The following information is provided by Stephens Inc. All inquiries on the following listings should be directed to Stephens. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Rockall Energy LLC and its affiliates, including Petro Harvester Operating Co., are offering to sell all or portions of the company, including producing assets located in North Dakota and the Gulf Coast throughout southern Louisiana and Mississippi. Rockall has retained Stephens Inc. as exclusive financial adviser in connection with this transaction.

The offering includes a securely diversified PDP base with over 230 active wells across the three positions—North Dakota, southern Louisiana and Mississippi—and is highly operated with average working interest over 90%. The package also includes a low-cost workover and recompletion inventory plus large-scale development potential with more than 400 gross drilling locations. Additionally, the North Dakota acreage is located in well-delineated and proven area of the Bakken/Three Forks and the Madison (Midale).

Highlights:

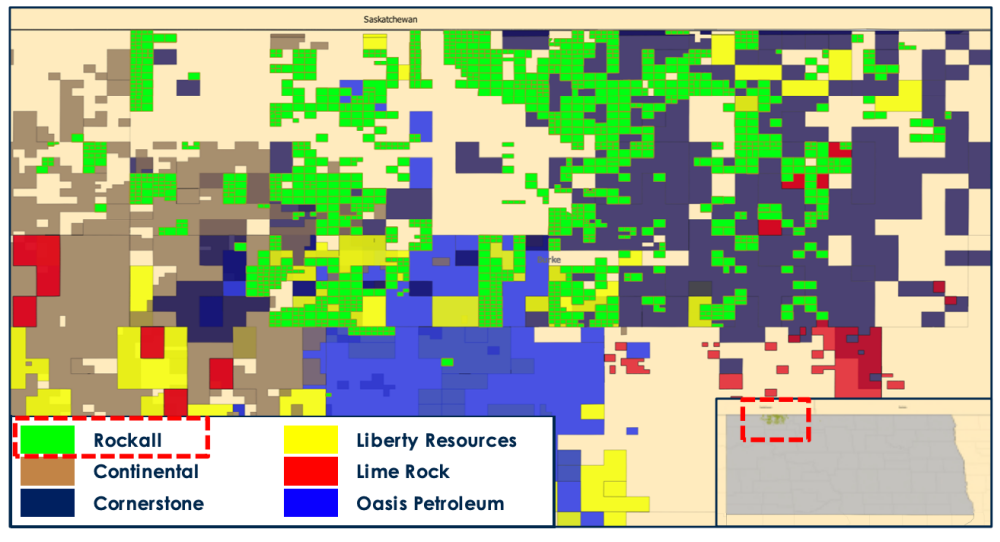

North Dakota

- ~76,000 net acres (100% operated) in Northern Burke County provide access to three well defined benches

- 11.2 MMboe of PDP reserves, with ~2,700 boe/d of net production (65% liquids) as of June 2021

- Upside includes 400+ gross drilling locations across the Bakken/Three Forks and Madison/Midale formations, providing access to both gas and liquids rich development

- Dedicated infrastructure in place, including long-term, fee-based contracts with regional G&P and pipeline takeaway midstream providers

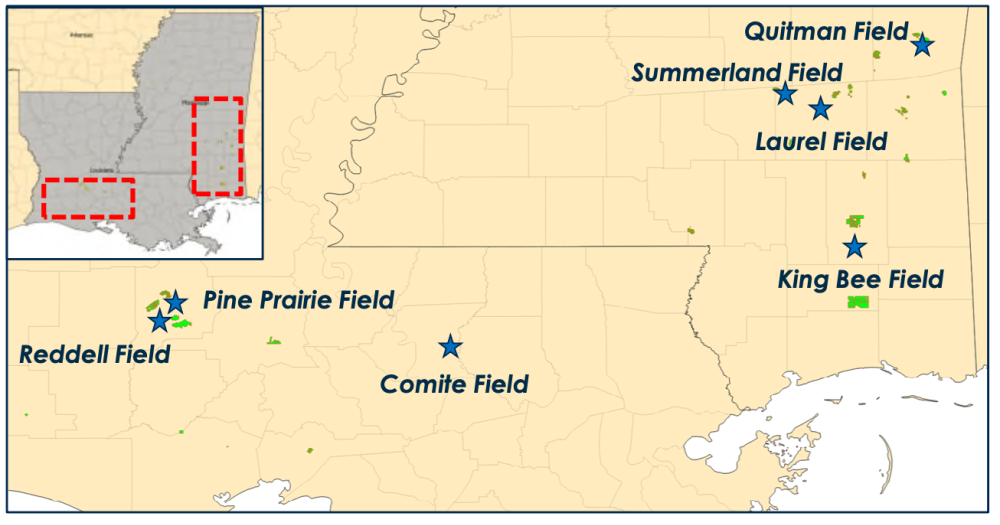

Louisiana and Mississippi

- ~23,000 net acres located in Evangeline, St. Landry, Iberia, Vermillion and East Baton Rouge counties (Louisiana), as well as ~34,000 net acres across Jones, Wayne, Clarke, Perry, Marion and Stone counties (Mississippi)

- Acreage is 96% operated and 90% HBP

- 9.0 MMboe of PDP reserves, with ~2,500 boe/d of net production (86% liquids) as of June 2021

- Upside includes 200+ low-cost, high-return workover and recompletion opportunities as well as 100+ new drill locations

Non-binding IOIs are due Oct. 22 with final bids due with purchase and sale agreement mark-ups on Nov. 5. Signing of the purchase and sale agreement is targeted by Nov. 29.

The seller’s preference is to receive a cash offer for the company or all assets. Offers for individual assets to be considered based on valuation, Stephens said.

A virtual data room is available. For information visit stephens.com or contact Keith Behrens, Stephens managing director, at Keith.Behrens@stephens.com or 214-258-2762.

Recommended Reading

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.