The following information is provided by Detring Energy Advisors. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

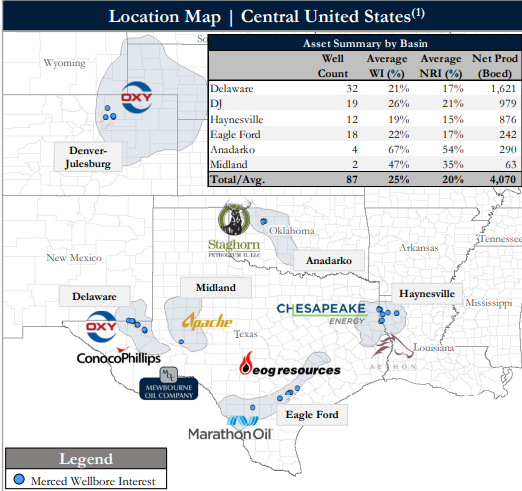

Merced Capital has retained Detring Energy Advisors to market for sale its diversified non-operated wellbore-only producing assets located across six of the most prominent basins across the Lower 48. The assets offer an attractive opportunity to acquire a balanced revenue stream (46% liquids) with established, proven production (4,070 Boed) generating meaningful cash flow ($42MM NTM). The assets are operated by premier basin-focused operators, which ensures continued superior well performance and operating efficiencies that translate to healthy, high-margin returns.

Asset highlights:

- Substantial Production Base of ~4,100 Net Boed (46% Liquids)

- Production generated by 87 horizontal producers

- PV10 of $142MM

- Net reserves of 9.0 MMBoe

- Assets operated by premier, well-capitalized, and basin-focused E&P’s offering high-quality stewardship and cost-efficient operations

- Includes Oxy, Mewbourne, Comstock, Shell, and Marathon

- Production generated by 87 horizontal producers

- Robust, Stable Cash Flow Generates Substantial Yield

- NTM cash flow of $42MM from established, reliable production base

- Average historical production of 30 months per wellbore

- Meaningful well count eliminates concentration risk

- The assets generate healthy returns with an operating cash margin of ~$41/Boe (LTM) underpinned by low lifting costs of ~$5/Boe

- High interests avg. 25% WI / 20% NRI

- NTM cash flow of $42MM from established, reliable production base

Bids are due Feb. 15. Upon execution of a confidentiality agreement, Detring will provide access to the Virtual Data Room, which opens on Jan. 17.

For more information, visit detring.com or contact Melinda Faust, managing director at Detring Energy Advisors, at mel@detring.com or 713-595-1004.

Recommended Reading

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.