The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

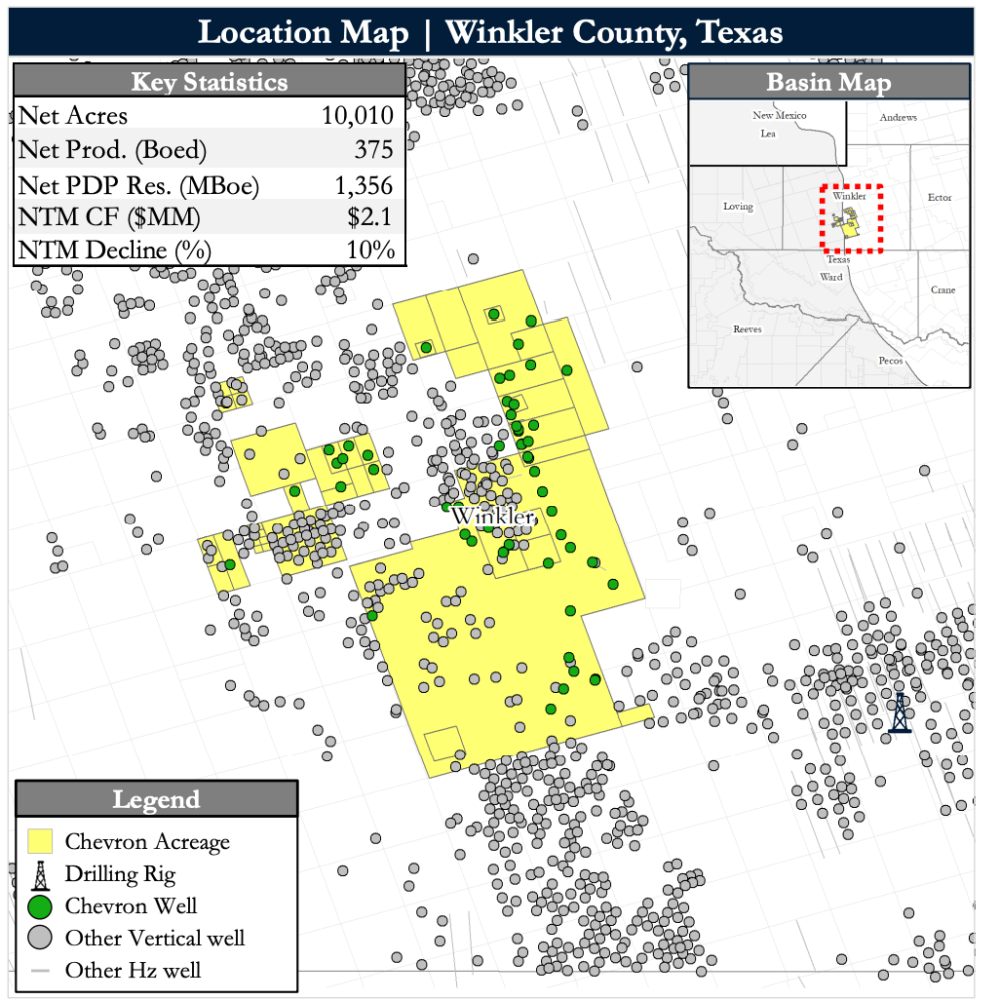

Chevron U.S.A. Inc. retained Detring Energy Advisors to market for sale certain of its oil and gas producing properties, leasehold and related assets located on the western slope of the Central Basin Platform in Winkler County, Texas.

The assets include meaningful low-decline, high-margin production, according to Detring, generating roughly $2.1 million of annual cash flow and a high working interest, fully HBP, operated footprint with upside potential consisting of recompletions, infill development drilling, prospective horizontal horizons and operational efficiency improvements.

Highlights:

- Legacy Assets with Operational and Development Opportunities

- Large, concentrated, HBP position provides complete operational control with the opportunity for value-add projects

- 10,010 net acres

- 100% Working Interest | 100% HBP

- Low royalty-burden (85% Net Revenue Interest)

- Well-maintained, albeit “underexploited” asset within Chevron’s portfolio

- Operational control provides opportunity to boost cash flow with additional operational oversight and capital budget

- Contiguous, operated acreage and well locations provide economies of scale for operations and workovers

- Large, concentrated, HBP position provides complete operational control with the opportunity for value-add projects

- Substantial Production Base (~380 boe/d | ~30% Liquids)

- Reliable, low-decline production providing a stable cash flow base

- $2.1 million next 12-month cash flow

- Shallow ~10% annual decline

- 16 currently producing vertical wells garnering a PV10 of $7.4 million

- PDP Net Reserves: ~1.4 MMboe (32% Liquids)

- PDP R/P: ~10 years

- Resilient cash flow stream supported by high revenue interests (~85%) and low lifting costs

- Reliable, low-decline production providing a stable cash flow base

Process Summary

- Evaluation materials available via the Virtual Data Room on Oct. 27

- Proposals due on Nov. 22

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Marketed: Navigation Powder River Eight Leasehold Lots in Wyoming

2024-04-09 - Navigation Powder River has retained EnergyNet for the sale of eight non-producing federal leasehold lots in Converse and Campbell counties, Wyoming.

ONEOK CEO: ‘Huge Competitive Advantage’ to Upping Permian NGL Capacity

2024-03-27 - ONEOK is getting deeper into refined products and adding new crude pipelines through an $18.8 billion acquisition of Magellan Midstream. But the Tulsa company aims to capitalize on NGL output growth with expansion projects in the Permian and Rockies.

Marketed: Anadarko Minerals Woodford Shale Opportunity

2024-02-26 - Anadarko Minerals has retained EnergyNet for the sale of a Woodford Shale opportunity in Blaine County, Oklahoma.

Aethon Cuts Rigs but Wants More Western Haynesville Acreage

2024-03-31 - Private gas E&P Aethon Energy has drilled some screamers in its far western Haynesville Shale play—and the company wants to do more in the area.

Daugherty: Diamondback Scales Up Amid Consolidation Super Cycle

2024-03-11 - It’s time for the strongest among the services sector to follow Diamondback's lead: find fortifying prey and hunt.