The following information is provided by Seaport Global Securities LLC. All inquiries on the following listings should be directed to Seaport Global Securities LLC. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

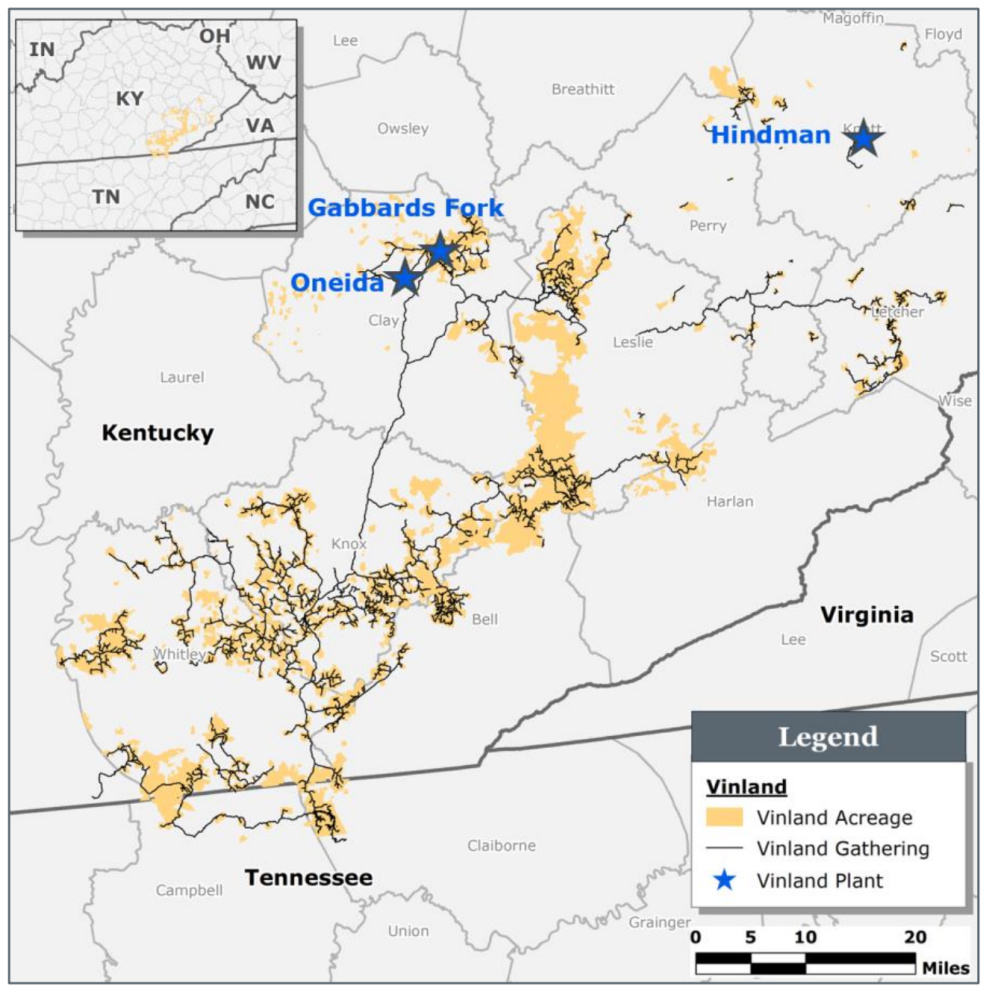

Vinland Energy LLC retained Seaport Global Securities LLC for the sale of its portfolio of producing and midstream assets in the southern Appalachian Basin, located primarily in eastern Kentucky.

The Vinland Kentucky assets represent an opportunity to acquire roughly 15 MMcfe/d of stable, low-decline, liquids-rich production that can be maintained or grown through a highly-efficient capital program, and that is further enhanced by a large, company-owned gas gathering and processing system, according to Seaport.

Highlights:

- Over 142,000 net acres of 100% operated core Appalachian acreage that is 100% HBP

- Current net production of about 15 MMcfe/d with less than a 3% annual decline

- Total proved reserves of 111 Bcfe with a PV-10 of $165 million (PDP PV-10 of $143 million); 10-year forecasted cumulative operating cash flow of $219 million

- Gas gathering and processing system with about 1,500 miles of company-owned and -operated pipeline and three NGL processing plants (total capacity of about 33 MMcf/d)

- Strong Midstream PV-10 contribution of $44 million

- Capital-efficient development plan with 4 WIPs and 20 PUDs reduces decline to nearly zero with minimal capex

- Liquids-rich development locations (62% oil), generate average IRRs of 73%

- Vertical development in the Maxon, Ravencliff and Big Lime formations

Bids are due Sept. 29. A virtual data room is available. For information contact James Libretti at jlibretti@seaportglobal.com.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.