The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

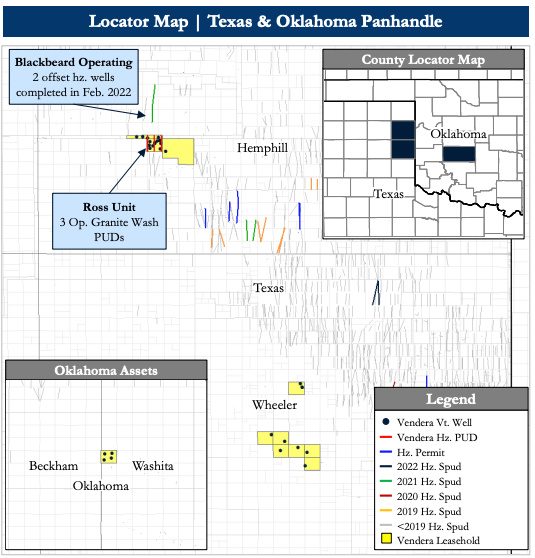

Vendera Resources retained PetroDivest Advisors to market for sale its operated oil and gas properties located in the Texas and Oklahoma Panhandle.

The assets offer an opportunity to acquire an operated, HBP footprint comprised of roughly 2,550 net acres and 26 low-decline vertical wells producing high-margin, gas-weighted cash flow from multiple stacked Granite Wash intervals, according to PetroDivest. Three operated horizontal Granite Wash PUD locations provide substantial undeveloped potential beyond PDP.

Asset Highlights:

- Low Decline (~2.25% next 12-month) Gas-Weighted Production | 1.8 MMcfe/d | 94% Gas

- ~$3.9 million next 12-month PDP operating cash flow

- Conventional vertical production from multiple stacked-pay intervals throughout the Granite Wash

- High-margin asset with >90% operating margin

- Low lifting costs of $0.20/Mcfe

- Current net production of 1,820 Mcfe/d (94% gas) from 26 legacy vertical wells

- PDP PV-10: ~$21 million

- PDP Net Reserves: 12.2 Bcfe

- R/P: >18 years

- ~2,550 Net Acres | 100% Held by Production | 100% Operated

- Concentrated leasehold blocks in Hemphill & Wheeler Counties, Texas and Washita County, Oklahoma

- 2,260 net acres in Texas

- 294 net acres in Oklahoma

- 60.0% average Working Interest & 52.2% average Net Revenue Interest

- Average 87% 8/8th Net Revenue Interest / 13% royalty

- Concentrated leasehold blocks in Hemphill & Wheeler Counties, Texas and Washita County, Oklahoma

- Horizontal PUD Inventory and Recent Workover

- Three operated horizontal PUDs located in the Ross Unit (49.7% working interest)

- Offset activity from Blackbeard Operating includes two recent DUCs

- Incremental workover on the Hobart Ranch 1967 well

- 200 Mcf/d uplift from velocity string install

- Significant 3P value and reserves

- 3P PV-10: ~$31 million

- 3P Net Reserves: 18.1 Bcfe

- Three operated horizontal PUDs located in the Ross Unit (49.7% working interest)

Process Summary:

- Evaluation materials available via the Virtual Data Room on Sept. 12

- Proposals due on Oct. 19

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.