The following information is provided by Energy Advisors Group. All inquiries on the following listings should be directed to Energy Advisors Group. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

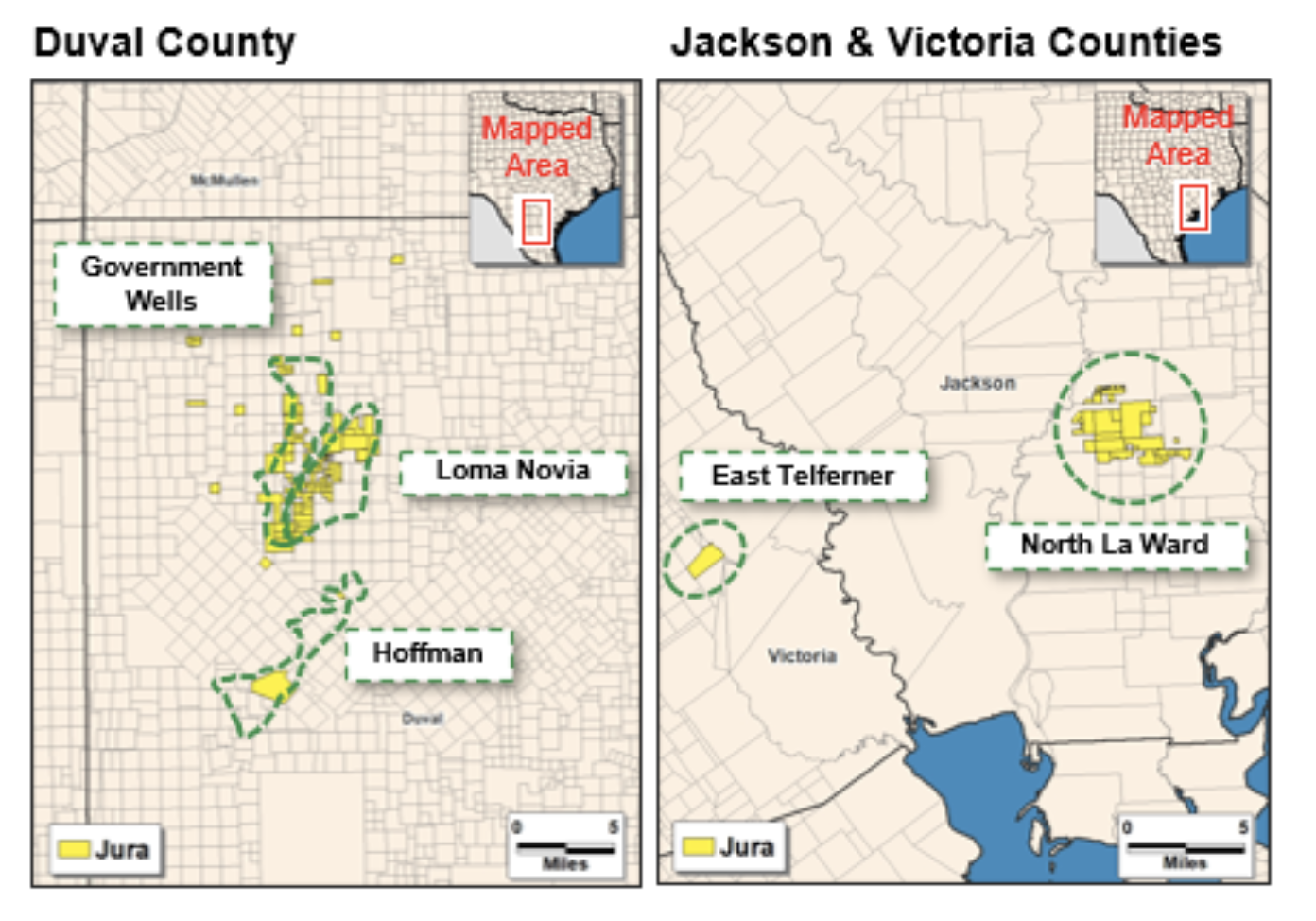

Jura Energy has retained EAG to market their South Texas operated assets in Duval, Jackson, and Victoria Counties. The 19,800 net acre position, which includes 98 producing and 19 SWD wells, provides steady production and cash flow and a considerable horizontal development opportunity documented by NSAI. Below you can find a summary of the asset along with the link to the online data room.

Gulf Coast oil sale package:

- 98-Producers. 19,800-Net Acres.

- JACKSON, YEGUA & FRIO

- Significant, Low-Risk Upside. Stacked Multi-Pay Opportunities

- Light Sweet Crude. Meaningful Premium.

- ~100% OPERATED WI; 81% NRI

- Gross Production: 310 bbl/d (Net Volumes: 251 bbl/d)

- 2022 Net Cash Flow: ~$4,600,000/Year

- Proved Developed Reserves: 1,912 Mbbls and a PV10: $13,400,000

- Third Party (NSAI) Reserve Report

For more information visit www.energyadvisors.com/deals or contact Rene McKale, Managing Director at EAG, at rmckale@energyadvisors.com or 281-229-4661, or Richard Martin, Director at EAG, at rmartin@energyadvisors.com or 469-866-9796.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.