The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

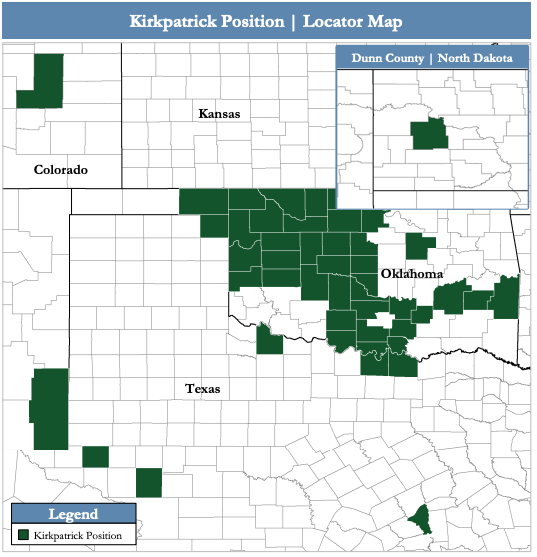

Kirkpatrick Oil Co. retained PetroDivest Advisors to market for sale its nonoperated oil and gas properties, leasehold and related assets in Oklahoma, Texas, Colorado, New Mexico and North Dakota.

The assets offer an attractive opportunity to acquire a diverse and balanced production stream of roughly 240 net boe/d (56% liquids) on a low annual decline with robust next 12-month cash flow of about $1.3 million from various conventional and unconventional fields in the Midcontinent, Permian, Denver-Julesburg and Williston basins, according to PetroDivest.

Highlights:

- Consistent, Stable and Liquids-Rich Production Profile

- ~240 net boe/d and ~$1.3 million Net Next 12-month cash flow from 366 wells (302 vertical and 64 horizontal)

- ~17% average Working Interest and ~13% average Royalty Interest

- Operational upside through reactivation of temporarily shut-in wells

- Net PDP Reserves: ~660,000 boe

- Balanced product mix with 31% oil, 44% gas and 25% NGL

- Net PDP PV-10: ~$4.5 million

- ~240 net boe/d and ~$1.3 million Net Next 12-month cash flow from 366 wells (302 vertical and 64 horizontal)

- ~11,500 Net Acres (100% HBP)

- Diversified footprint across 49 counties and five states with access to a multitude of conventional and unconventional plays

- Value concentrated primarily in Oklahoma and Texas

- Depth rights typically limited to conventional targets

- Additional undeveloped potential through vertical infill drilling and specific horizontal opportunities

- Diversified footprint across 49 counties and five states with access to a multitude of conventional and unconventional plays

Process Summary:

- Evaluation materials available via the Virtual Data Room on Oct. 13

- Bids due Nov. 10

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

AI Advancing Underwater, Reducing Human Risk

2024-03-25 - Experts at CERAWeek by S&P Global detail the changes AI has made in the subsea robotics space while reducing the amount of human effort and safety hazards offshore.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

CERAWeek: AI, Energy Industry Meet at Scary but Exciting Crossroads

2024-03-19 - From optimizing assets to enabling interoperability, digital technology works best through collaboration.

CERAWeek: Large Language Models Fuel Industry-wide Productivity

2024-03-21 - AI experts promote the generative advantage of using AI to handle busywork while people focus on innovations.

The Pandora's Box of AI: Regulation or Self-governance?

2024-04-04 - Experts urge policymakers to learn from the failure to rein in the internet and move quickly to regulate AI.