The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

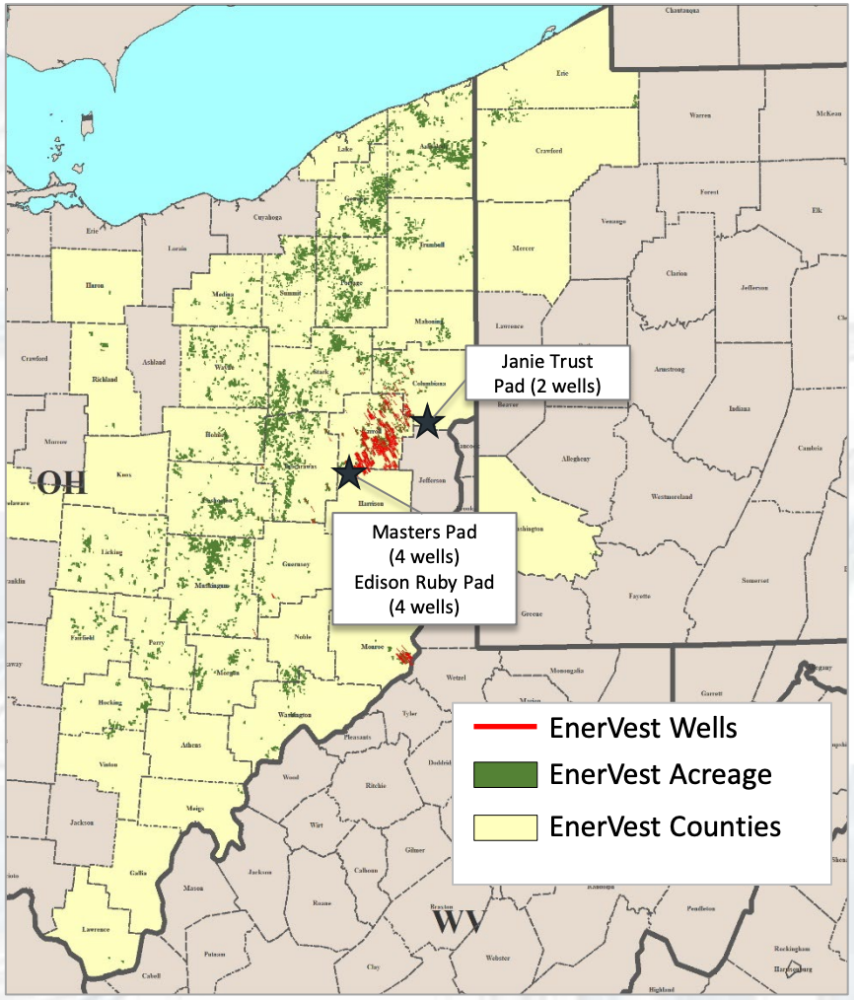

EnergyNet Indigo has been selected as the exclusive adviser to market EnerVest Energy Institutional Fund IX LP’s nonoperated working interest and overriding royalty interest (ORRI) within the Utica shale play.

Highlights:

- 146,053.27 Net Leasehold Acres in Ohio and Pennsylvania (99% HBP)

- Six-month Average 8/8ths Production: 347,006 Mcf/d of gas and 7,984 bbl/d of oil

- Six-month Average Net Income: $1,240,041 per month

- Nonoperated Working Interest in 410 Wells:

- 32.889388% to 0.001577% Working Interest / 28.332567% to 0.00138% Net Revenue Interest

- 395 Producing Wells | Nine Shut-In Wells | Six DUC Wells

- Select Operators includes EAP Ohio LLC, Penn Energy Resources LLC and Pin Oak Energy Partners LLC

- ORRI in 48 Wells:

- 2.101976% to 0.003364% ORRI

- 46 Producing Wells | Two Shut-In Wells

- Select Operators include Equinor USA Onshore Properties Inc., Penn Energy Resources LLC and Seneca Resources Co. LLC

Bids are due on Oct. 7. The transaction is expected to have an Aug. 1 effective date and close by Oct. 28.

A virtual data room is available. For complete due diligence information visit indigo.energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.