The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

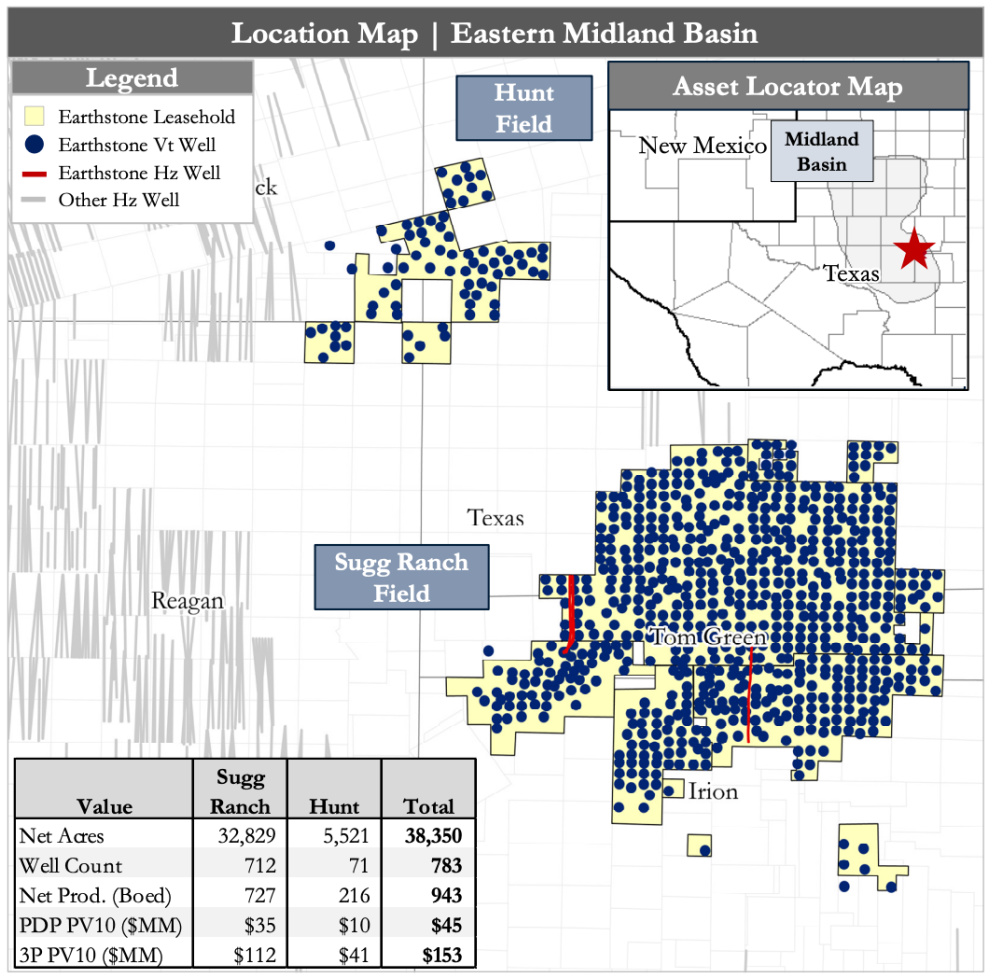

Earthstone Energy Inc. retained Detring Energy Advisors to market for sale its oil and gas leasehold, producing properties and related assets concentrated in the eastern Midland Basin across Glasscock, Irion, Reagan, Sterling and Tom Green counties in West Texas.

The assets offer comprises a large, operated, contiguous and fully HBP Permian footprint producing 940 boe/d (roughly 70% liquids) and $13 million of operating cash flow plus a consistent workover program offering continued low-cost production maintenance and 29 identified, near-term horizontal locations targeting the Wolfcamp A.

Asset Highlights:

- 940 boe/d Net Production and $13 million PDP next 12-month Operating Cash Flow

- Liquids-weighted production (~70% liquids) from 630 active wells, including four horizontals, across two fields: Hunt and Sugg Ranch

- 38,350 net acres (100% HBP)

- Average 98% Working Interest and 74% Net Revenue Interest

- Production primarily sourced from Canyon and Wolfcamp reservoirs

- Current PDP wells offer predictable cash flow base and decades of cash flow generation, with low-risk inventory identified adding significant reserves

- PDP PV-10 and net reserves of $45 million and 3.2 million boe, respectively

- Liquids-weighted production (~70% liquids) from 630 active wells, including four horizontals, across two fields: Hunt and Sugg Ranch

- Consistent Workover Program Maintaining Production

- Net production maintained at ~900-1,000 boe/d since acquisition (April 2021) due to an active workover/RTP program

- 7 boe/d average uplift per historical, low-cost workover ($30,000/well)

- 70+ near-term workovers add material value to existing production base

- PDNP PV-10: $6 million

- Further opportunities exist to continue reactivating wells and recompleting productive zones

- Net production maintained at ~900-1,000 boe/d since acquisition (April 2021) due to an active workover/RTP program

- Horizontal Wolfcamp Development Potential

- 29 initial horizontal locations identified targeting the Wolfcamp A

- Targeting based on “lessons learned” from existing on-lease development

- Highly-economic proximal results provide long-term development within operating cash flow

- Average IRR >100%

- ~$100 million in undeveloped PV-10

- 29 initial horizontal locations identified targeting the Wolfcamp A

Process Summary:

- Evaluation materials are available via the Virtual Data Room on Aug. 17

- Bids are due on Sept. 21

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

North Carolina Grants Mining Permit to Piedmont Lithium

2024-04-16 - Located in Gaston County, North Carolina, the project is being designed to produce 30,000 metric tons of lithium hydroxide per year.

Element3 Extracts Lithium from Permian’s Double Eagle Wastewater

2024-01-30 - The field test was conducted with wastewater from a subsidiary of Double Eagle Energy Holdings’ produced water recycling facility.

Elephant in the North: E3 Lithium CEO on Finding Opportunity ‘Hunters’

2024-02-28 - E3 Lithium is working toward commercial lithium production for its Clearwater project in South-Central Alberta’s Bashaw District, while developing its own DLE technology.

Occidental’s Lithium Technology ‘Ready for Prime Time’

2024-03-20 - Occidental is leaning towards a ‘build, own and operate’ approach to growing its direct lithium extraction business.

Exclusive: Building Battery Value Chain is "Vital" to Energy Transition

2024-04-18 - Srini Godavarthy, the CEO of Li-Metal, breaks down the importance of scaling up battery production in North America and the traditional process of producing lithium anodes, in this Hart Energy Exclusive interview.