The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

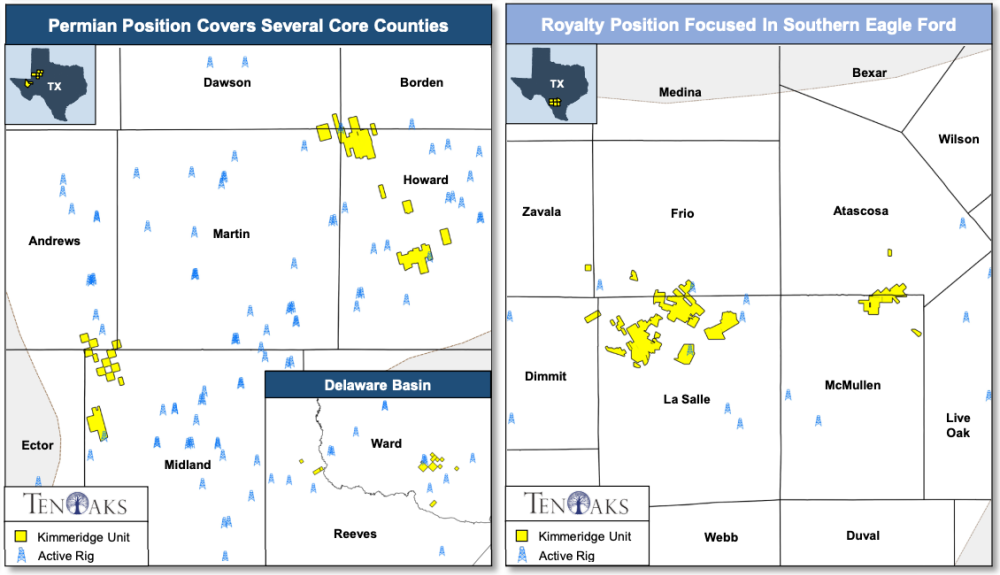

Kimmeridge Energy Management Co. LLC retained TenOaks Energy Advisors as its exclusive adviser in connection with the sale of certain royalty properties located in the Permian Basin and Eagle Ford Shale.

Highlights:

- Sizable royalty position located in two of the most active shale plays in the Lower 48

- 10,310 net royalty acres (73% Eagle Ford / 27% Permian)

- >900 producing horizontal wells across multiple formations

- 40 horizontal spuds in 2021

- Next 12-month Cash Flow: $17.1 million (PDP/DUC/Permit only)

- $9.2 million Eagle Ford / $7.9 million Permian

- Near-term upside includes 23 DUCs and 16 high-impact permits with two rigs currently on position (One Midland / One Eagle Ford)

- >1,000 quantified drilling locations targeting multiple proven formations

- Primarily operated by Callon Petroleum and Texas American Resources Co.

- Very low administrative burden with only three checks

Bids are due by noon CST on Feb. 15. The transaction is expected to have an effective date of Jan. 1 with a purchase and sale agreement signing targeted by March 8.

A virtual data room will be available starting Jan. 13. For information visit tenoaksenergyadvisors.com or contact Forrest Salge at TenOaks Energy Advisors at 817-233-4096 or Forrest.Salge@tenoaksadvisors.com.

Recommended Reading

Balticconnector Gas Pipeline Will be in Commercial Use Again April 22, Gasgrid Says

2024-04-17 - The Balticconnector subsea gas link between Estonia and Finland was damaged in October along with three telecoms cables.

Targa Resources Ups Quarterly Dividend by 50% YoY

2024-04-12 - Targa Resource’s board of directors increased the first-quarter 2024 dividend by 50% compared to the same quarter a year ago.

Canada’s First FLNG Project Gets Underway

2024-04-12 - Black & Veatch and Samsung Heavy Industries have been given notice to proceed with a floating LNG facility near Kitimat, British Columbia, Canada.

Biden Administration Argues Against Enbridge Pipeline Shutdown Order

2024-04-11 - The U.S. argues that shutting down the pipeline could interrupt service and violate a 1977 treaty between the U.S. and Canada to keep oil flowing.