The following information is provided by Energy Advisors Group (EAG). All inquiries on the following listings should be directed to EAG. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

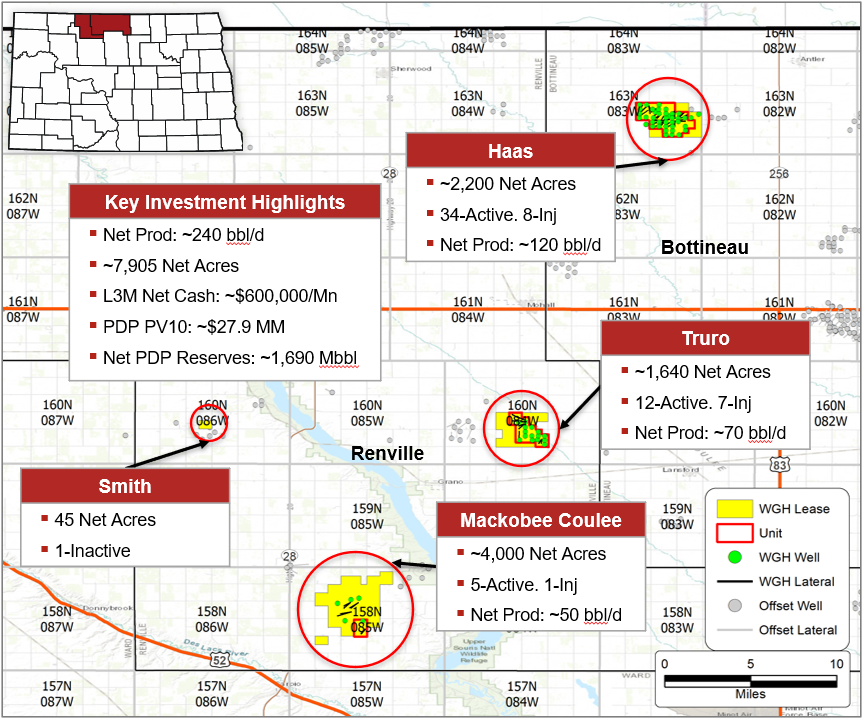

A private seller retained Energy Advisors Group (EAG) to market certain Williston Basin operated assets located in Bottineau and Renville counties, North Dakota.

The assets were previously marketed by EAG in 2019/2020 and sold to a private company that is now rationalizing its diverse geographic properties. These assets are comprised of long-life, high-value conventional waterfloods in the Madison Pool with Bluell & Sherwood potential. They offer solid consistency and upside in a $70 to $120 oil market, with cash flow currently exceeding $600,000/month.

Highlights:

