The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

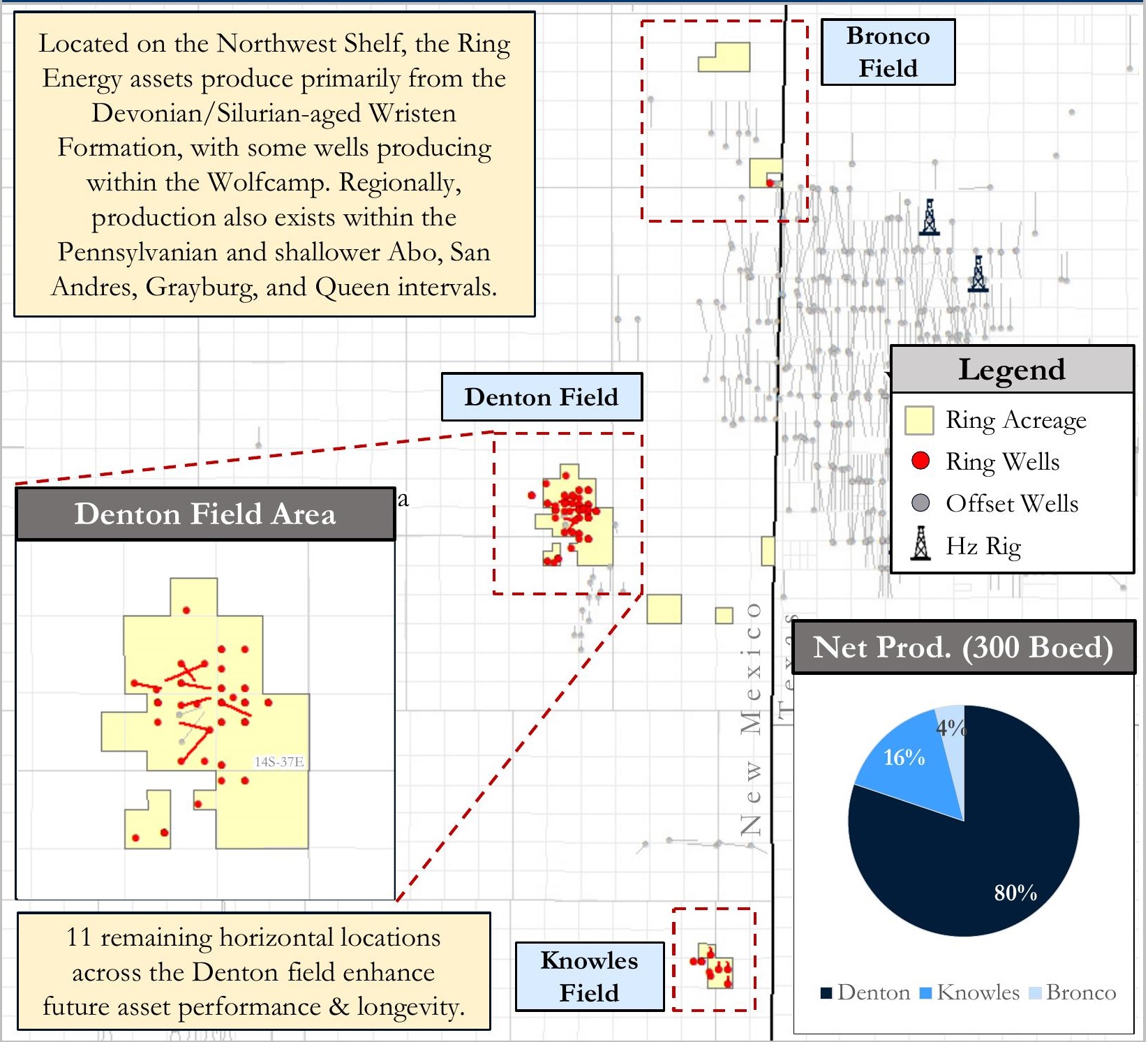

Ring Energy is offering for sale its operated oil and gas leasehold, producing properties, and related assets located in Lea County, New Mexico. The assets include 300 Boe/d of oil-weighted net production (93% oil) from 22 active PDP wells (9 horizontal), $2.2 million in cash flow across the next twelve months, and a central field office supporting asset enhancement via 11 horizontal Devonian locations and 5 identified vertical recompilations. Ring Energy has retained PetroDivest Advisors as its exclusive advisor relating to the transaction.

Asset Highlights:

- Oil-Weighted Net Production | 300 Boe/d | 93% Oil | 6% Decline

- Low-decline asset offers predictable performance and long-term PDP value (9.5 years R/P)

- 22 active producing wells (9 horizontal)

- 95% average WI & 76% average NRI

- Net Reserves: 1.9 MMboe (95% oil)

- Conventional oil-weighted production provides $2.2 million in next-twelve-month operating cash flow

- PDP PV10: $9.1MM

- Low-decline asset offers predictable performance and long-term PDP value (9.5 years R/P)

- ~5,180 Net Acres | Majority Held By Production

- Three distinct, concentrated field areas spanning 5,700 gross acres

- 72% held-by-production

- Additional 53 surface acres and 68 mineral acres included

- Centrally located field office in the Denton field provides operational and development support

- Includes field automation equipment and three active SWD wells

- Three distinct, concentrated field areas spanning 5,700 gross acres

- Identified Devonian Horizontal Development Opportunities

- Low-cost development of 11 horizontal Devonian locations underpinned by supporting technical data

- Seismic data exists across key development areas

- 40%+ IRR at $1.4MM/well D&C

- Full field development significantly enhances value and asset longevity

- PDNP+PUD PV10: $5.4MM

- Grand Total PV10: $14.5MM

- Low-cost development of 11 horizontal Devonian locations underpinned by supporting technical data

Bids are due on June 14. For complete due diligence information on this property, please visit http://www.petrodivest.com/ or contact Linda Fair.

Recommended Reading

Aethon Cuts Rigs but Wants More Western Haynesville Acreage

2024-03-31 - Private gas E&P Aethon Energy has drilled some screamers in its far western Haynesville Shale play—and the company wants to do more in the area.

Tellurian Exploring Sale of Upstream Haynesville Shale Assets

2024-02-06 - Tellurian, which in November raised doubts about its ability to continue as a going concern, said cash from a divestiture would be used to pay off debt and finance the company’s Driftwood LNG project.

Ohio Oil, Appalachia Gas Plays Ripe for Consolidation

2024-04-09 - With buyers “starved” for top-tier natural gas assets, Appalachia could become a dealmaking hotspot in the coming years. Operators, analysts and investors are also closely watching what comes out of the ground in the Ohio Utica oil fairway.

From Tokyo Gas to Chesapeake: The Slow-burning Fuse that Lit Haynesville M&A

2024-03-01 - TG Natural Resources rides the LNG wave with Rockcliff deal amid shale consolidation boom.

EQT Ups Stake in Appalachia Gas Gathering Assets for $205MM

2024-02-14 - EQT Corp. inked upstream and midstream M&A in the fourth quarter—and the Appalachia gas giant is looking to ink more deals this year.