The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Eagle River Energy Advisors LLC has been exclusively retained by Sam Gary Jr. & Associates Inc. to raise $10 million via the sale of a volumetric production payment (VPP) or a similar structured financing on certain operated working interest assets in Kansas.

Summary:

- Financing Terms

- Proceeds: $10 million

- Term: Three years

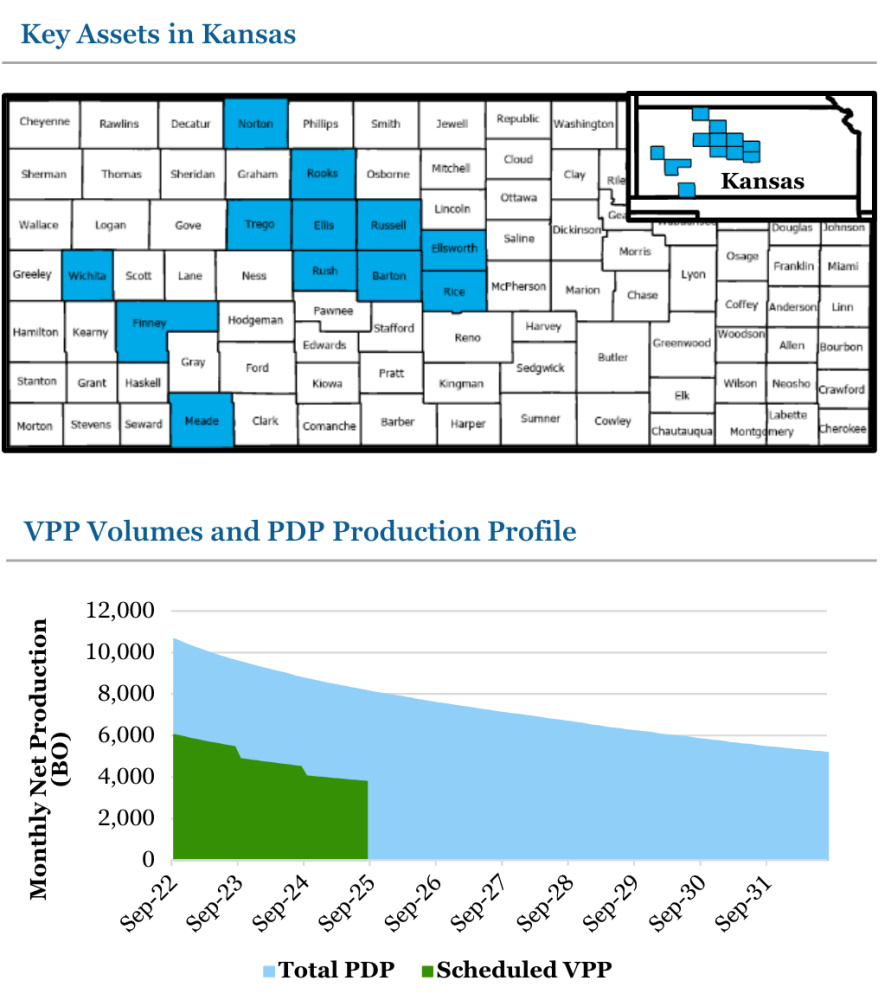

- Collateral: First lien on 163 operated PDP wells

- Scheduled VPP Production: ~172,000 BO

- Excellent credit profile

- Scheduled VPP Production:

- ~52% of ~332,000 PDP BO over three-year term

- ~9% of ~1.9 MMBO total PDP BO over life of wells

- Cash Flow Coverage Ratio: 1.7x

- Well seasoned production base with stable decline from legacy vertical wells in Kansas

- Highly diversified production across 18 fields and 12 counties

- Highly experienced, well capitalized operator

- Scheduled VPP Production:

- Summary of Collateral

- Net Production of 385 bbl/d (May)

- ~7% annual production decline

- Last 12-month net cash flow of $6.4 million

- ~1.9 MMBO PDP reserves

- PDP PV-10 = $32.1 million; PDP PV-20 = $22.2 million

Bids are due by 4 p.m. MT on Aug. 15. The transaction effective date is Sept. 1. A virtual data room will be available starting July 25. For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

Laredo Oil Settles Lawsuit with A&S Minerals, Erehwon

2024-03-12 - Laredo Oil said a confidential settlement agreement resolves a title dispute with Erehwon Oil & Gas LLC and A&S Minerals Development Co. LLC regarding mineral rights in Valley County, Montana.

Watson: Implications of LNG Pause

2024-03-07 - Critical questions remain for LNG on the heels of the Biden administration's pause on LNG export permits to non-Free Trade Agreement countries.

Yellen Expects Further Sanctions on Iran, Oil Exports Possible Target

2024-04-16 - U.S. Treasury Secretary Janet Yellen intends to hit Iran with new sanctions in coming days due to its unprecedented attack on Israel.

Kinder Morgan Exec: Building Pipelines ‘Challenging, but Manageable’

2024-04-05 - Allen Fore, vice president of public affairs for Kinder Morgan, said building anything, from a new road to an ice cream shop, can be tough but dealing with stakeholders up front can move projects along.

The Jones Act: An Old Law on a Voyage to Nowhere

2024-04-12 - Keeping up with the Jones Act is a burden for the energy industry, but efforts to repeal the 104-year-old law may be dead in the water.