The following information is provided by RedOaks Energy Advisors LLC. All inquiries on the following listings should be directed to RedOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Hibernia Resources III LLC has retained RedOaks Energy Advisors as the exclusive adviser in connection with the sale of certain operated wellbore only properties located in the Midland Basin.

Key Considerations:

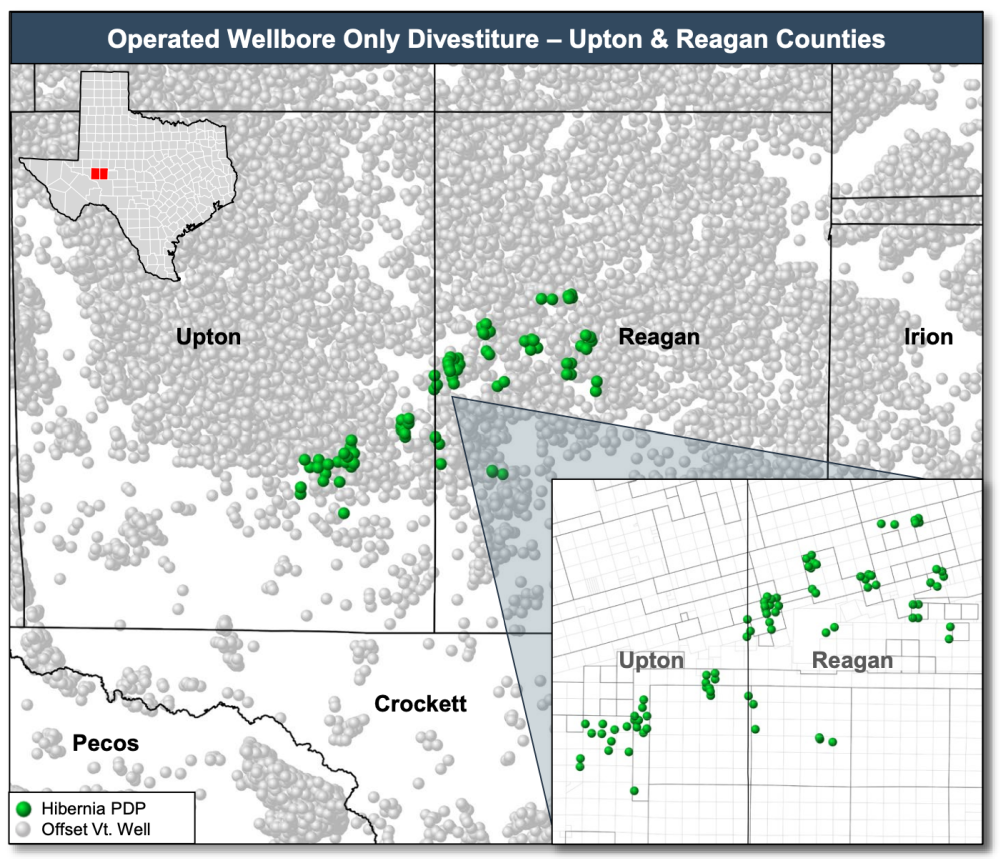

- Opportunity to acquire low-decline wellbore only operations across Upton and Reagan counties

- 54 active producers (average working interest: 86.3% net revenue interest: 64.5%)

- Forecasted May 2022 net production: 503 boe/d (67% liquids)

- Forecasted NTM PDP net cash flow: $7 million

- PDP PV-10: $24.4 million

- 27 RTP cases | Numerous wells with behind pipe potential

Bids are due May 17. A virtual data room is available. The transaction effective date is May 1.

For information visit redoaksenergyadvisors.com or contact Will McDonald, associate of RedOaks, at Will.McDonald@redoaksadvisors.com or 214-727-4996.

Recommended Reading

US Interior Department Releases Offshore Wind Lease Schedule

2024-04-24 - The U.S. Interior Department’s schedule includes up to a dozen lease sales through 2028 for offshore wind, compared to three for oil and gas lease sales through 2029.

Utah’s Ute Tribe Demands FTC Allow XCL-Altamont Deal

2024-04-24 - More than 90% of the Utah Ute tribe’s income is from energy development on its 4.5-million-acre reservation and the tribe says XCL Resources’ bid to buy Altamont Energy shouldn’t be blocked.

Mexico Presidential Hopeful Sheinbaum Emphasizes Energy Sovereignty

2024-04-24 - Claudia Sheinbaum, vying to becoming Mexico’s next president this summer, says she isn’t in favor of an absolute privatization of the energy sector but she isn’t against private investments either.

Venture Global Gets FERC Nod to Process Gas for LNG

2024-04-23 - Venture Global’s massive export terminal will change natural gas flows across the Gulf of Mexico but its Plaquemines LNG export terminal may still be years away from delivering LNG to long-term customers.

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.