The following information is provided by Meagher Energy Advisors. All inquiries on the following listings should be directed to Meagher. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

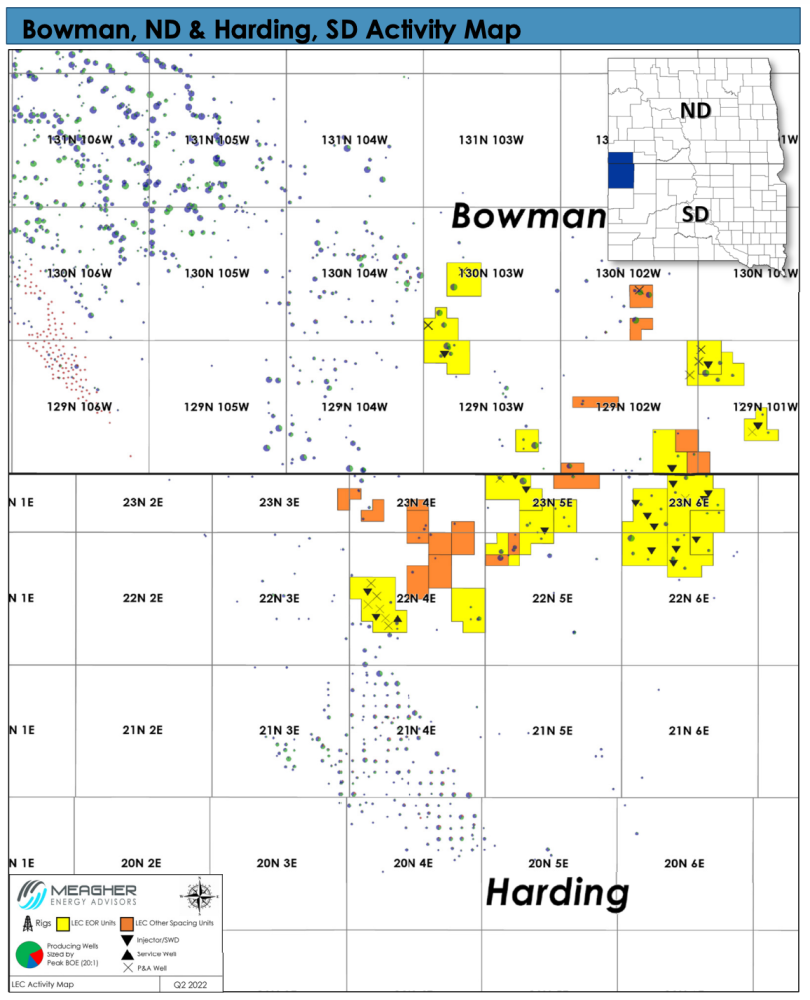

Luff Exploration Co. retained Meagher Energy Advisors for the sale of Williston Basin Waterflood assets in North Dakota’s Bowman County and South Dakota’s Harding County.

Highlights:

- Operated, shallow-decline, high-margin waterfloods with water supply and disposal system providing additional cash flow.

- Gross and net daily oil production of 1,490 bbl/d of oil and 1,040 bbl/d of oil respectively (~80% from 15 unitized waterfloods). Water production approximately 8,000 bbl/d of water from EOR units.

- July estimated EBITDA of $2.15 million with a 75% profit margin. NTM PDP operating net cash flow of $23 million. Wholly owned midstream contributes $80,000-$90,000/month.

- 4.604 million bbl net oil PDP reserves representing a 12.1-year R/P ratio. 1P reserves of 5.646 million bbl for a 14.9-year R/P ratio. Near-term declines less than 5.5% for operated waterfloods.

- 40,000 net acres, including nearly 30,000 net acres in 15 unitized secondary recovery units. Minimal federal acreage in a favorable regulatory environment.

- Two ESP installation candidates, five infill drilling and two horizontal re-entries adding incremental 1.042 million bbl net reserves. Tertiary recovery potential with CO₂ miscible flooding utilized in nearby fields.

Bids are due June 23. The transaction has an effective date of July 1. A purchase and sale agreement is expected to be executed by July 8 with closing by Aug. 29.

For information visit meagheradvisors.com or contact Nick Asher, vice president of business development, at nasher@meagheradvisors.com.

Recommended Reading

Report: Crescent Midstream Exploring $1.3B Sale

2024-04-23 - Sources say another company is considering $1.3B acquisition for Crescent Midstream’s facilities and pipelines focused on Louisiana and the Gulf of Mexico.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

Energy Transfer Announces Cash Distribution on Series I Units

2024-04-22 - Energy Transfer’s distribution will be payable May 15 to Series I unitholders of record by May 1.

Balticconnector Gas Pipeline Back in Operation After Damage

2024-04-22 - The Balticconnector subsea gas link between Estonia and Finland was severely damaged in October, hurting energy security and raising alarm bells in the wider region.

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.