The following information is provided by Meagher Energy Advisors. All inquiries on the following listings should be directed to Meagher Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

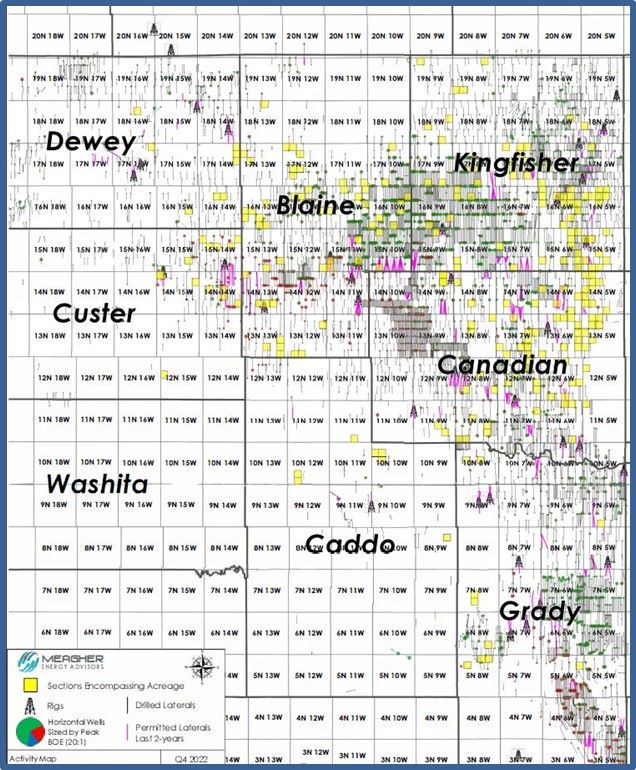

An undisclosed seller retained Meagher Energy Advisors for the sale of SCOOP/STACK non-operated production, leasehold and minerals assets in Blaine, Kingfisher and Canadian counties, Oklahoma. The position includes 8,900 net leasehold acres with over 35 active rigs drilling in the basin.

Key considerations:

- December 2022 PDP net cashflow of $2.3 million and 2,281 boe/d (50% liquids)

- Over 8,900 net leasehold acres and 192 net royalty acres in Mississippian and Woodford formations

- Production from seven new DUCs adding 192 net boe/d and $242,000/month by Q1 2023

- Eight additional 2-mile, Tier 1 locations permitted on the position. Seven expected online in Q1 2023, adding 417 net boe/d and $622,000/month by March

- Tier 1 well performance in Meramec/Osage and Woodford formations

- Devon, Continental, BCE-Mach, Ovintiv and Canvas with rigs on or adjacent to the position. Over 35 active rigs drilling in the basin.

- 92 low-risk, “line-of-sight” PUDs add 1.2 MMbbl net oil reserves and 14.4 Bcf gas. Hundreds of additional drilling locations available.

Bids are due on Jan. 17, 2023. The transaction is expected to have an effective date of Dec. 1, 2022 and closing date of April 3, 2023.

For more information visit meagheradvisors.com or contact Nick Asher, vice president at Meagher Energy Advisors, at nasher@meagheradvisors.com or 303-721-9781.

Recommended Reading

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.