The following information is provided by Eagle River Energy Advisors. All inquiries on the following listings should be directed to Eagle River Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Eagle River Energy Advisors, LLC has been exclusively retained by The Petroleum Synergy Group, Inc. (“Seller”) to divest certain non-operated leasehold working interests across America.

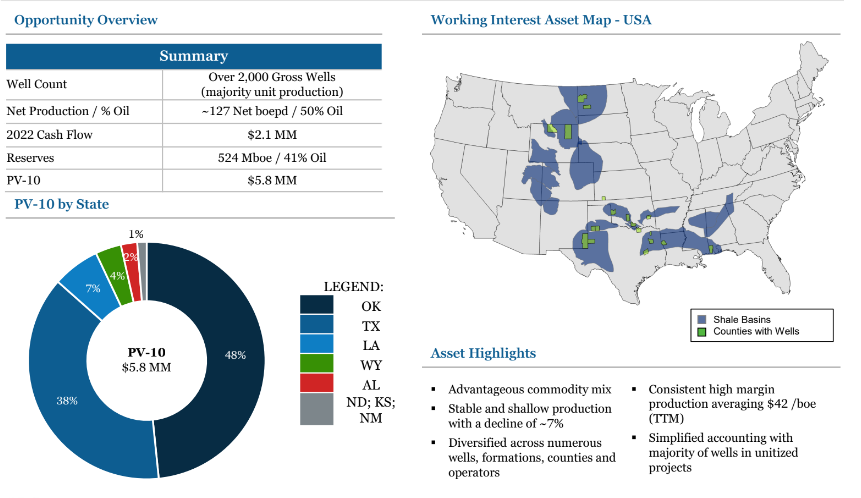

The assets provide the opportunity to acquire a balanced commodity mix stream that generated $2.1MM of 2022 cash flow from ~127 BOE/D of net production. Additionally, this package is diversified by well count, well vintage, commodity and operator with locations spread across the United States, with simplified accounting with the majority of wells in unitized projects. Lastly, these assets exhibit a stable and shallow production with a decline of ~7%.

Asset Highlights:

- Advantageous commodity mix

- Stable and shallow production with a decline of ~7%

- Diversified across numerous wells, formations, counties and operators

- Consistent high margin production averaging $42 /boe (TTM)

- Simplified accounting with majority of wells in unitized projects

Bids are due at 4:00 p.m. MT on April 13. For complete due diligence information, please visit eagleriverenergyadvisors.com or Michael Stolze, senior managing director at MStolze@EagleRiverEA.com or Austin McKee, managing director, at AMcKee@EagleRiverEA.com.

Recommended Reading

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.

CNOOC Finds Light Crude at Kaiping South Field

2024-03-07 - The deepwater Kaiping South Field in the South China Sea holds at least 100 MMtons of oil equivalent.

Orange Basin Serves Up More Light Oil

2024-03-15 - Galp’s Mopane-2X exploration well offshore Namibia found a significant column of hydrocarbons, and the operator is assessing commerciality of the discovery.

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.