The following information is provided by Energy Advisors Group. All inquiries on the following listings should be directed to Energy Advisors Group. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

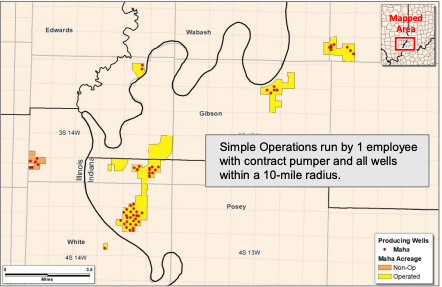

Maha Energy retained Energy Advisors Group (EAG) to market for sale their established oil production package in Indiana and Illinois in a strategic move to focus on their international operations. The operated conventional wells are produced from the stacked St. Louis, Salem & Warsaw formations all at depths of less than 4,000 ft TVD. These assets are all located within 10-mile radius and run by 1 employee and contract pumpers. The package includes an office building, 4.5-acre storage yard and workshop and are ready for continuous operations and drilling.

Maha Energy's third party (McDaniel & Associates) engineering YE2022 reserve report states a PV10 of $10.5 MM for the Proved reserves and a 3P PV10 of $37.3 MM. Maha Energy has a strong preference to close by the end of Q1 so interested parties should contact EAG immediately.

Key Highlights

- Located in the mature Illinois Basin that has produced over 4 billion barrels since 1905

- 75% NRI leases across 3,295 net acres (61% HBP)

- Acreage position is only 50% developed with notable remaining inventory for significant cash flow growth

- Simple local operations all located within a 10-mile radius

- Established Production. 59-Wells. 49-Producers.

- Stacked Pay Opportunities. Conventional carbonate reservoir (St. Louis, Salem & Warsaw Formations)

- Each reservoir has ~6.5% porosity and net pays of 40+ feet all at depths of <4,000 feet

- Producing gross 265 (WI) bbl/d (net 200 bbl/d) in December 2022

- 2021 / 2022 rig program has added meaningful reserves and proved additional upside

- Delivering $600,000/Mn net operating income in 2022

- 6 SWDs and 4 water injectors support field-wide development

- Existing local infrastructure in place provides for efficient development

- Available as a corporate or asset sale

Upon execution of a confidentiality agreement, EAG will provide access to the Virtual Data Room.

For more information visit energyadvisors.com/deals or contact Steve Henrich, Director at EAG, at shenrich@energyadvisors.com or 403-874-7801, or Alan Yoelin, Director at EAG, at ayoelin@energyadvisors.com or 702-346-1587.