The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

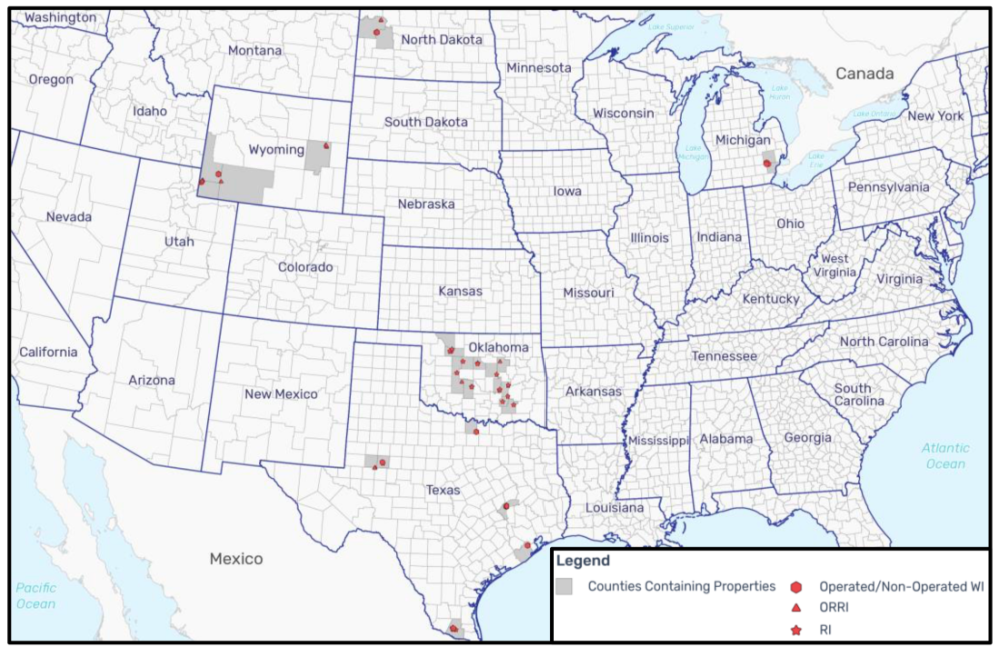

Stephens Production Co. retained EnergyNet for the sale of certain oil and gas properties including a large asset package located throughout Colorado, Michigan, North Dakota, Oklahoma, Texas and Wyoming.

The sealed-bid offering comprises 243 properties and includes nonoperated working interest, overriding royalty interest (ORRI) and royalty interest generating around $250,000 a month in cash flow. Bids are due at 4 p.m. CST on Feb. 10. The transaction is expected to close in early March with an effective date of Jan. 1.

Highlights:

- Nonoperating Working Interest in 56 Properties:

- Average Working Interest ~19.81% / Average Net Revenue Interest ~16.53%

- 51 Producing Properties | One Saltwater Disposal | Four Shut-In Properties

- Select Operators: ConocoPhillips and MD America Energy LLC

- Royalty Interest in 105 Properties:

- Average Royalty Interest ~4.27%

- 85 Producing Properties | 20 Shut-In Properties

- Select Operators: Blackbeard Operating LLC and Merit Energy Co.

- ORRI in 75 Properties:

- Average ORRI ~0.32%

- 63 Producing Properties | 12 Shut-In Properties

- Select Operators: Birch Operations Inc. and Hilcorp Energy Co.

- Participating Minerals in Seven Producing Properties:

- Average Working Interest/Net Revenue Interest ~1.46%

- Operators: EOG Resources Inc. and SM Energy Co.

- Six-month Average 8/8ths Production: 10,123 bbl/d of Oil and 33,712 Mcf/d of Gas

- Six-month Average Net Income: $256,504/Month

Separately, Stephens Production Co. also retained EnergyNet for the sale of a seven-well Mississippian Play package with operations plus HBP leasehold acreage in Oklahoma’s Woods County. Bids for the separate package are due by 1:35 p.m. CST on Feb. 9.

For complete due diligence information on either package visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.

CNOOC Finds Light Crude at Kaiping South Field

2024-03-07 - The deepwater Kaiping South Field in the South China Sea holds at least 100 MMtons of oil equivalent.

Eni Finds 2nd Largest Discovery Offshore Côte d’Ivoire

2024-03-08 - Deepwater Calao Field’s potential resources are estimated at between 1 Bboe and 1.5 Bboe.

Cronos Appraisal Confirms Discovery Offshore Cyprus

2024-02-15 - Eni-operated block partner TotalEnergies says appraisal confirms the presence of significant resources and production potential in the block.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.