The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

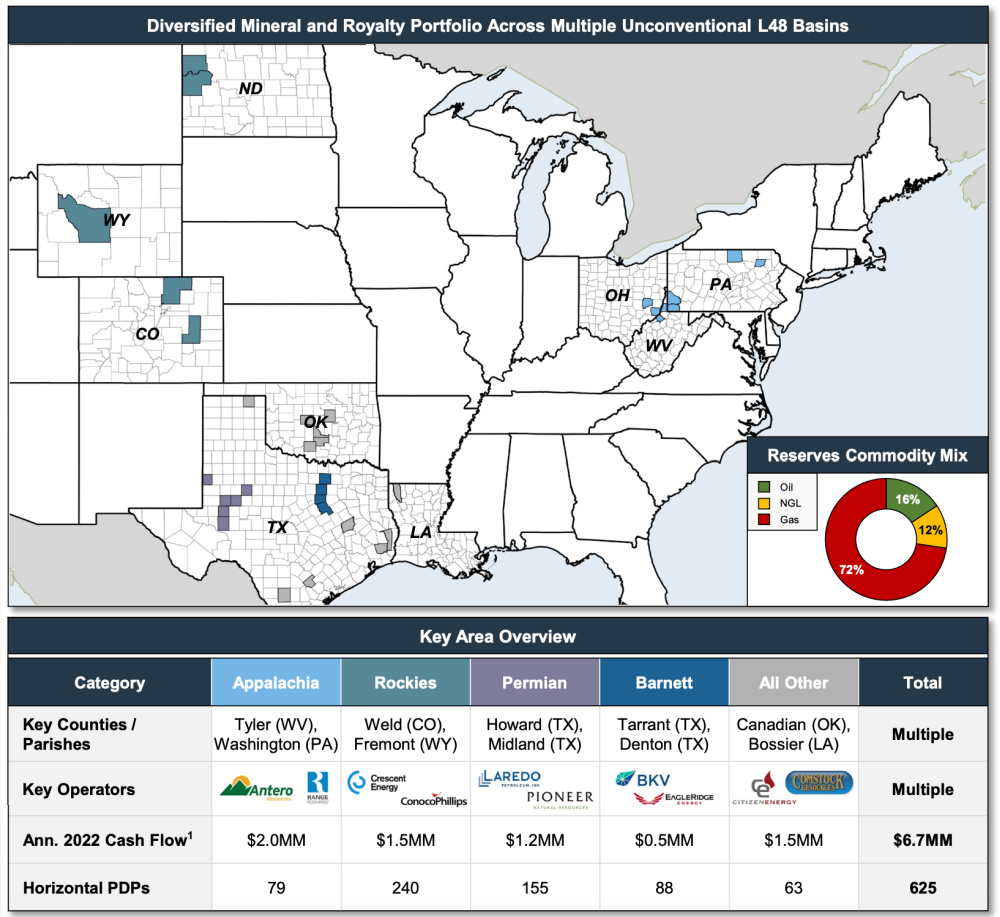

Rising Phoenix Royalties is offering for sale a diversified mineral and royalty portfolio across several basins in the continental U.S. The company has retained TenOaks Energy Advisors as its exclusive adviser in connection with the transaction.

Key Considerations:

- Attractive mineral and royalty portfolio strategically positioned in areas with ongoing serendipitous growth

- Asset anchored by large royalty ownership in the Rockies (Williston, D-J, Wind River), Permian (Midland Basin) and Marcellus / Utica

- Notable commodity diversification: 75% gas | 28% liquids

- Predictable, growing cash flow profile

- August 2022 cash flow: ~$700,000

- Annualized 2022 cash flow: ~$6.7 million

Bids are due Oct. 26. The transaction has an effective date of Oct. 1 and is targeted to close in December.

A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact B.J. Brandenberger at TenOaks Energy Advisors at 214-663-6999 or BJ.Brandenberger@tenoaksadvisors.com.

Recommended Reading

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.

TotalEnergies to Acquire Remaining 50% of SapuraOMV

2024-04-22 - TotalEnergies is acquiring the remaining 50% interest of upstream gas operator SapuraOMV, bringing the French company's tab to more than $1.4 billion.

TotalEnergies Cements Oman Partnership with Marsa LNG Project

2024-04-22 - Marsa LNG is expected to start production by first quarter 2028 with TotalEnergies holding 80% interest in the project and Oman National Oil Co. holding 20%.

Is Double Eagle IV the Most Coveted PE-backed Permian E&P Left?

2024-04-22 - Double Eagle IV is quietly adding leases and drilling new oil wells in core parts of the Midland Basin. After a historic run of corporate consolidation, is it the most attractive private equity-backed E&P still standing in the Permian Basin?