The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

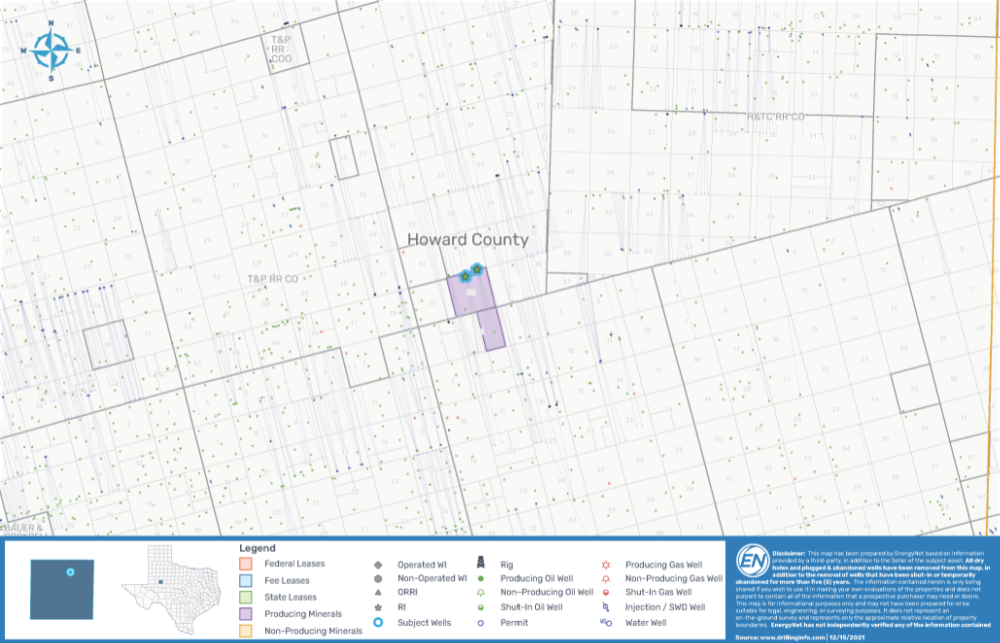

Route 66 Minerals LP retained EnergyNet for the sale of a package of mineral and royalty interests in the Permian Basin through an auction closing Jan. 11. The offering includes interests in 10 producing wells operated by Laredo Petroleum Inc. in Howard County, Texas.

Highlights:

- 0.215437% to 0.02052% Mineral Interest/Royalty Interest in 10 Producing Wells

- Current Average 8/8ths Production: 4,713 bbl/d of Oil and 2,978 Mcf/d of Gas

- Three-month Average Net Income: $18,124/Month

- Operator: Laredo Petroleum Inc.

Bidding closes at 2:55 p.m. CST on Jan. 11. For complete due diligence information on any of the packages visit energynet.com or email Zachary Muroff, vice president of business development, at Zachary.Muroff@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.