The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

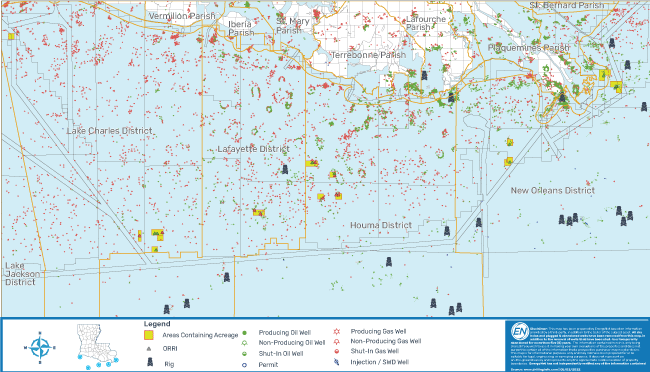

An undisclosed seller retained EnergyNet to sell a 266 well package of overriding royalty interest (ORRI) offshore Louisiana in the U.S. Gulf of Mexico.

Highlights:

- ORRI in 266 wells

- Sliding-scale ORRI between 2% - 10% based on LLS crude oil pricing

- Three-month average net cash flow: $539,681/month

- Net Proved Reserves(1): 896 Mboe (73% oil)

- 2022E Proved cash flow projection: $9.0 MM(1)

- Operators include Arena Offshore LP, Fieldwood Energy and Renaissance Offshore LLC

Sealed bids are due at 4 p.m. CST on May 27. For complete due diligence information visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Reilly Bliton, director of engineering, at Reilly.Bliton@energynet.com.

Recommended Reading

CEO: EQT Positioned to Meet Demand of Power-guzzling AI Data Centers

2024-04-01 - EQT Corp.’s Toby Rice said demand for AI could exceed the power demand required to meet U.S. residential demand and jump 20% by 2030, in this Hart Energy Exclusive interview.

‘Monster’ Gas: Aethon’s 16,000-foot Dive in Haynesville West

2024-04-09 - Aethon Energy’s COO described challenges in the far western Haynesville stepout, while other operators opened their books on the latest in the legacy Haynesville at Hart Energy’s DUG GAS+ Conference and Expo in Shreveport, Louisiana.