Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

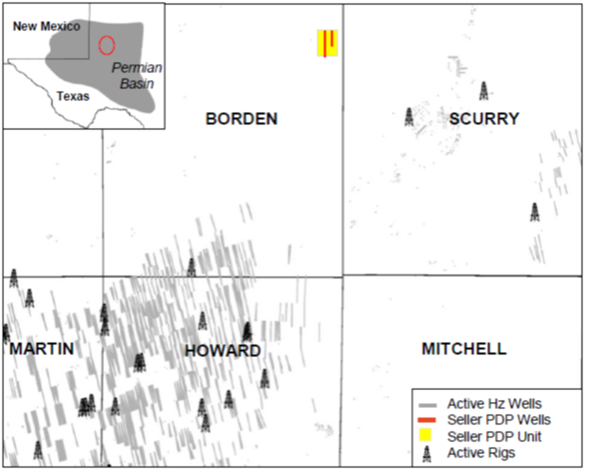

Eagle River Energy Advisors LLC has been exclusively retained by a private seller to divest certain operated assets in the Midland Basin in Borden County, Texas.

The assets are producing about 65 gross bbl/d of oil, with a roughly 80% oil cut, and a next 12-month cash flow projected at $855,000. This is a low cost, shallow horizontal oil carbonate play, with a shallow 10% annual production decline from the Mississippian formation, according to Eagle River. The DSU offsets the largest Mississippian Chert Field in the Permian Basin and has 11 potential horizontal drilling locations in the Mississippian, Wolfcamp and Spraberry formations, the firm added.

Highlights:

Operated Oil Production

- Single operated DSU in Borden County, Texas

- 89% Working Interest / 67% Net Revenue Interest

- Two producing wells ~65 gross bbl/d of Oil

- ~$855,000 next 12-month cash flow

- Offsetting the largest Mississippian Chert field in the Permian Basin (Fluvanna Field)

- Oil production with ~80% oil cut

- Shallow decline production profile at ~10%

Upside Potential in Undeveloped Locations

- ~$52 million total potential capex investment

- Multiple prospective plays including the Wolfcamp, Mississippian Chert, Ellenberger, Strawn and Spraberry

- Three horizontal Mississippian infill locations

- Eight potential horizontal drilling locations in the Mississippian, Wolfcamp and Spraberry formations

- Low cost, shallow horizontal oil carbonate play

Bids are due at 4 p.m. MT on Aug. 5. The sale is expected to have a July 1 effective date.

A virtual data room will be available starting July 7. For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

RWE Boosts US Battery Storage with Three Projects

2024-02-14 - The three projects—two in Texas and one in Arizona—will lift RWE’s total U.S. battery storage capacity to about 512 megawatts.

Energy Transition in Motion (Week of April 12, 2024)

2024-04-12 - Here is a look at some of this week’s renewable energy news, including a renewable energy milestone for the U.S.

Equinor, Ørsted Bid for Better Contract in NY Offshore Wind Auction

2024-01-26 - New York State has received bids to supply power from three offshore wind projects in its expedited fourth solicitation that allowed developers to exit old contracts and re-offer projects at higher prices.

Equinor, Ørsted/Eversource Land New York Offshore Wind Awards

2024-02-29 - RWE Renewables and National Grid’s Community Offshore Wind 2 project was waitlisted and may be considered for award and contract negotiations later, NYSERDA says.

Dominion Energy Receives Final Approvals for 2.6-GW Offshore Wind Project

2024-01-30 - Dominion Energy’s Coastal Virginia Offshore Wind project will feature 176 turbines and three offshore substations on a nearly 113,000-acre lease area off Virginia Beach.