The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

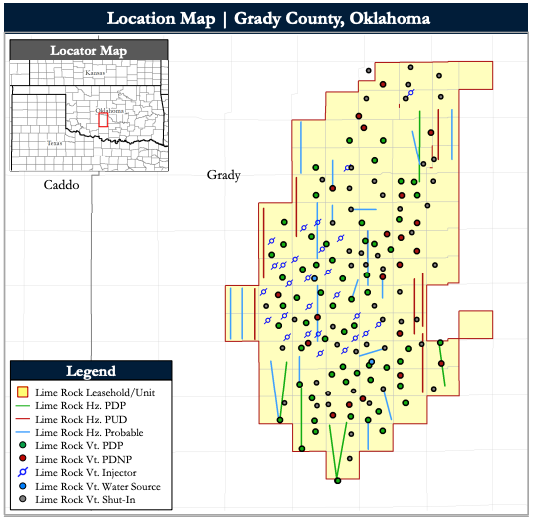

Lime Rock Resources retained Detring Energy Advisors to market for sale its operated, contiguous, 100% HBP Norge Marchand Sand Unit located in western Grady County, Oklahoma.

The assets comprise substantial liquids-weighted production generating roughly $11 million of next 12-month PDP cash flow, with multiple economic development projects including highly-economic Marchand and Medrano horizontal locations, vertical refracs, returns to production and waterflood optimization, according to Detring.

Highlights:

- Substantial Liquids-Rich Production

- Current net production: 900 boe/d (60% oil / 80% liquids)

- PDP PV-10: $42 million

- PDP Net Reserves: 3.1 MMboe

- Well Count: 46 producers (40 verticals / 6 horizontals)

- Sizeable base of low-decline, predictable cash flow

- PDP Next 12-month Cash Flow: $11 million

- 15% Next 12-month Decline (11% 2024E)

- Low lifting costs of $13/boe

- Current net production: 900 boe/d (60% oil / 80% liquids)

- Operated and HBP Waterflood

- Large, operated, and contiguous footprint of ~12,000 gross acres

- 100% HBP across multiple formations provides complete operational control with the opportunity for value-add projects

- Assets offer attractive optionality with exposure to the liquids-rich Marchand and gas-rich Medrano

- Efficient operations allowed by concise footprint (~8x4 miles)

- Attractive royalty burden at ~86% net revenue interest 8/8th (average 78% working interest / 67% net revenue interest)

- Large, operated, and contiguous footprint of ~12,000 gross acres

- Large Inventory of Economic Development Opportunities

- 10 high-impact undeveloped locations identified for Marchand and Medrano horizontal development with 100%+ IRR

- Significant pipeline of 40 low-risk return-to-production and refrac projects

- Substantial 3P PV-10 ($96 million) and net reserves (10.9 MMboe)

Process Summary:

- Evaluation materials available via the Virtual Data Room on Nov. 8

- Proposals due on Dec. 15

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.