The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

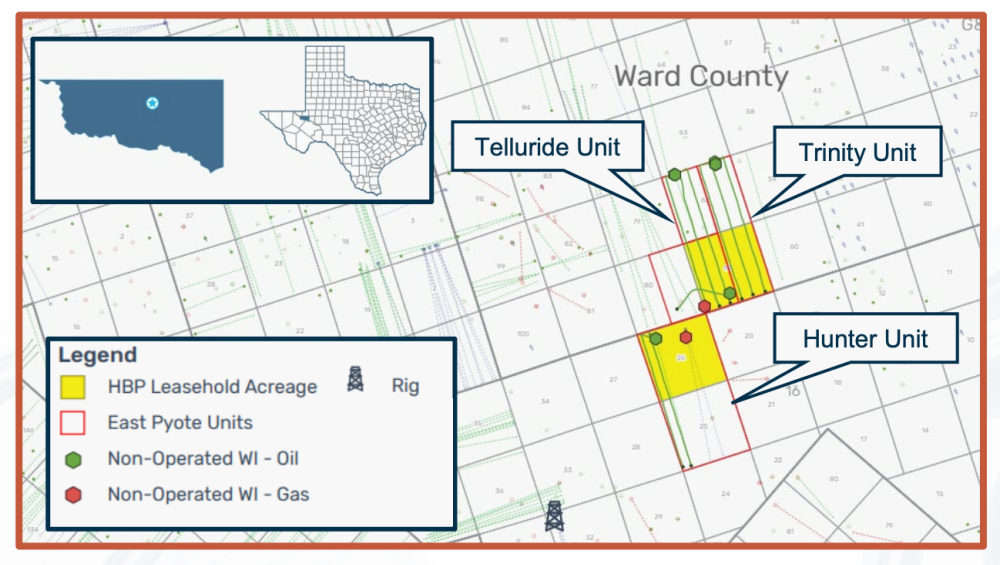

Finley Resources retained EnergyNet Indigo for the sale of a Delaware Basin opportunity comprising an acreage position consisting of three leases limited to the Wolfcamp Formation in the Permian in Ward County, Texas.

Asset Overview:

- 11 wells including eight Wolfcamp horizontals

- Two newly proposed horizontal Wolfcamp wells (elected to participate)

- Average Working Interest ~19% / Average Net Revenue Interest ~16%

- Current net production 348 boe/d (81% liquids)

- Six-month average net income: $440,000/month

- 1,283 gross (432 net) leasehold acres

- 100% HBP

- Three existing horizontal DSUs

- 15% average royalty burden

- Undeveloped locations in proven stacked Wolfcamp targets

- Multiple horizons de-risked throughout position with strong well performance in and around leasehold

- Wolfcamp A Upper

- Wolfcamp A Lower

- Wolfcamp B

- Wolfcamp C

- 34 undeveloped locations at modest development spacing

- Existing DSUs enable full development with two-mile laterals

- Compelling single well economics for full undeveloped inventory

- Average EUR 1.4 MMboe (10,000 ft)

- Average IRR 56%

Bids are due March 10. The transaction is expected to close in March with an effective date of Feb. 1.

A virtual data room is available. For complete due diligence information visit indigo.energynet.com or email Zachary Muroff, vice president of business development, at Zachary.Muroff@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Tethys Oil Releases March Production Results

2024-04-17 - Tethys Oil said the official selling price of its Oman Export Blend oil was $78.75/bbl.

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.