The following information is provided by Barclays. All inquiries on the following listings should be directed to Barclays. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

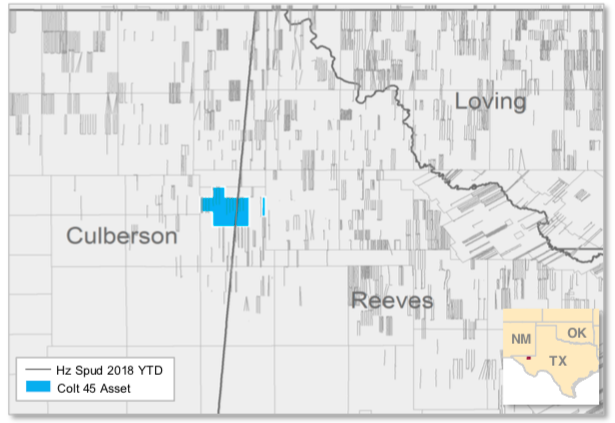

EnCore Permian is offering for sale its Colt 45 State Unit oil and gas assets located in western Reeves and Culberson counties, Texas, within the Delaware Basin. The company retained Barclays as its exclusive financial adviser in connection with the transaction.

Highlights:

Contiguous Position in the Delaware Basin

- Contiguous operated acreage position in the most active and economic basin in the U.S.

- ~7,700 net acres with 100% working interest

Stable Cash Flows with Strong Returns on Future Inventory

- Current net production of 6,300 boe/d

- 29% oil, 38% gas, 33% NGL

- Backlog of workovers focused on artificial lift optimization projects to further boost PDP

- Second-half 2021E Annualized EBITDA of ~$55 million

- Proved Developed (PDP, PDNP, DUC) PV-10 of ~$125 million

- High inventory of IRR > 100% Wolfcamp locations

Prolific Geologic Setting with High Quality Well Results

- Proven stacked pay in the Wolfcamp A and B as well as untapped resource potential in the Wolfcamp C and Lower Bone Spring

- Acreage with relatively homogeneous lithology and manageable structure thanks to seismic coverage

Asset Primed for Full Field Development

- Optimal development designed to capture full upside potential

- Large inventory of longer lateral locations targeting the Wolfcamp A and Wolfcamp B with additional upside in the Wolfcamp C

- 39 Wolfcamp A net locations / 55 Wolfcamp B net locations

Sufficient Infrastructure for Future Growth

- Acreage connectivity and investment in field level infrastructure positions the asset for full potential

- Midstream infrastructure holds the capacity to handle rapid asset growth

- No MVCs in addition to having gathering and marketing simplicity among all production streams

- No H2S issues or treating facility requirements

- Ability to decrease opex significantly below current costs and improve the revenue stream by implementing certain surface level technologies already underway

On behalf of EnCore, Barclays is reaching out to a select group of potential buyers with respect to EnCore’s operated position in the Delaware. Preliminary indications will be due mid- to late September.

A virtual data room is available. All communication or inquiries related to the sales process must be directed to Barclays representatives. Primary Barclays contacts for the transaction are Associate Johnny Gragg, Johnny.Gragg@Barclays.com, and Analyst Elizabeth Owen, Elizabeth.Owen@Barclays.com.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.