The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

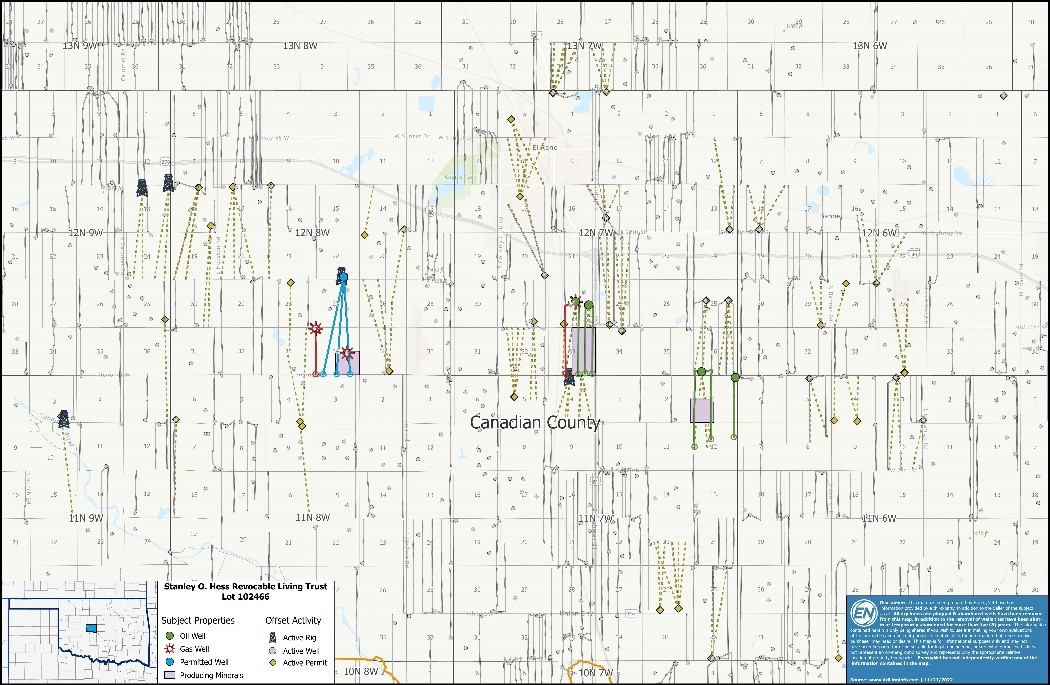

Michael Joseph Hess, trustee, and Stanley O. Hess Revocable Living Trust retained EnergyNet for the sale of a nine-well package in Canadian County, Oklahoma. The Lot# 102466 package includes nine wells producing MI/RI plus three permitted wells operated by Camino Natural Resources LLC, Canvas Energy LLC, Paloma Resources LLC and Teocalli Explorations LLC.

Opportunity highlights:

- Producing MI/RI in Nine Wells:

- 0.566667% to 0.221534% RI

- Three Permitted Hz Mississippian Wells

- Three-Month Net Income: $19,403/Month

- Six-Month Average 8/8ths Production: 9,084 Mcf/d and 600 bbl/d

- Six-Month Average Net Production: 46 Mcf/d and 2 bbl/d

- Operators:

- Camino Natural Resources LLC

- Canvas Energy LLC

- Paloma Resources, LLC

- Teocalli Exploration LLC

Bids are due at 3:00 p.m. CDT on Dec. 20. For complete due diligence information, please visit energynet.com or email Emily McGinley, director, at emily.mcginley@energynet.com.