The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

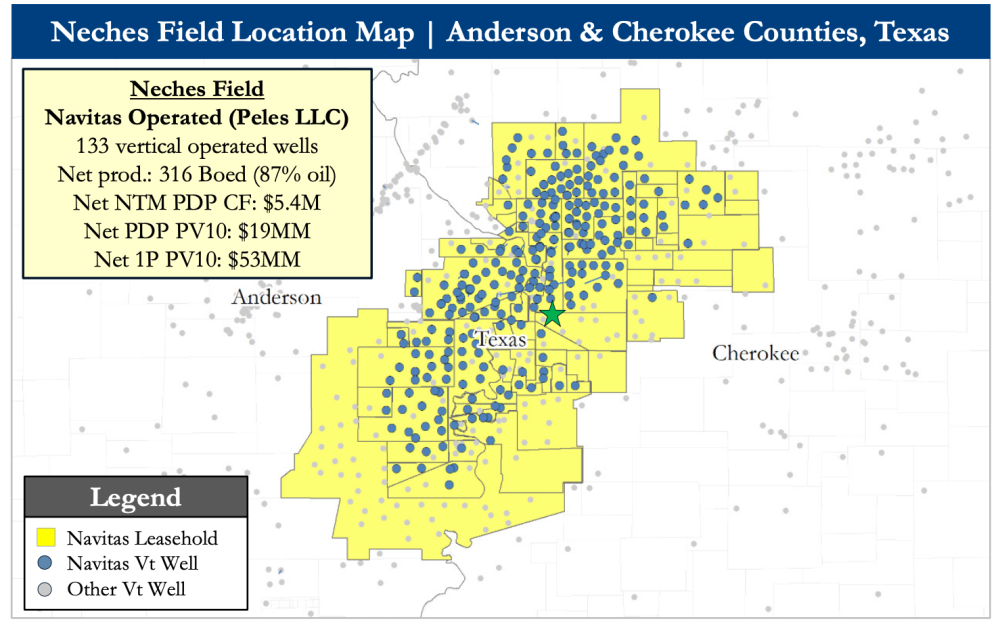

Navitas Petroleum Onshore LLC has retained PetroDivest Advisors to market for sale its oil and gas producing properties and leasehold in Anderson and Cherokee counties, Texas.

The assets offer an attractive opportunity, PetroDivest said, to acquire low-decline, operated, vertical production from Woodbine target intervals which generate a resilient, high-margin cash flow stream from an oil-weighted product mix on steady decline with over 35 proven, low-cost, infill locations supporting long-term development and production maintenance.

Asset Highlights:

- High-margin, operated, oil-weighted production

- Stable net PDP cash flow ($5.4 million next 12-month) from 316 boe/d of net production

- PDP Net PV-10: $19 million

- Low aggregate decline (~5%) stabilized after operational improvements

- Oil-weighted product mix (87% oil)

- High margins provide meaningful cash flow for further development

- $28/boe aggregate lifting costs

- ~60% net cash flow margin per boe

- Stable net PDP cash flow ($5.4 million next 12-month) from 316 boe/d of net production

- Contiguous, Legacy Woodbine Field

- 9,400 net acres (100% HBP) with access to Woodbine production

- HBP status provides optionality of further development timing

- 133 vertical wells (41 current PDP)

- Average 99% working interest and 77% net revenue interest (PDP)

- Large, contiguous position enables convenient operations

- Includes field office and SCADA system

- 9,400 net acres (100% HBP) with access to Woodbine production

- Significant Remaining Undeveloped Potential

- 37 additional, low-cost and highly-economic vertical Woodbine locations underpin the continued development program

- 1P Net PV-10: $53 million

- Low-cost PUDs (~$800,000/well)

- Several areas of bypassed oil support infill drilling due to the stratigraphic architecture of the Woodbine

- 37 additional, low-cost and highly-economic vertical Woodbine locations underpin the continued development program

Process Summary

- Evaluation materials available via the Virtual Data Room on May 4

- Bids are due on June 8

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Triangle Energy, JV Set to Drill in North Perth Basin

2024-04-18 - The Booth-1 prospect is planned to be the first well in the joint venture’s —Triangle Energy, Strike Energy and New Zealand Oil and Gas — upcoming drilling campaign.

PGS, TGS Merger Clears Norwegian Authorities, UK Still Reviewing

2024-04-17 - Energy data companies PGS and TGS said their merger has received approval by Norwegian authorities and remains under review by the U.K. Competition Market Authority.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.