The following information is provided by RedOaks Energy Advisors LLC. All inquiries on the following listings should be directed to RedOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Excess Energy LLC retained RedOaks Energy Advisors as the exclusive adviser in connection with the sale of certain royalty properties located across multiple basins.

Key Considerations:

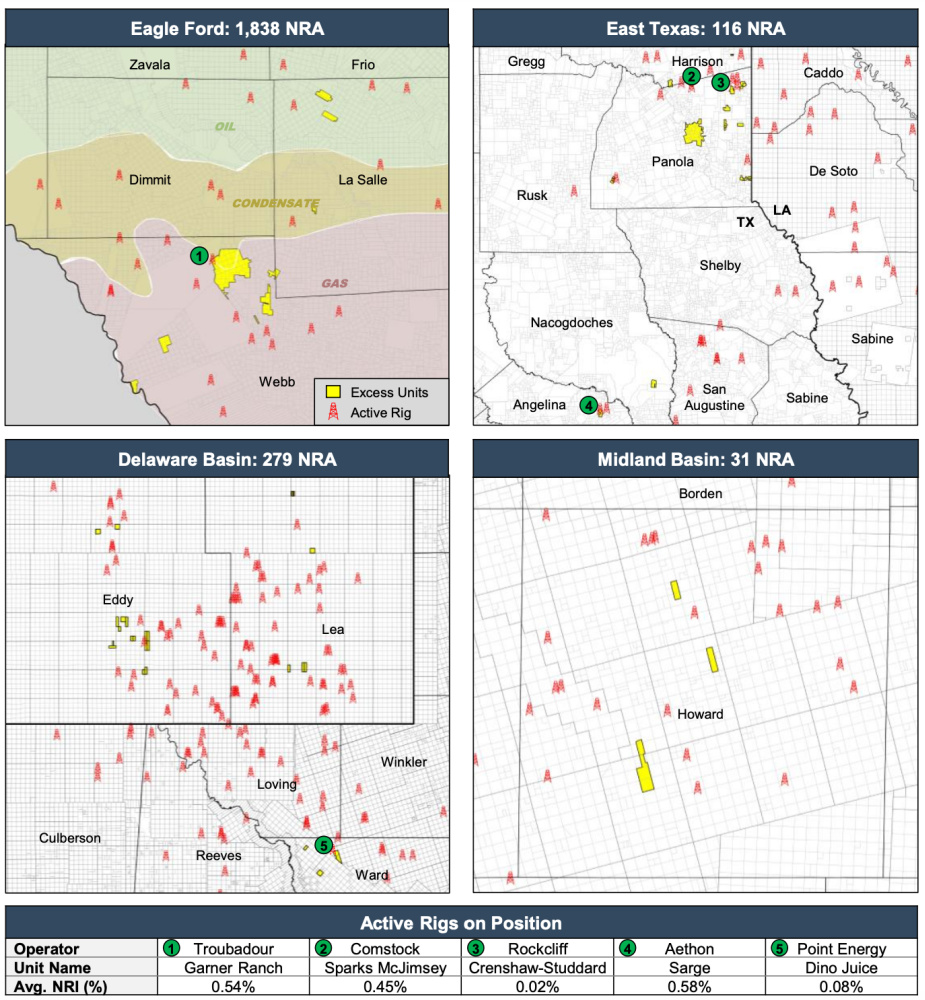

- 2,263 net royalty acres located across four major areas (Eagle Ford, Delaware Basin, Midland Basin and East Texas)

- Next 12-month Net Cash Flow: $7.5 million (28% PDP | 57% DUC/Permit | 15% Location)

- Significant near-term development from 64 DUCs and 70 permits

- Key operators: EOG Resources Inc., Lewis Petroleum, Centennial Resource Development Inc., Mewbourne Oil Co. and Aethon Energy

- Seller will entertain offers on an area-by-area basis

Bids are due Aug. 11. The transaction is expected to have an effective date of Aug. 1.

A virtual data room is available. For information visit redoaksenergyadvisors.com or contact Will McDonald, associate of RedOaks, at Will.McDonald@redoaksadvisors.com or 214-727-4996.

Recommended Reading

Eni, Vår Energi Wrap Up Acquisition of Neptune Energy Assets

2024-01-31 - Neptune retains its German operations, Vår takes over the Norwegian portfolio and Eni scoops up the rest of the assets under the $4.9 billion deal.

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.