The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

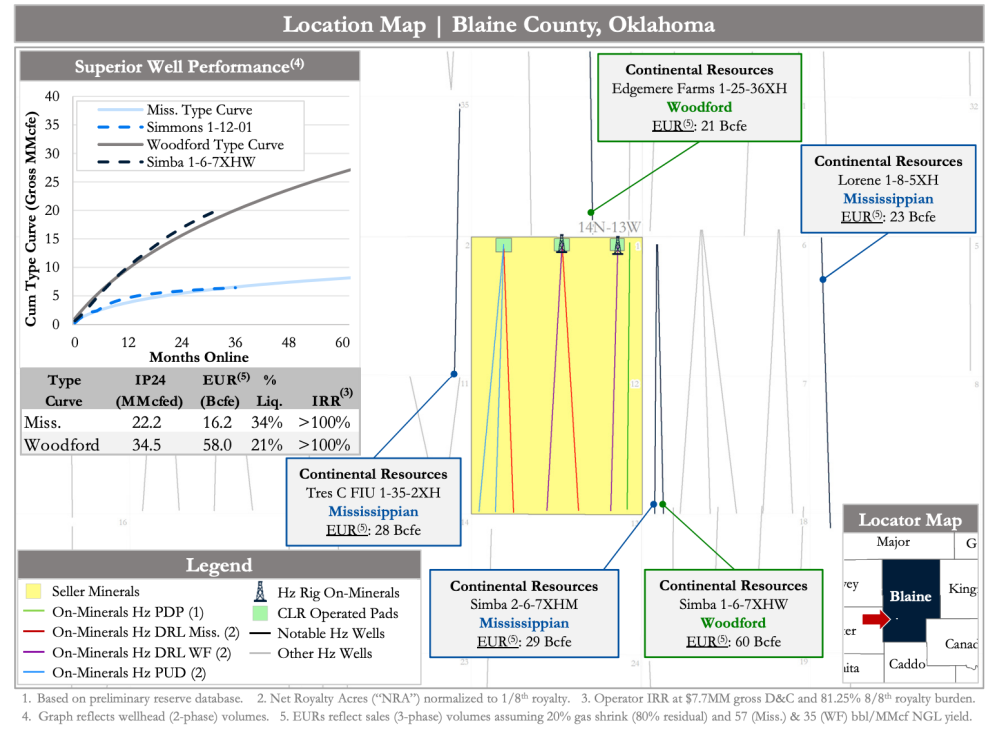

A private seller retained PetroDivest Advisors to market for sale its oil and gas mineral and royalty interests located in Oklahoma’s Blaine County.

The assets offer an attractive opportunity to acquire exposure to a high interest royalty unit (1.28% average interest) under imminent development and operated by Continental Resources Inc., PetroDivest said. Additionally, the assets comprise one producing and four recently permitted wells with two rigs on location and exposure to strong well results in the prolific overpressured core of the STACK play.

Highlights:

- 133 Net Royalty Acres in Section 14N-13W-01

- Continental Resources operated unit with two rigs on location drilling four recently permitted locations

- High-interest locations (1.3% in future locations)

- ~1.5 million 2022E Cash Flow

- Substantial line-of-sight production and cash flow from four actively drilling wells

- PDP plu Active Drilling PV-10: $3.8 million

- PDP plus Active Drilling Net Reserves: 2.00 Bcfe

- Two additional PUD’s (Mississippian and Woodford)

- 3P PV-10: $5.4 million

- Substantial line-of-sight production and cash flow from four actively drilling wells

- World-Class Well Results Established by Continental

- Continental is the premier Midcon operator with a fantastic track record of well performance in the area, according to PetroDivest

- Strong EURs from the Woodford and Mississippian formations in the overpressured core of the STACK play

- Offset the Simba 1-6-7XHW, with the largest gas EUR in Oklahoma of ~60 Bcfe

Process Summary:

- Evaluation materials available via the Virtual Data Room on Sept. 22

Bids are due Oct. 13. For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

Enbridge Closes First Utility Transaction with Dominion for $6.6B

2024-03-07 - Enbridge’s purchase of The East Ohio Gas Co. from Dominion is part of $14 billion in M&A the companies announced in September.

SCF Acquires Flowchem, Val-Tex and Sealweld

2024-03-04 - Flowchem, Val-Tex and Sealweld were formerly part of Entegris Inc.

Pembina Cleared to Buy Enbridge's Pipeline, NGL JV Interests for $2.2B

2024-03-19 - Pembina Pipeline received a no-action letter from the Canadian Competition Bureau, meaning that the government will not challenge the company’s acquisition of Enbridge’s interest in a joint venture with the Alliance Pipeline and Aux Sable NGL fractionation facilities.

Global Partners Buys Four Liquid Energy Terminals from Gulf Oil

2024-04-10 - Global Partners initially set out to buy five terminals from Gulf Oil but the purchase of a terminal in Portland was abandoned after antitrust concerns were raised by the FTC and the Maine attorney general.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.