The following information is provided by Detring Energy Advisors. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

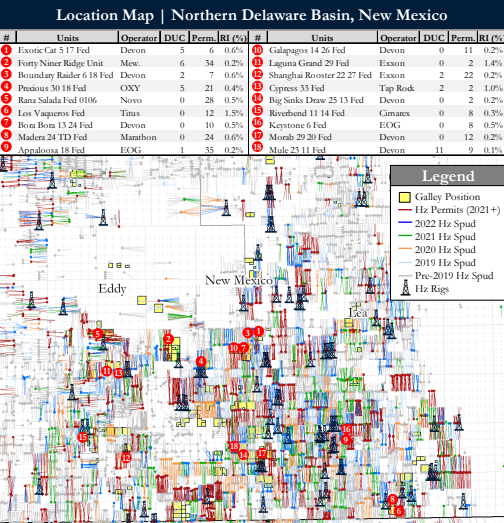

Galley NM Assets LLC retained Detring Energy Advisors to market for sale its oil and gas overriding royalty interests located in the core of the northern Delaware Basin, New Mexico.

The assets provide an attractive opportunity to acquire: (i) 2,303 Net Royalty Acres generating $21MM in NTM Cash Flow in the most active and economic basin in the Lower 48; (ii) 400+ near-term DUC’s and Permits which underwrite growth through mid-2024; and (iii) ~2,300 additional PUD locations throughout six horizons of the most productive horizontal targets in North America, ensuring continued development and premium allocations within operator portfolios.

Asset Details:

- Active, Growing Development with $21MM Cash Flow (2023E)

- Substantial operator activity results in rapid growth underwritten by recent DUCs (52) and permits (202)

- DUC & permit inventory provides ~2 years of line-of-sight growth

- ~900 producing wells (~820 hz) provide a stable cash flow base

- Net Production: ~800 Boed (71% liquids)

- PDP PV8: $31MM

- Substantial operator activity results in rapid growth underwritten by recent DUCs (52) and permits (202)

- Premier Northern Delaware Footprint Encompassing ~2,300 Net Royalty Acres

- Extensive core position offers exposure to the most active & prolific region in the United States

- Average 18 permits/month sustained on-lease as operators continue bulk pad development across multiple zones

- ~4x increase in wells TIL’d over 5 years (2019-2023E)

- High-interest units under basin-focused, well-capitalized operators including Devon, Exxon, Cimarex & Oxy

- Extensive core position offers exposure to the most active & prolific region in the United States

- Assets Only 25% Developed with ~2,300 Highly Economic PUD Locations Remaining

- Large remaining inventory provides 15+ years of running room

- 3P PV10: $194MM ($480MM PV0)

- 3P Net Reserves: 12.5 MMBoe

- Six primary horizontal targets across the Wolfcamp, Bone Spring & Avalon, with additional long-term potential not quantified

- World-class, repeatable well results generate 250+ Boed/Mft IP30 (avg.)

- U.S.-leading ~5x ROI-Disc. across all major targets ensures continued allocation of operator capital

- Large remaining inventory provides 15+ years of running room

Proposals are due Feb. 22. Upon execution of a confidentiality agreement, Detring will provide access to the Virtual Data Room, which opens on Jan. 18.

For more information, visit detring.com or contact Melinda Faust, managing director at Detring Energy Advisors, at mel@detring.com or 713-595-1004.

Recommended Reading

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Report: Freeport LNG Hits Sixth Day of Dwindling Gas Consumption

2024-04-17 - With Freeport LNG operating at a fraction of its full capacity, natural gas futures have fallen following a short rally the week before.

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.