The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

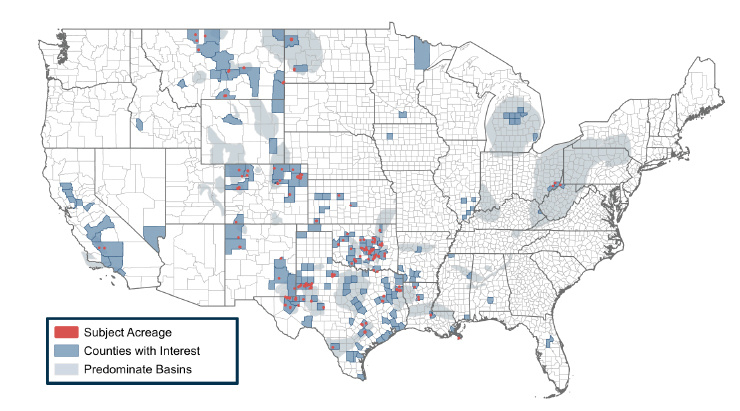

A private seller and its affiliates are offering an attractive opportunity to acquire producing mineral and royalty assets in core positions across Lower 48 including Permian Basin, Williston, Eagle Ford, Marcellus and the Midcontinent. The seller has retained has EN Indigo as the exclusive financial adviser for this transaction.

Highlights:

- Premier Assets in Key Basins:

- Attractive opportunity to acquire producing mineral and royalty assets in core positions across Lower 48 including Permian Basin, Williston, Eagle Ford, Marcellus and the Midcon

- ~42,000 net mineral acres

- Average PDP net revenue interest ~1.4% across entire package

- PDP net production of ~1,095 boe/d (59% oil) as of May 2022

- Material Cash Flow with Active Development:

- PDP next 12-month cash flow ~$13 million

- Steady number of wells poised for near-term development (WIP, DUC, Permit)

- Long-term producing assets with low decline and de-risked future production

- Large inventory of active permits on or offsetting positions

- Primed for Continued Development:

- Strong economic inventory held by premier operators within basins

- Noticeable ongoing near-term development

- Attractive commodity prices accelerating onshore L48 development

- Resilient and Diverse Exposure:

- Strategic position across Lower 48 allowing for diversity of risk

- Permitted locations in the Delaware, Midland and Williston Basins

Sealed-bids for Lot# 92820 are due at 4 p.m. CDT on Nov. 16. For complete due diligence information visit energynet.com or email managing directors Zachary Muroff and Cody Felton or Keith Ries, managing director of engineering.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

ProPetro Reports Material Weakness in Financial Reporting Controls

2024-03-14 - ProPetro identified a material weakness in internal controls over financial reporting, the oilfield services firm said in a filing.

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

Stockholder Groups to Sell 48.5MM of Permian Resources’ Stock

2024-03-06 - A number of private equity firms will sell about 48.5 million shares of Permian Resources Corp.’s Class A common stock valued at about $764 million.

TC Energy Appoints Sean O’Donnell as Executive VP, CFO

2024-04-03 - Prior to joining TC Energy, O’Donnell worked with Quantum Capital Group for 13 years as an operating partner and served on the firm’s investment committee.