The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

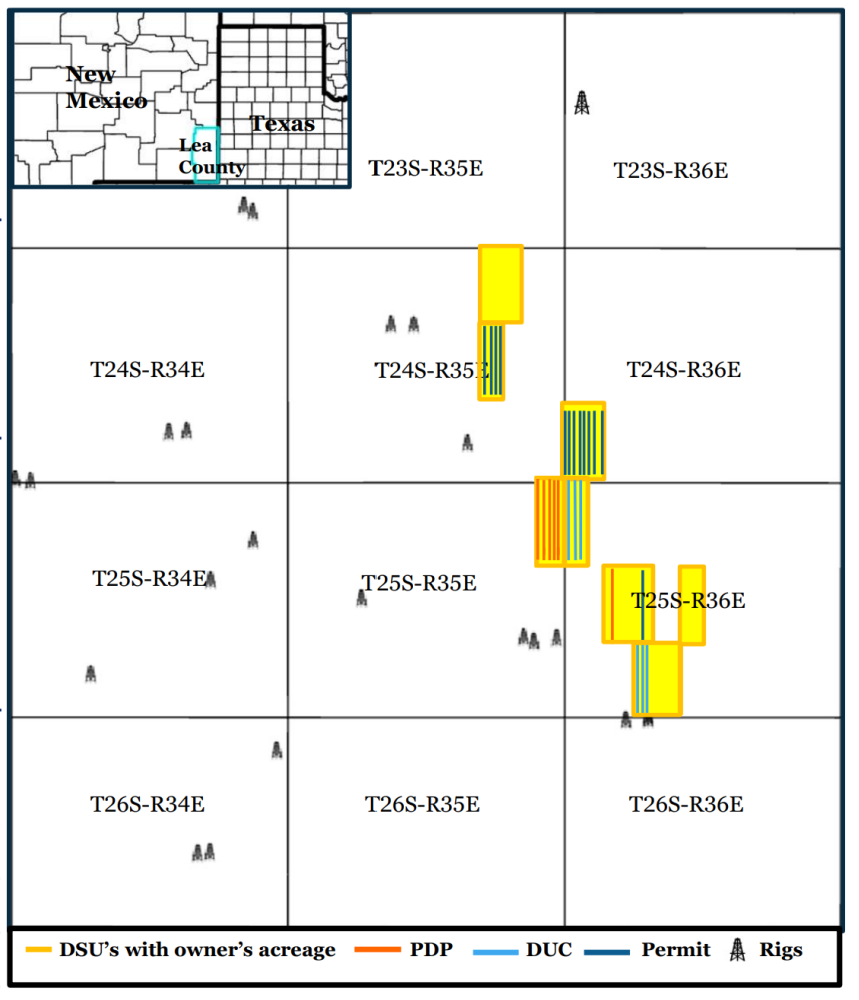

Eagle River Energy Advisors LLC has been exclusively retained by Max Permian LLC to divest certain nonoperated working interests in the Delaware Basin of New Mexico.

The assets provide the opportunity to invest a significant amount of capex in an active development program targeting the Bone Spring and Wolfcamp formations with single well IRRs exceeding 100%.

In addition to six PDP wells and 19 near-term locations (six DUCs and 13 permitted locations), there are 46 additional undeveloped locations that provide a significant inventory of future capital investment opportunities, according to Eagle River. The assets are operated by Ameredev, Franklin Mountain and Matador, all extremely active operators in the Delaware Basin, the firm added.

Asset highlights:

- Gross Producing Wells - 6 PDP

- Gross Near Term Wells - 6 DUCs / 13 Permits

- Undeveloped Locations - 46 PUDs

- Average Working Interest / Net Revenue Interest - 6.5% / 4.8%

- Forecast 12-month Cash Flow from June - ~$14.65 million

Bids for the acquisition opportunity with Max Permian LLC referenced are due at 4 p.m. CT on May 25. The transaction effective date is June 1.

A virtual data room will be available starting April 29. For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

As ONEOK Digests Magellan, Sets Stage for More NGL Growth in 2024

2024-02-28 - ONEOK is continuing the integration of its newly acquired Magellan assets in 2024 as the company keeps an eye out for M&A opportunities and awaits regulatory approvals for certain projects.

Dallas Fed Energy Survey: Permian Basin Breakeven Costs Moving Up

2024-03-28 - Breakeven costs in America’s hottest oil play continue to rise, but crude producers are still making money, according to the first-quarter Dallas Fed Energy Survey. The situation is more dire for natural gas producers.

Enterprise Buys Assets from Occidental’s Western Midstream

2024-02-22 - Enterprise bought Western’s 20% interest in Whitethorn and Western’s 25% interest in two NGL fractionators located in Mont Belvieu, Texas.

EIA: E&P Dealmaking Activity Soars to $234 Billion in ‘23

2024-03-19 - Oil and gas E&Ps spent a collective $234 billion on corporate M&A and asset acquisitions in 2023, the most in more than a decade, the U.S. Energy Information Administration reported.

Continental Resources Makes $1B in M&A Moves—But Where?

2024-02-26 - Continental Resources added acreage in Oklahoma’s Anadarko Basin, but precisely where else it bought and sold is a little more complicated.