The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

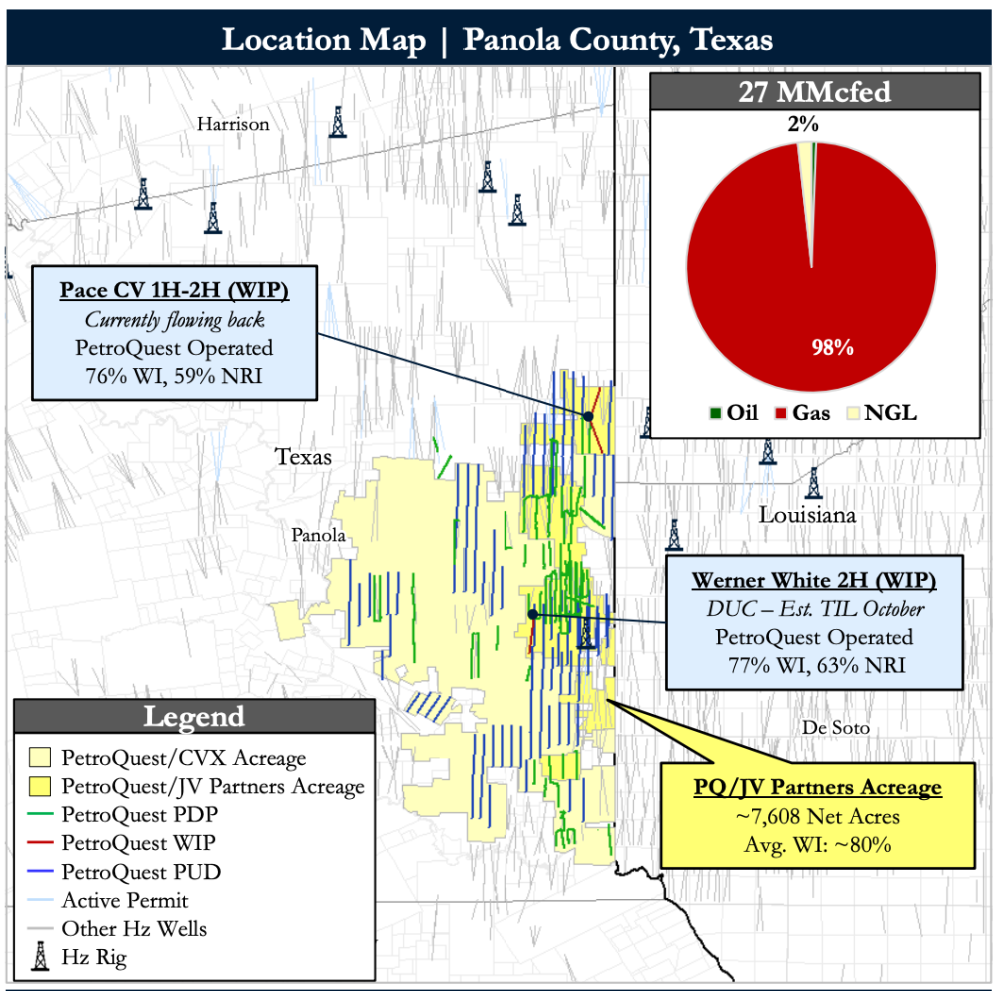

PetroQuest Energy Inc. retained Detring Energy Advisors to market for sale its oil and gas leasehold and related interests located in Panola County, Texas.

The assets offer an attractive opportunity, Detring said, to acquire a large, contiguous, HBP and operated position consisting of roughly 28,600 net acres plus high-margin, gas-weighted production generating $52 million next 12-month cash flow and more than 170 highly-economic locations across multiple landing targets within the prolific Cotton Valley formation.

Asset Highlights:

- Substantial Production Base Underpins Cash Flow

- 27 MMcfe/d net production (PDP+WIP)

- Stable PDP production base (20 MMcfe/d) with growth from three high-interest WIPs (7 MMcfe/d)

- PDP+WIP PV-10: $127 million

- PDP+WIP Net Reserves: 62 Bcfe

- High-margin cash flow of $52 million next 12-month (PDP+WIP)

- Buyer to benefit from flush production and cash flow from WIPs

- Proximity to Gulf Coast markets and LNG export ensures premium pricing

- Netback of $7.38/Mcfe (2022E) at current strip pricing

- Ample free cash flow to fund continued horizontal development

- 27 MMcfe/d net production (PDP+WIP)

- Large, Contiguous, HBP Position with Upside Potential

- Total operated footprint comprised of ~28,600 net acres (99% HBP) with Cotton Valley rights

- Average Working Interest: 59% / Net Revenue Interest: 78% (8/8th)

- Joint-operatorship with Chevron across ~21,000 net acres (proposing party operates through completion)

- Average Working Interest: 50% / Net Revenue Interest: 78% (8/8th)

- Includes Bossier and Travis Peak rights

- Total operated footprint comprised of ~28,600 net acres (99% HBP) with Cotton Valley rights

- Low-Risk and Long-term Inventory Across Multiple Cotton Valley Targets

- 170+ horizontal locations continuing PetroQuest’s development program, which targets the E4, Eberry and Davis intervals

- Average Cotton Valley EUR: 9.1 Bcfe

- Type curves generate an average 2.6 times ROI with payout in under 10 months

- Substantial 3P PV-10 ($507 million) and net reserves (740 Bcfe)

- Additional upside in the Bossier Shale which has proven production potential across the position

- 170+ horizontal locations continuing PetroQuest’s development program, which targets the E4, Eberry and Davis intervals

Process Summary:

- Evaluation materials are available via the Virtual Data Room on June 15

- Proposals are due on July 20

For information visit detring.com or contact Matt Loewenstein at Matt@detring.com or 713-595-1003.