- Bottineau and Renville counties, North Dakota operations for sale

- 54-PDP Wells, 16-Injectors and 5-SI. ~8,300-Gross Acres

- Madison Pool. Bluell and Sherwood Potential

- 3D Proprietary Seismic Coverage. Identified Upside

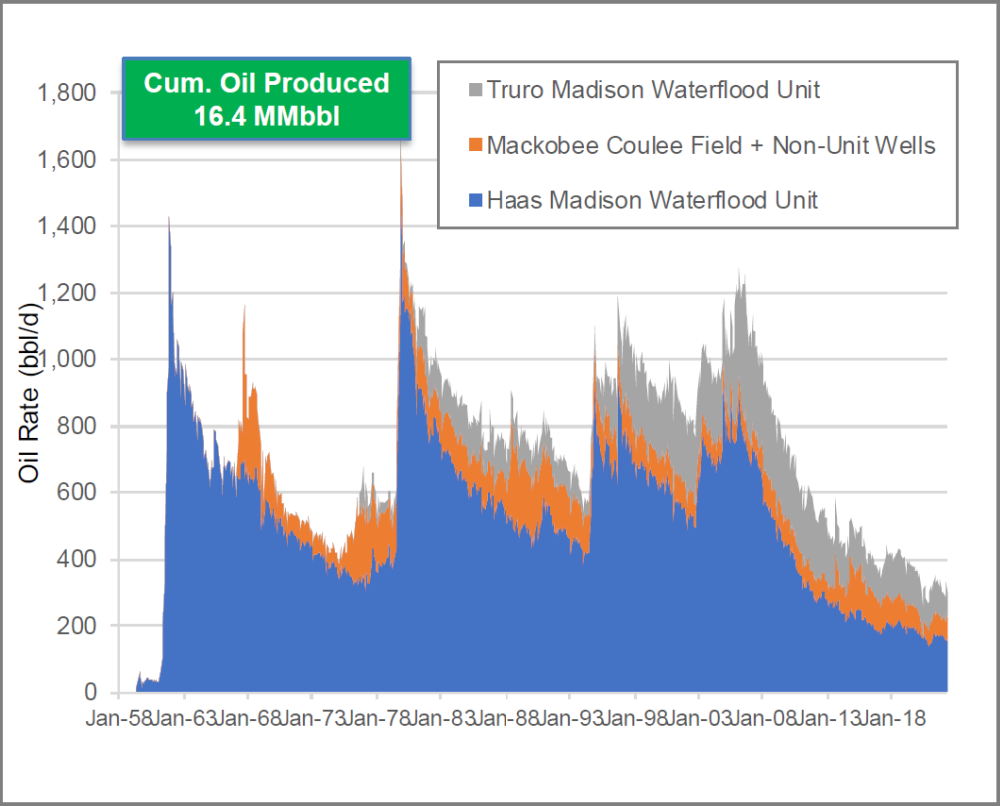

- Long Life Conventional Oil. Solid Production: >16 MMbbl Produced to Date.

- Shallow Decline with Consistent Oil Cut

- 100% Operated Working Interest; 74.4% Net Revenue Interest

- Gross Production: ~320 bbl/d. Net Volumes: ~240 bbl/d

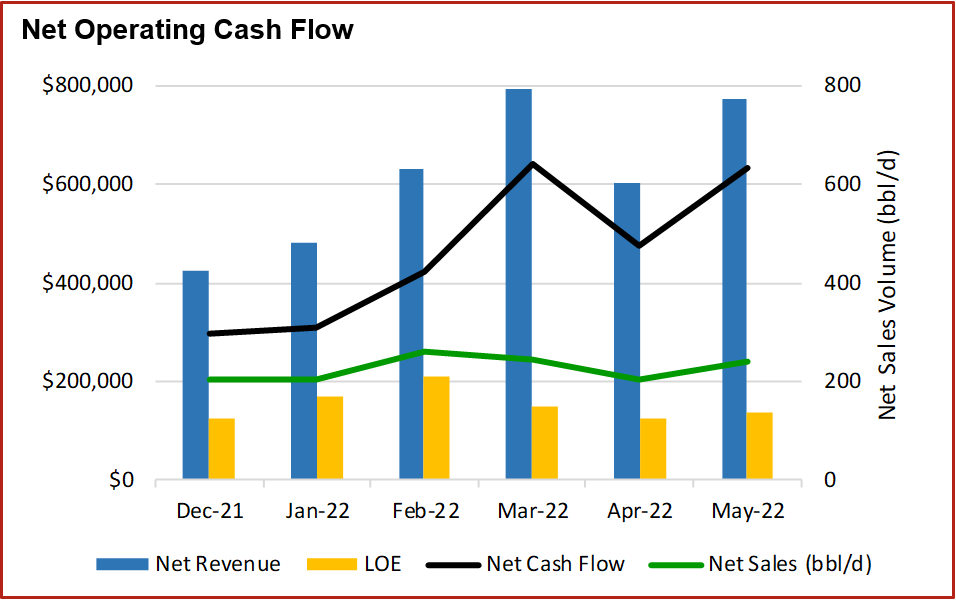

- Last Three-month 2022 Net Operating Cash Flow: ~$600,000/month

- PDP Reserves: ~1.7 million bbl. PV-10: ~$28 million. PDNP Reserves: ~430,000 bbl. PV10: $6.7 million

Quick Production and Cash Flow Summary:

The 54 active producers generated ~250 bbl/d net sales in May bringing the recent monthly revenues to over $1 million and a net cash flow over $630,000.

The LOS Net Summaries showed the last six monthly net cash flow including all the costs of the assets.

Divestiture Process:

Asset Sale. Bids are due Aug. 2. Upon execution of a confidentiality agreement, EAG will provide access to confidential evaluation material in the virtual data room. For more information, email EAG directors Steve Henrich at shenrich@energyadvisors.com, or Alan Yoelin at ayoelin@energyadvisors.com.

Recommended Reading

Report: Freeport LNG Hits Sixth Day of Dwindling Gas Consumption

2024-04-17 - With Freeport LNG operating at a fraction of its full capacity, natural gas futures have fallen following a short rally the week before.

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.

Core Scientific to Expand its Texas Bitcoin Mining Center

2024-04-16 - Core Scientific said its Denton, Texas, data center currently operates 125 megawatts of bitcoin mining with total contracted power of approximately 300 MW.

Trans Mountain Pipeline Announces Delay for Technical Issues

2024-01-29 - The Canadian company says it is still working for a last listed in-service date by the end of 2Q 2024.