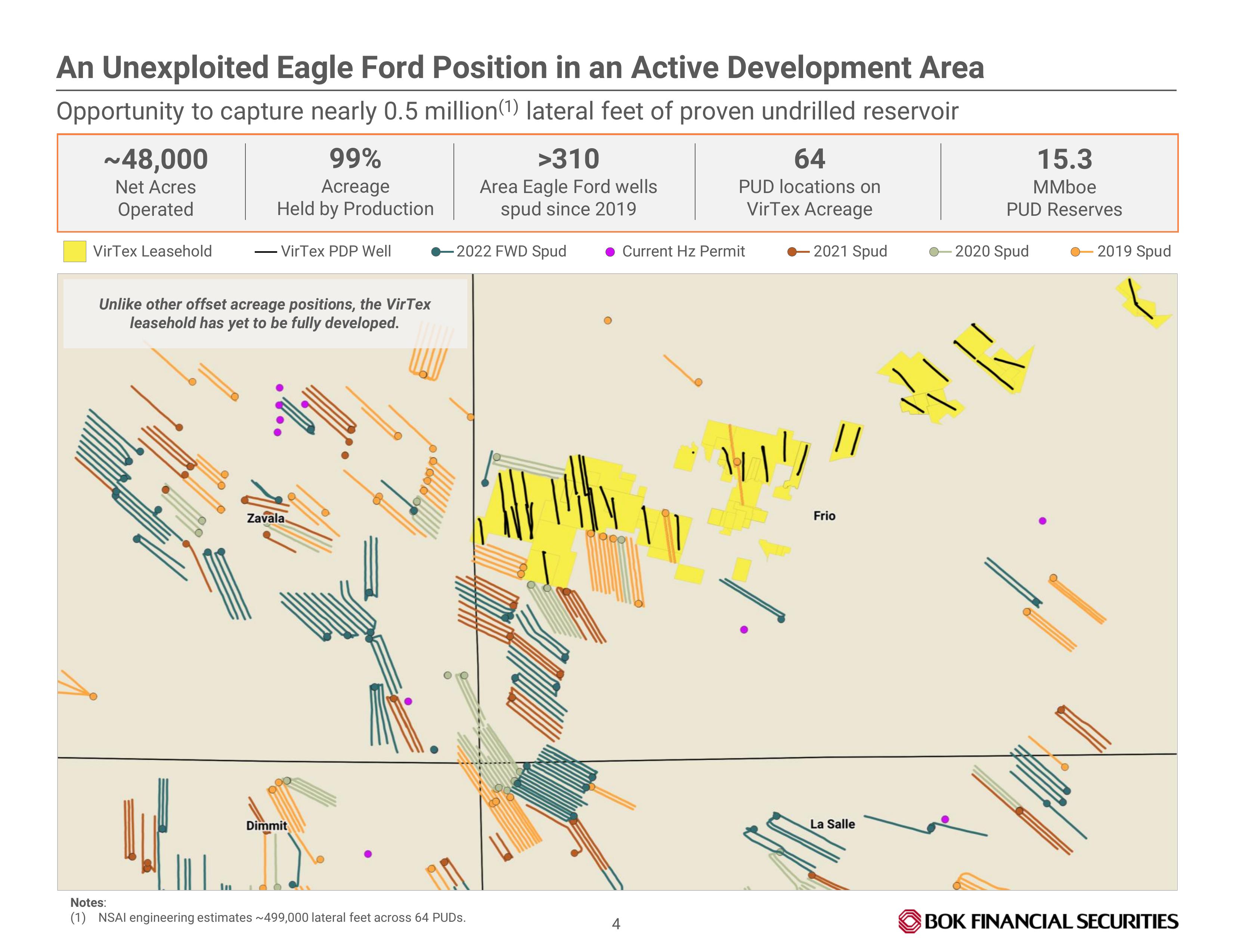

Asset Overview

- ~48,000 net acres concentrated in Frio and Atascosa Counties (99% HBP)

- 170 operated PDP wells and 64 PUD locations; 13 non-operated PDP wells

- Average 93% WI / 75% NRI (8/8th) on operated PDP wells

Reserves & Production

- PDP PV-10: $53 million (includes third-party midstream income)

- Net production: 1,342 boe/d (58% liquids); 2,828 boe/d gross

- F12M PDP cash flow: $12.8 million

- 16 near-term Eagle Ford infill locations: PV10 of $55MM and 6.4 MMboe net reserves

- Total 3P PV10: $454MM and 52 MMboe net reserves

Midstream System

- 127 miles of gathering pipelines providing multiple interconnects to major markets along the Gulf Coast

- 11 MMcf/d of current gas throughput

- Owned compressor facilities and Amine Treatment Plant

Divestment Process Timeline

- Virtual data room (“VDR”) and data room presentations available on Tuesday, May 9th

- Bids are due Wednesday, June 14th

Bids are due June 14. For complete due diligence information, please visit BOK Financial’s website or email Cristina Stellar, at cstellar@bokf.com, or Jason Reimbold, at jreimbold@bokf.com.

Recommended Reading

Enterprise Buys Assets from Occidental’s Western Midstream

2024-02-22 - Enterprise bought Western’s 20% interest in Whitethorn and Western’s 25% interest in two NGL fractionators located in Mont Belvieu, Texas.

Report: Occidental Eyes Sale of Western Midstream to Reduce Debt

2024-02-20 - Occidental is reportedly considering a sale of pipeline operator Western Midstream Partners as the E&P works to close a $12 billion deal in the Permian Basin.

Sitio Royalties Dives Deeper in D-J with $150MM Acquisition

2024-02-29 - Sitio Royalties is deepening its roots in the D-J Basin with a $150 million acquisition—citing regulatory certainty over future development activity in Colorado.

Analysts: Diamondback-Endeavor Deal Creates New Permian Super Independent

2024-02-12 - The tie-up between Diamondback Energy and Endeavor Energy—two of the Permian’s top oil producers—is expected to create a new “super-independent” E&P with a market value north of $50 billion.

E&P Highlights: Feb. 12, 2024

2024-02-12 - Here’s a roundup of the latest E&P headlines, including more hydrocarbons found offshore Namibia near the Venus discovery and a host of new contract awards.