The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Editor's note: Bid due date for this listing has been changed to March 17.

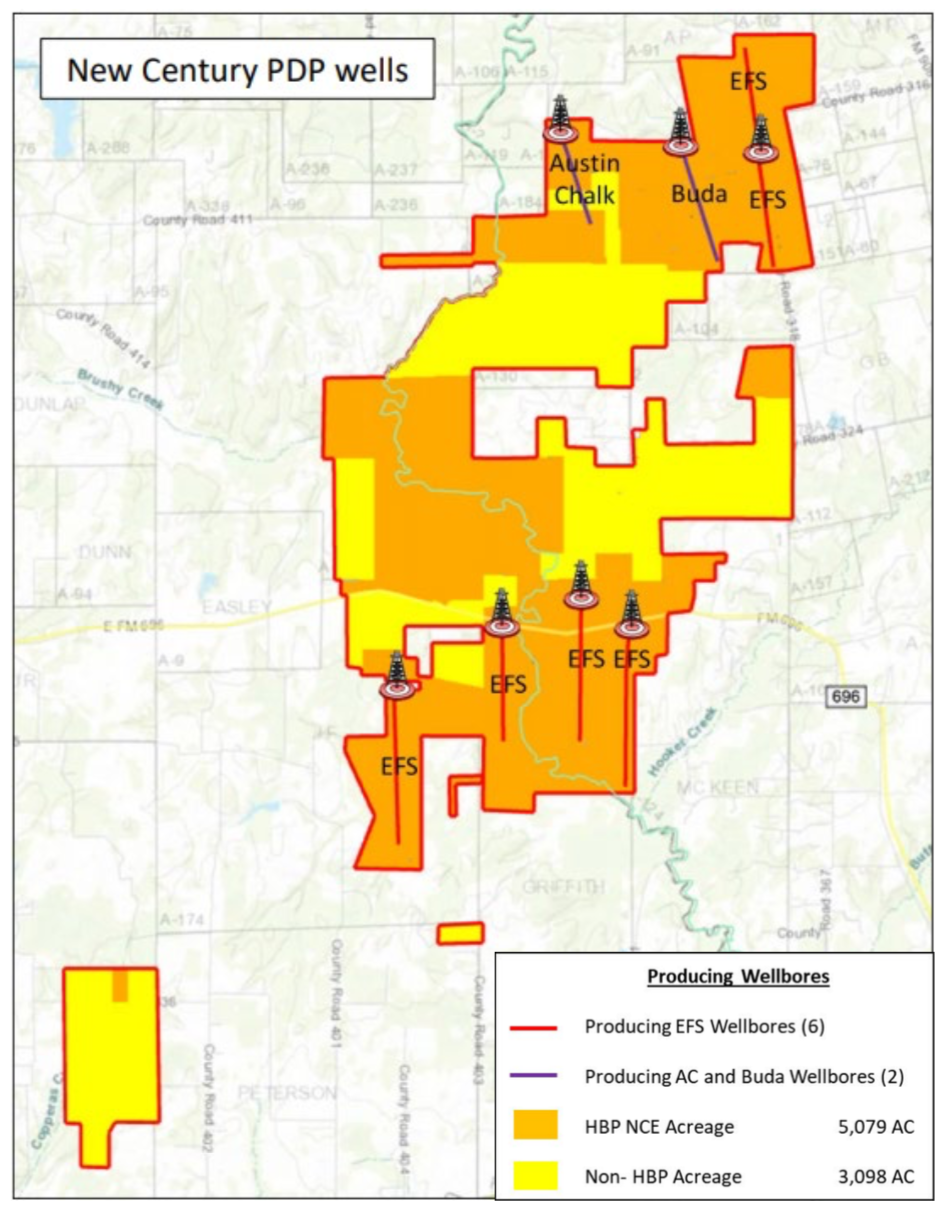

New Century Operating LLC retained EnergyNet for the sale of an Eagle Ford / Austin Chalk opportunity. The offering includes certain oil and gas properties and related assets located in Burleson and Lee counties, Texas, owned by New Century Operating.

Highlights:

- Operations in 11 Wells:

- Average Working Interest ~100.00% / Average Net Revenue Interest ~76%

- Eight Producing Wells | Three Shut-In Wells

- Six-Month Average Net Production: 120 bbl/d of Oil

- 12-Month Average Net Income: $92,378/Month

- 8,173.80 Net Acres:

- 4,991.36 Net HBP Leasehold Acres

- 3,182.44 Net Non-HBP Leasehold Acres

- Operator Bond Required

- Position within the Black Oil Window with High Rock Quality and Oil-in-Place

- 61% HBP, High Net Revenue Interest, and Ideally Configured for Development

- Enhanced Completion Designs - Highly Successful

- Multiple Benches - Eagle Ford and Austin Chalk, and Buda

- PDP Wells: Six Eagle Ford, One Austin Chalk, One Buda

- PUD locations: 12 Eagle Ford, Six Austin Chalk, Two Buda

- Probable Eagle Ford locations: 79 (6,000 ft to 8,500 ft Horizontals)

- Total Proved Reserves: $55.7 million PV-10:

- PDP PV-10 = $8.9 million

- PUD PV-10 = $46.8 million

Bids are due at 4 p.m. CST March 10. The transaction is expected to have a March 1 effective date.

For complete due diligence information on either package visit energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

Pioneer Natural Resources Shareholders Approve $60B Exxon Merger

2024-02-07 - Pioneer Natural Resources shareholders voted at a special meeting to approve a merger with Exxon Mobil, although the deal remains under federal scrutiny.

Parker Wellbore, TDE Partner to ‘Revolutionize’ Well Drilling

2024-03-13 - Parker Wellbore and TDE are offering what they call the industry’s first downhole high power, high bandwidth data highway.