The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

A private seller retained PetroDivest Advisors to market for sale its diversified overriding royalty interests (ORRI) located across Texas and North Dakota.

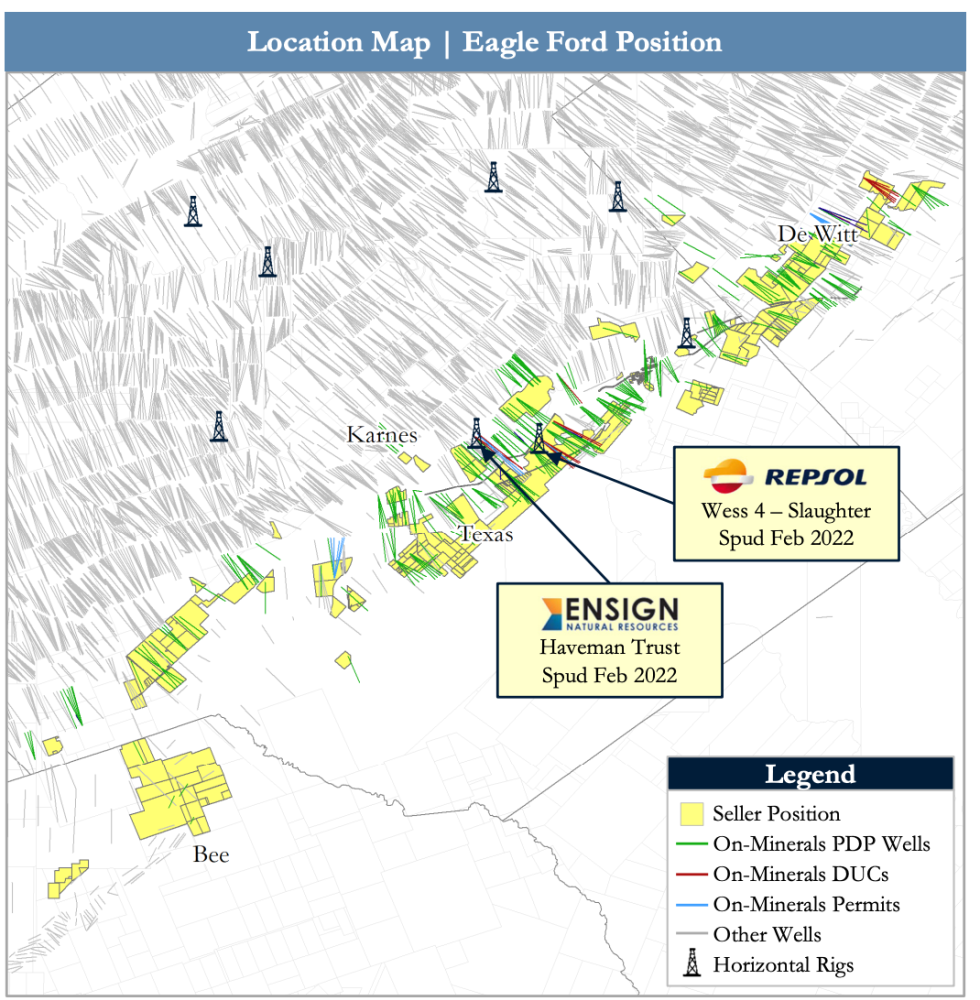

The seller’s assets offer an attractive opportunity, PetroDivest said, to acquire a concentrated footprint in the core of the Eagle Ford covering about 2,200 net royalty acres underneath premier, highly-active operators including Repsol and ConocoPhillips and meaningful production from 400 producing wells with imminent near-term growth driven by 17 DUCs and 15 Permits generating $3.1 million next 12-month cash flow (PDP/DUC/Permit).

Highlights:

- Meaningful Cash Flow with Line-of-Sight Development

- 90 boe/d net production (~60% liquids) from 400 producing wells with average ~0.6% royalty interest

- PDP PV-10: $4.8 million

- PDP Net Reserves: 270,000 boe

- Strong on-lease activity with two rigs currently running and 17 recently drilled DUCs

- $3.1 million next 12-month cash flow

- 15 permits provide line-of-sight growth through First-half 2023

- PDP+DUC+Permit PV-10: $8.9 million

- 90 boe/d net production (~60% liquids) from 400 producing wells with average ~0.6% royalty interest

- Substantial Undeveloped Inventory (~440 remaining locations)

- 180+ remaining Lower Eagle Ford infill locations yielding 100%+ IRRs

- Additional upside reserves potential from 150+ Upper Eagle Ford and Austin Chalk locations

- High quality, blocky acreage position under premier, well-capitalized Eagle Ford Operators

- ~55,000 gross-acre footprint allows for consistent development activity

- 180+ remaining Lower Eagle Ford infill locations yielding 100%+ IRRs

Process Summary

- Evaluation materials available via the Virtual Data Room on March 21

- Bids are due on April 20

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Segrist: The LNG Pause and a Big, Dumb Question

2024-04-25 - In trying to understand the White House’s decision to pause LNG export permits and wondering if it’s just a red herring, one big, dumb question must be asked.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.