The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Riverside Energy retained EnergyNet Indigo for the sale of a 4,411 well package comprising overriding royalty interest (ORRI) in certain natural gas properties in Michigan’s Antrim Shale through a sealed-bid offering closing April 22.

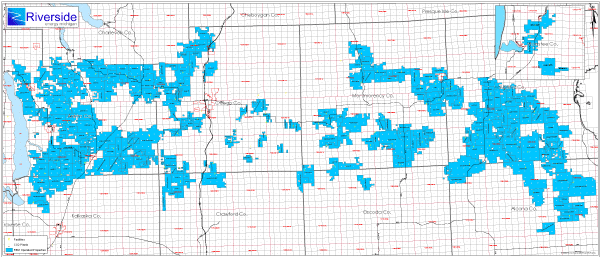

The ORRI assets are located in Michigan’s Alcona, Alpena, Antrim, Charlevoix, Crawford, Kalkaska, Manistee, Montmorency, Oscoda and Otsego counties.

Highlights:

- Offering 5% ORRI on Riverside's Interests in 4,411 Operated Wells

- Unique Opportunity to Acquire Mature and Predictable Low Decline ORRI Assets Within the Antrim Shale Formation

- Attractive Diverse Position Across 10 Michigan Counties

- Long Life Low Risk Reserves - Average 2%-4% Terminal Decline

- Six-Month Average Gas Sales: 93,280 Mcf/d

- Six-Month Average Net Income: $224,411/Month

- Next 12-Month Cash Flow (Net) on ORRI: $3.2 million

- Strong Operations with Riverside Energy Following Previous Operator Chevron

- Production from Antrim Shale w/ Further Production Enhancement Potential

- PDP PV 4: $49.5 million

- PDP PV 5: $43.4 million

- PDP PV 8: $31.2 million

Bids are due by 4 p.m. CDT April 22. For complete due diligence information visit indigo.energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.