The following information is provided by Meagher Energy Advisors. All inquiries on the following listings should be directed to Meagher Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

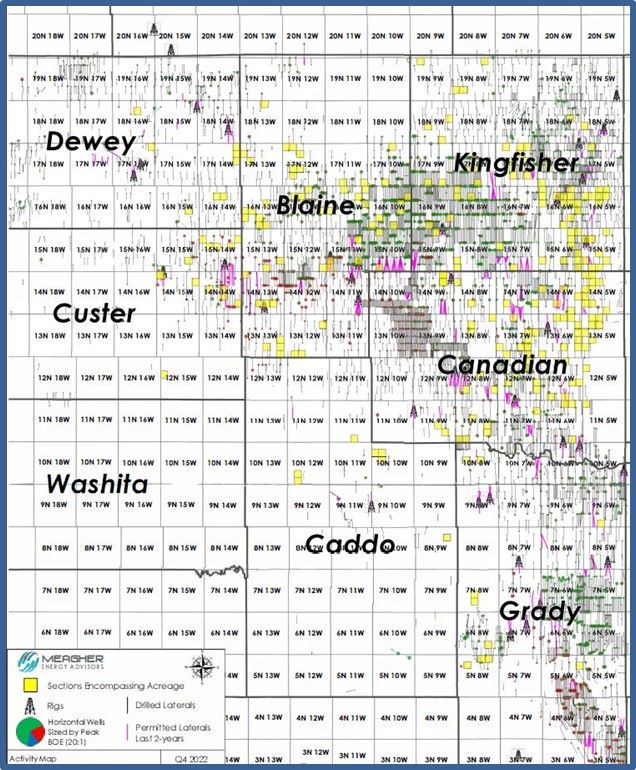

An undisclosed seller retained Meagher Energy Advisors for the sale of SCOOP/STACK non-operated production, leasehold and minerals assets in Blaine, Kingfisher and Canadian counties, Oklahoma. The position includes 8,900 net leasehold acres with over 35 active rigs drilling in the basin.

Key considerations:

- December 2022 PDP net cashflow of $2.3 million and 2,281 boe/d (50% liquids)

- Over 8,900 net leasehold acres and 192 net royalty acres in Mississippian and Woodford formations

- Production from seven new DUCs adding 192 net boe/d and $242,000/month by Q1 2023

- Eight additional 2-mile, Tier 1 locations permitted on the position. Seven expected online in Q1 2023, adding 417 net boe/d and $622,000/month by March

- Tier 1 well performance in Meramec/Osage and Woodford formations

- Devon, Continental, BCE-Mach, Ovintiv and Canvas with rigs on or adjacent to the position. Over 35 active rigs drilling in the basin.

- 92 low-risk, “line-of-sight” PUDs add 1.2 MMbbl net oil reserves and 14.4 Bcf gas. Hundreds of additional drilling locations available.

Bids are due on Jan. 17, 2023. The transaction is expected to have an effective date of Dec. 1, 2022 and closing date of April 3, 2023.

For more information visit meagheradvisors.com or contact Nick Asher, vice president at Meagher Energy Advisors, at nasher@meagheradvisors.com or 303-721-9781.

Recommended Reading

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.

CNOOC Finds Light Crude at Kaiping South Field

2024-03-07 - The deepwater Kaiping South Field in the South China Sea holds at least 100 MMtons of oil equivalent.

Eni Finds 2nd Largest Discovery Offshore Côte d’Ivoire

2024-03-08 - Deepwater Calao Field’s potential resources are estimated at between 1 Bboe and 1.5 Bboe.