The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

HRM Resources III LLC retained EnergyNet Indigo as its exclusive adviser to assist with the sale of certain oil and gas properties and related assets located in the Greater Green River Basin through a sealed-bid offering closing Feb. 17.

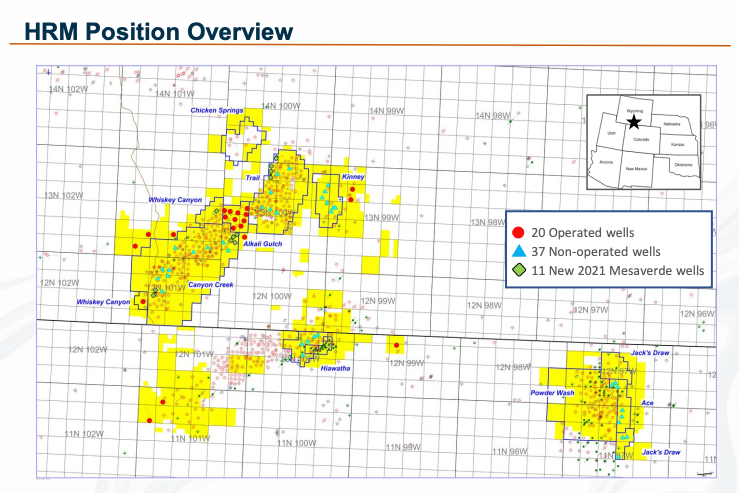

The offering, according to EnergyNet, comprises an opportunity to acquire interests in operated and nonoperated wells along with considerable leasehold acreage the Greater Green River Basin in Wyoming’s Sweetwater County and Moffat County, Colorado. The package also includes substantial near-term cash flow from 57 PDP wells providing reliable, long-term returns on investment.

Additionally, the contiguous acreage and well locations provide economics of scale for operations and workovers, EnergyNet said, with gas-weighted production generating about 6 MMcfe/d and a stable, low next 12-month production decline average of roughly 9% primarily from the Mesaverde Formation.

Highlights:

Asset Overview

~70,000 combined Net leasehold acres

- Operated Working Interest in 20 Wells:

- Average Working Interest ~97% / Net Revenue Interest ~82%

- An Additional Overriding Royalty Interest (ORRI) in 12 Wells

- 15 Producing Wells | Five Shut-In Wells

- Nonoperated Working Interest in 37 Wells (52 Prop.)

- Average Working Interest ~67% / Net Revenue Interest ~54%

- An Additional ORRI in 33 Properties

- 10 Wells Completed in Multiple Formations

- 41 Producing Properties | Three Non-producing Properties | One Active Injection Well | Seven Shut-In Properties

- Operator: Wexpro Co.

- Current Six-month Average Net Income: $392,741/month

- PDP NPV-10: $16.47M

- PDP Net Res.: 22.6 Bcfe

Upside

Flexible upside potential

- 21 low risk proved undeveloped locations on 40 acres spacing

- Horizontal development potential of proven Baxter shale with modern D&C techniques

- Self-driven development pace on largely HBP leasehold acreage

Bids are due by 4 p.m. CST on Feb. 17. The transaction is expected to close in early March with an effective date of March 1.

A virtual data room is available. For complete due diligence information visit indigo.energynet.com or email Ethan House, vice president of business development, at Ethan.House@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.