The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Finley Production Co. LP retained EnergyNet for the sale of a Liberty Field opportunity in South Texas through a sealed-bid offering closing Nov. 10.

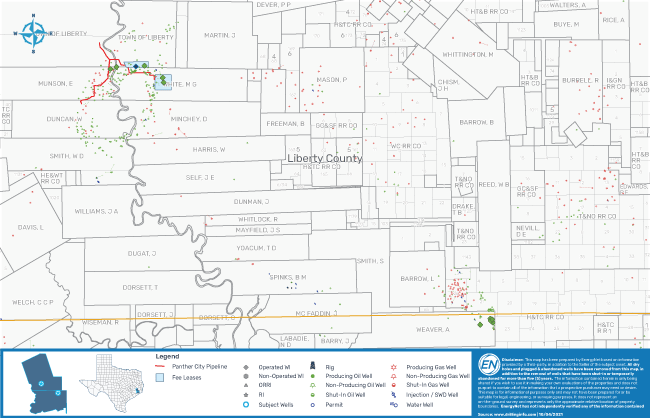

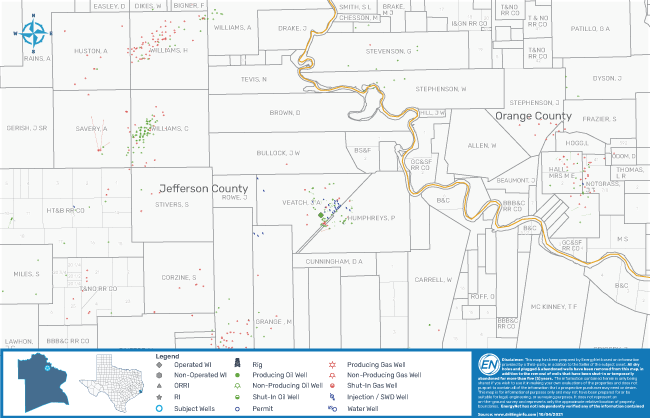

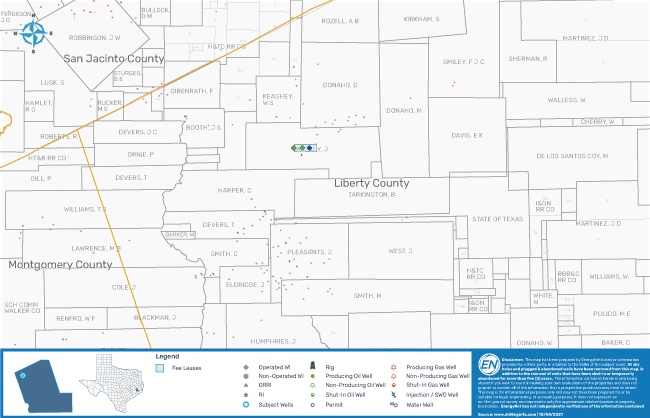

The offering comprises a 15 property package with operations plus a pipeline in Chambers, Jefferson and Liberty counties, Texas.

Highlights:

- Operations in 15 Properties:

- 100.00% to 50.00% Working Interest / 80.00% to 37.50% Net Revenue Interest

- Five Producing Properties | Two Active Saltwater Disposal Wells

- Three-month Average 8/8ths Production: 60-70 bbl/d of Oil

- Three-month Average Net Income: $44,372/Month

- 100.00% Working Interest in the Panther City Pipeline

- Operator Bond Required

Bids are due at 4 p.m. CST on Nov. 10. For complete due diligence information on any of the packages visit energynet.com or email Zachary Muroff, vice president of business development, at Zachary.Muroff@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.