The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

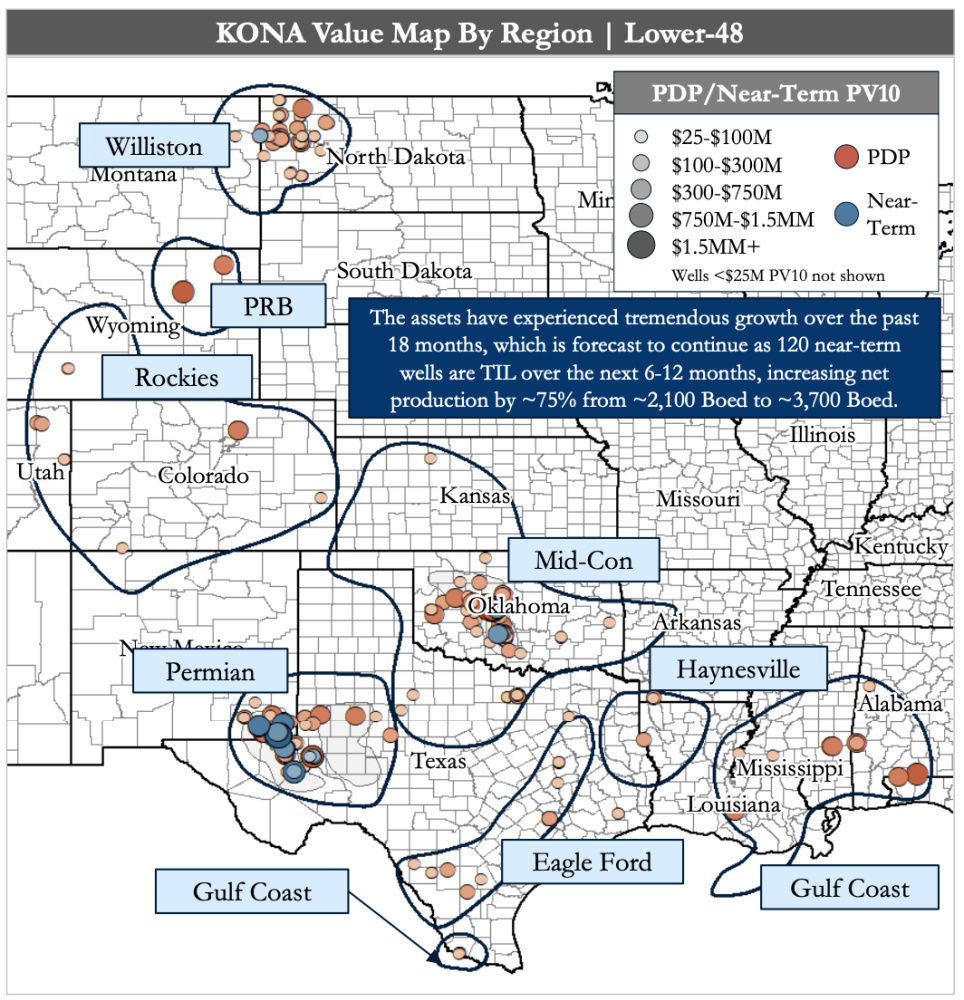

KONA Oil & Gas Properties retained Detring Energy Advisors to market for sale its nonoperated oil and gas interests concentrated in top resource plays throughout the Lower 48.

The assets generate $71 million in operating cash flow from about 800 producing wells plus 120 DUCs and permits. Additionally, the assets include ongoing development in key regions, including the Delaware Basin, SCOOP/STACK and Williston Basin, driving continued near-term production and cash flow growth with substantial remaining undeveloped inventory offering highly economic development under top operators, according to Detring.

Asset Highlights:

- 2,100 boe/d of net production and $43 million in next 12-month operating cash flow (PDP-only)

- Substantial PDP assets with exposure to all major Lower-48 basins and plays

- PDP Net Reserves: 5.2 MMboe (45% oil)

- PDP PV-10: $123 million

- 820 PDP wells (368 horizontal)

- Average 2.8% working interest and 2.2% net revenue interest (horizontal only)

- Existing production and cash flow provides ample funding for ongoing development of near-term wells

- Substantial PDP assets with exposure to all major Lower-48 basins and plays

- Rapidly Developing Asset Offers Imminent Cash Flow Uplift

- The assets have experienced tremendous growth over the past 18 months, which is forecast to continue as 120 near-term wells are TIL over the next 6-12 months

- Net production set to increase by ~75% from ~2,100 boe/d to ~3,700 boe/d

- Delaware Basin alone has averaged eight spuds/month on-lease since January 2021

- 80 DUCs and 40 permits contribute $29 million in next 12-month operating cash flow

- DUC/Permit PV-10: $60 million

- Top Delaware operators, including Devon Energy Corp., Coterra Energy Inc., Tap Rock Resources and more, are engaged in robust drilling programs driving near-term value

- The assets have experienced tremendous growth over the past 18 months, which is forecast to continue as 120 near-term wells are TIL over the next 6-12 months

- Significant Remaining Potential Identified In Over 40 Units

- Interest in 43 units across the Permian, Williston, and Midcon regions with >250 identified locations

- Highly-economic remaining potential through key regions and targets provides surety of development

- 100%+ average IRR

- ~$120million in additional undeveloped NPV-10

Process Summary:

- Evaluation materials are available via the Virtual Data Room on July 27

- Bids are due on Aug. 31

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Cheniere Energy Declares Quarterly Cash Dividend, Distribution

2024-01-26 - Cheniere’s quarterly cash dividend is payable on Feb. 23 to shareholders of record by Feb. 6.

Marathon Petroleum Sets 2024 Capex at $1.25 Billion

2024-01-30 - Marathon Petroleum Corp. eyes standalone capex at $1.25 billion in 2024, down 10% compared to $1.4 billion in 2023 as it focuses on cost reduction and margin enhancement projects.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.